Bitcoin Price Analysis: 1 July

The Bitcoin market was in a recovery mode, however, that trend did not last for long. The asset lost ground when the value slipped under $34,000. At the time of press, BTC was trading at $33,365.

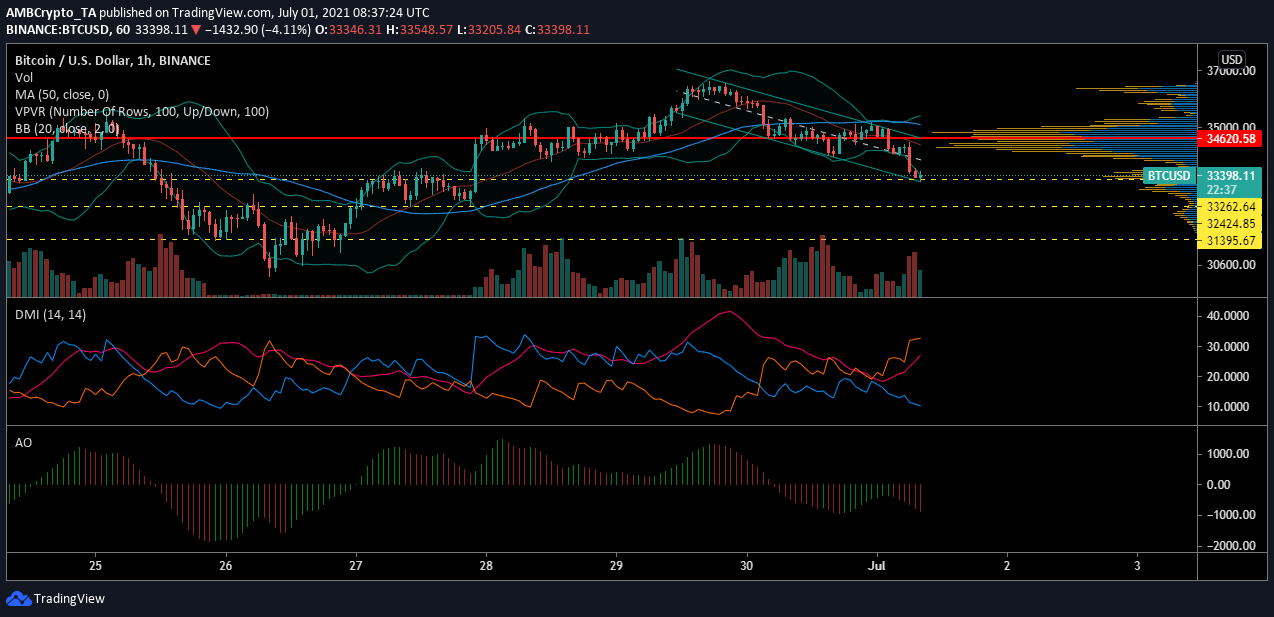

Bitcoin hourly chart

Source: BTCUSD on TradingView

Bitcoin’s price was consolidating at $34,620 before it took off to $36,617. After the digital asset hit this high of $36k, the value began depreciating. It slipped to support at $34,620 but was not able to hold on to this value and slipped to the next level of support at $33,262.

As the price was already on a descent, it was difficult to predict the future movement of the largest digital asset.

Reasoning

The volatility in the market has been a result of the ongoing changes in regulations around the world, especially in China. As visible in the chart above, BTC’s value has been falling within a descending channel and found some balance at $34,620. The Visible Range indicator marked this price level as the Point of Control [POC], meaning the price level saw high trading pressure.

This could be the reason BTC consolidated here, but as the selling pressure increased, it fell further down to $33,262. The asset remained close to this support as the buyers saw this value as an entry point. Nevertheless, the buying pressure was not enough to flip the strong bearishness.

Directional Movement Index [DMI] noted that BTC was experiencing downward pressure since yesterday and it was only growing. The -DI crossed over the +DI and was currently diverged. This suggested the high downward pressure experienced by the market.

Conclusion

With high volatility in the current market, Bitcoin’s price could continue to trade close to $33,262. The market was showing strong bearishness in the market and the signs of trend reversal were scanty. The momentum has moved down to the negative zone, which could keep the price where it is now.