Bitcoin price analysis: 13 December

Disclaimer: The findings of the following article are the sole opinion of the writer and should not be taken as investment advice

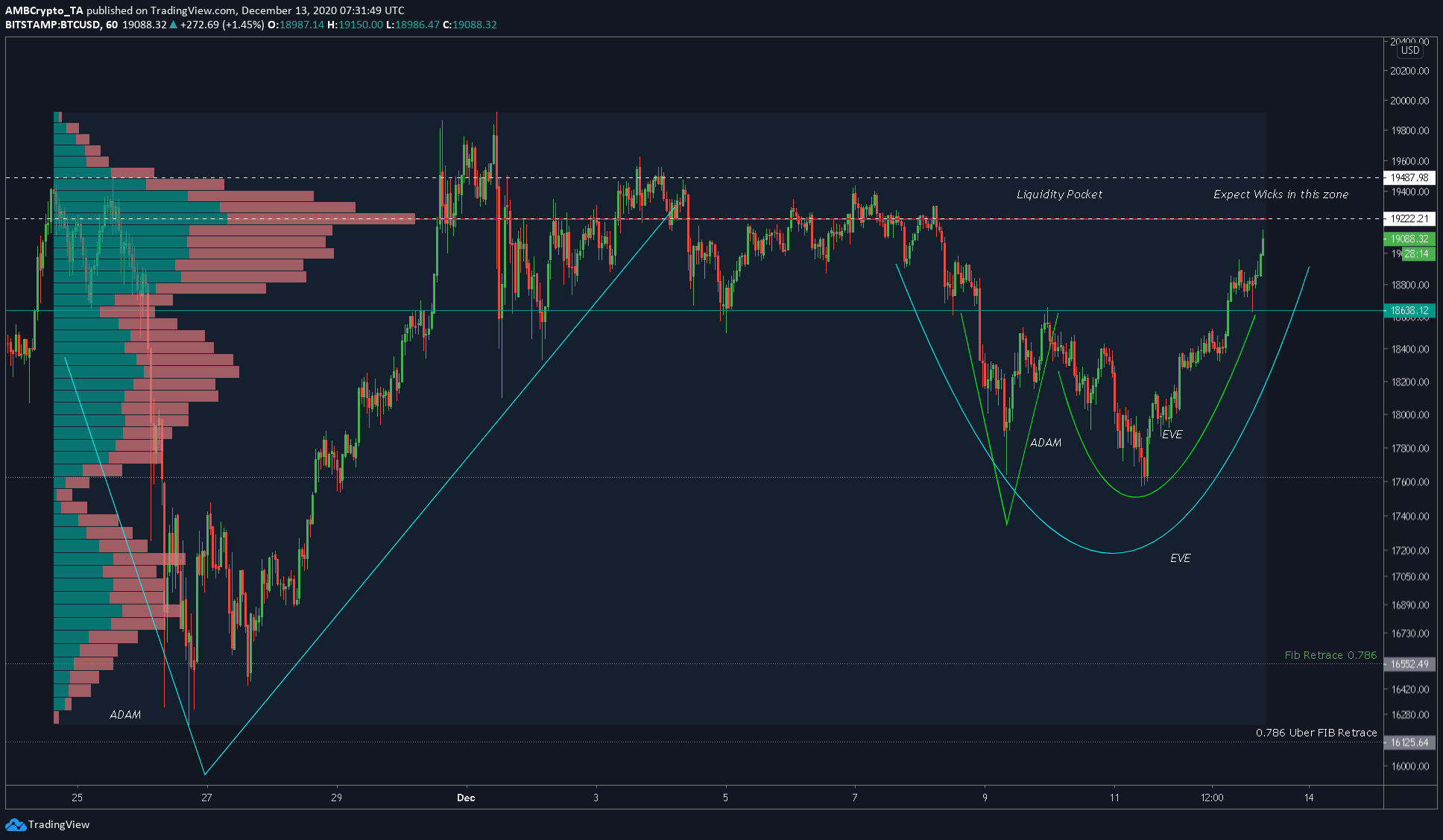

Bitcoin, the world’s largest cryptocurrency, was hovering in the $17,000-range 24-hours ago. However, the price did seem to have appreciated considerably since. At press time, Bitcoin looked toppy, with its price recorded to be just over $19,100. There seemed to be a recurring theme/fractals all across Bitcoin’s shorter timeframe of 1-hour.

We can expect wicks up to $19,600, however, they will be ephemeral. Hence, the overall short-term outlook of Bitcoin seemed bearish. Let’s take a look at the reasons for this.

Bitcoin 1-hour chart

Source: BTCUSD on TradingView

Bitcoin’s 1-hour chart highlighted the recurring theme of Adam [V shape] and Eve [rounded bottom]. The larger Adam [cyan color] and Eve started from the drop seen in November and extends up to 13 December. The smaller pattern [highlighted in green], however, started on 8 December and ends today.

Rationale

Both these patterns have reached their end as they were facing resistance at $19,225, a level that also happens to the Point of Control for the trading range extending from 24 November 24 to 13 December. For this range, the POC at $19,225 will prevent the price from pushing higher. Moreover, the resistance above these, at least up to $19,487, will serve as a liquidity pocket, where we might see candles with brief surges, but a close below $19,225 or near.

Source: BTCUSD on TradingView

The attached chart takes into consideration the indicators, all of which looked toppy. The RSI was in the overbought zone as Bitcoin hit $19,000 while the OBV showed good volume surge backing the price surge. However, the Stochastic RSI showed a re-entry into the overbought zone as well.

For these aforementioned reasons, we can expect Bitcoin to drop sharply as it hits the POC or as it enters the liquidity pocket, hence, the short position.

Levels to look out for

Entry: $19225.40

Stop-Loss: $19640.89

Take-Profit: $18219.56

Risk-to-Reward:2.42

The profit level can be extended up to $17,624, with appropriate trailing stop-loss.