Bitcoin Price Analysis: 8 March

A weekly return of 12.66% allowed Bitcoin to retrace above $50,000 as the largest digital asset was eyeing consolidation above immediate resistance at $52500. The resistance has been tested over the past week, after which BTC slid to $46,000 yet again. Due to volatility at the moment, Bitcoin had a market cap of $948 billion, with a 24-hour trading volume of $46 billion.

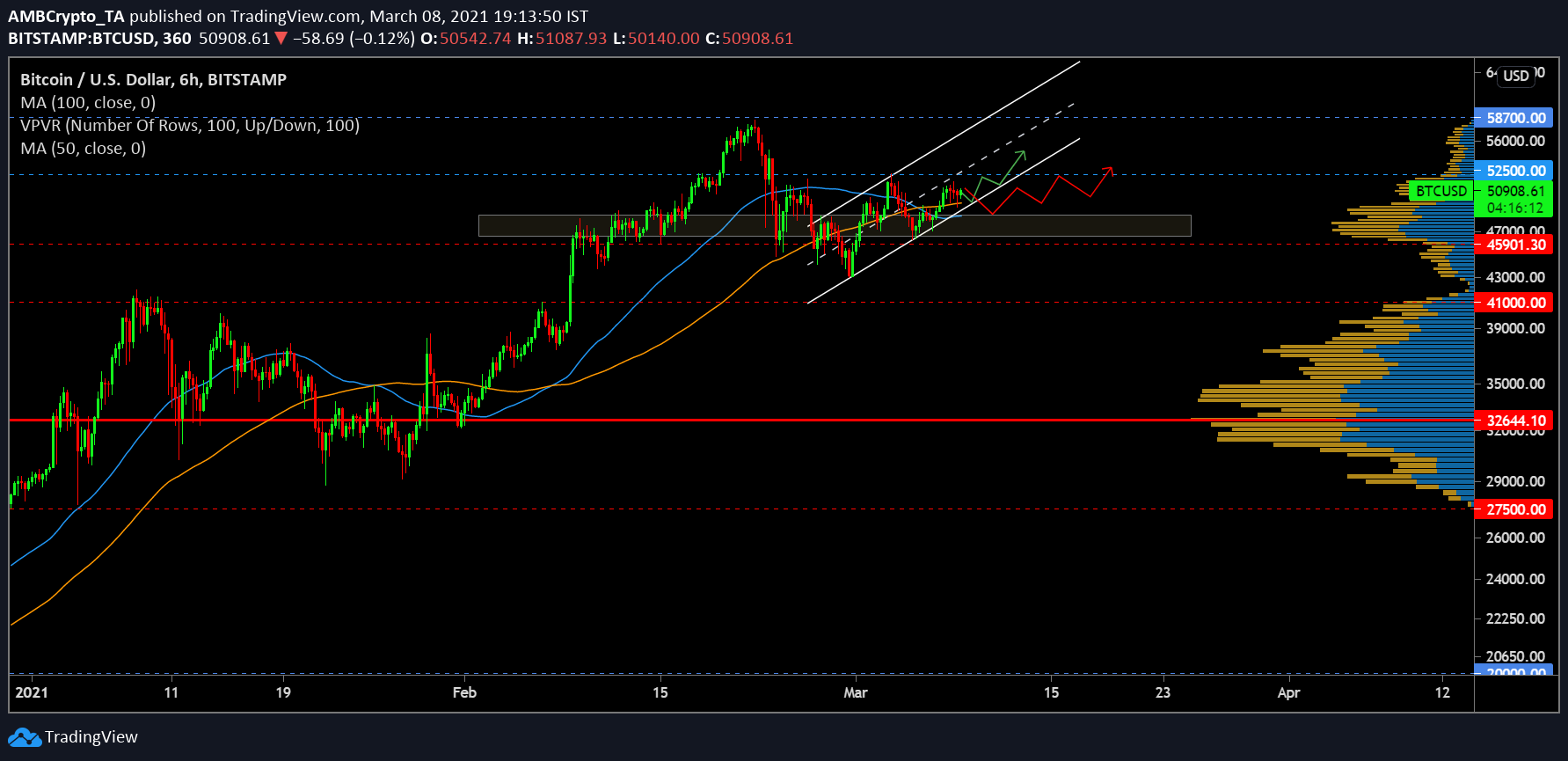

Bitcoin 6-hour chart

BTC/USD on Trading View

After Bitcoin’s recovery started to take place on the 28 February, the asset can be pictured moving within an ascending channel in the 6-hour chart. The current state of the market is extremely turbulent and the price can be expected to entertain another bearish breakout over the long-term. However, the placement of the retracement is uncertain. Support zone at $46,000-$48,000 appeared strong according to VPVR indicator; therefore any correction will likely bounce from this trading region.

Resistance at $52,500 seemed rigid as well. Bitcoin breaking above this mark would open the possibility of another re-test above $56,000 but the odds of that happening over the next week is low, due to the current macro-economic scenario.

100-moving average recently crossed over 50-moving average, which is temporarily bearish for Bitcoin. The red-arrow could dictate the possible direction of Bitcoin during this period of turbulence before the asset regains more bullish momentum.

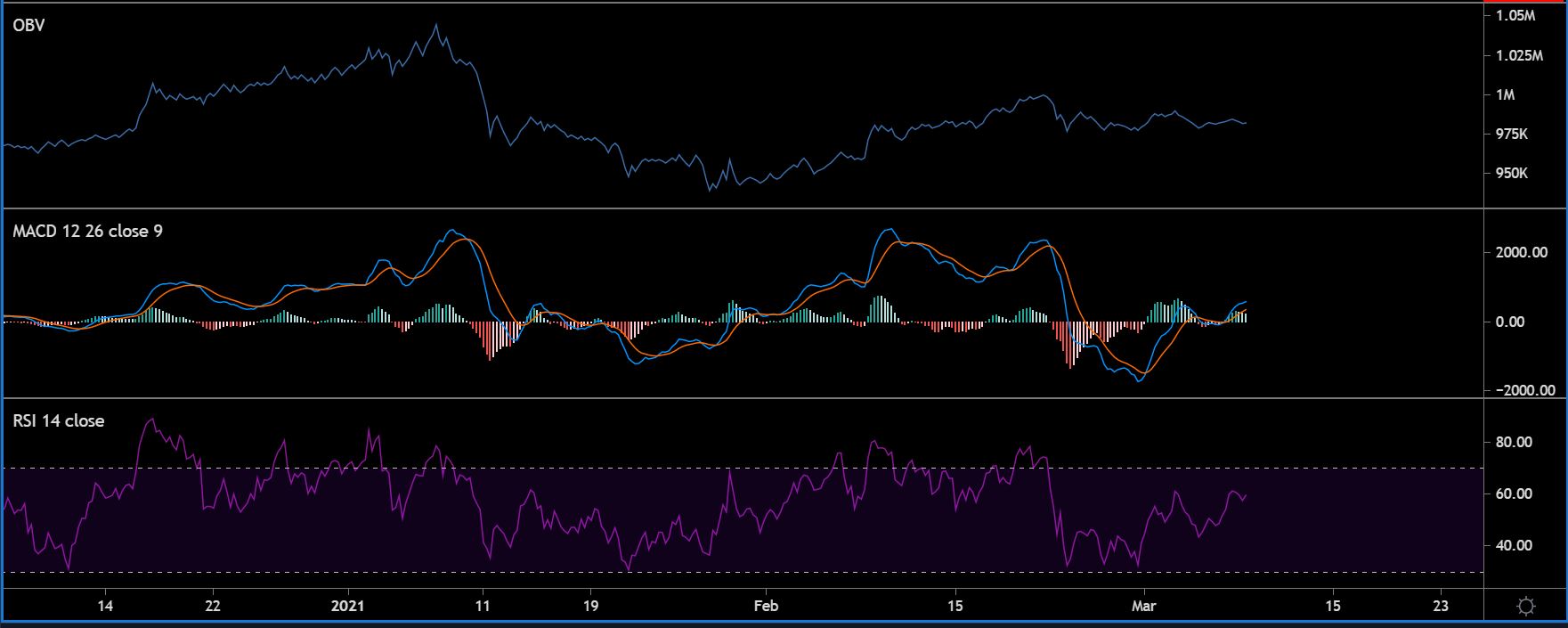

Market Indicators

BTC/USD on Trading View

According to On-Balance-Volume, market activity hasn’t picked up to the same level witnessed in 9 January, when Bitcoin reached $42,000. However, this opens up the window for upside rather than a drop for BTC.

MACD indicator presented more optimism, with the bullish line just above the signal indicator; but bullish momentum is relatively weaker than in the past.

Relative Strength Index is indicative of rising buying pressure but currently remains under the threshold of 60 and past data suggested that a push over the over-bought zone has triggered bullish rallies.

Verdict

Bitcoin will hold a value under $52,500 for the rest of the week; however any bullish breakout above the resistance will come at a rapid pace if the move above occurs in the short-term.