Bitcoin price bottom might be in, or not!

- BTC’s Spent Output Profit Ratio has suggested that a local price bottom might be in.

- However, the recent movement of dormant coins suggests otherwise.

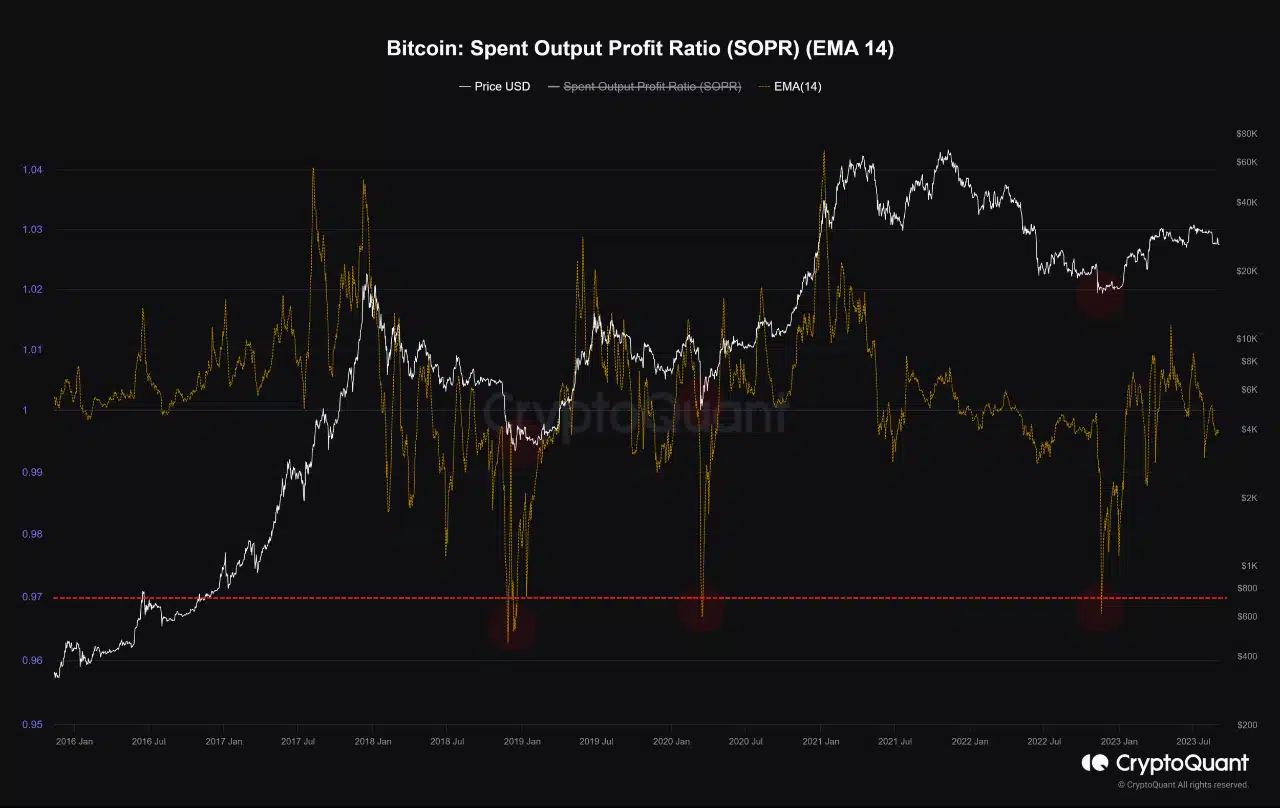

Bitcoin’s [BTC] Spent Output Profit Ratio (SOPR) has slipped below the critical threshold of 0.97, suggesting that the coin’s price has clinched a local bottom, and a price rebound may occur soon, pseudonymous Cryptoquant analyst Tarekonchain found in a new report.

Read Bitcoin’s [BTC] Price Prediction 2023-2024

The SOPR is a key metric used to gauge the profitability of coins that have been moved on the blockchain. When an asset’s SOPR is greater than one, it means that coins are being moved on average at a profit. Conversely, a SOPR value below 1 indicates that, on average, coins moved are being moved at a loss.

Taking a cue from metric’s historical precedents, Tarekonchain noted:

“Market bottoms tend to occur when the SOPR drops below the critical threshold of 0.97. This means that during bear markets or major corrections, investors often capitulate, selling their Bitcoin holdings at a loss, which causes the SOPR to dip below this threshold.”

According to the analyst, when BTC’s SOPR dropped below this critical threshold in January 2019 and April 2020, it was followed by a rebound in the king coin’s value.

“As of last November 2022, the SOPR metric briefly touched the 0.97 threshold, indicating that investor sentiment was approaching a critical level,” Tarekonchain added.

This metric suggests otherwise

While BTC’s SOPR signaled “a potential market bottom” per Tarekonchain, the coin’s Age Consumed metric suggested otherwise.

The Age Consumed metric tracks the number of tokens changing addresses on a certain date, multiplied by the time they last moved.

Typically, a surge in Age Consumed suggests that a significant number of once-idle tokens have begun to change address. This hints at a sudden and strong shift in the behavior of long-term holders.

Conversely, when the Age Consumed metric dips, long-held coins remain in wallet addresses without being traded.

This metric is an excellent tool to track assets’ local tops and bottoms because long-term holders are not often predisposed to swift movements of their dormant coins. Therefore, whenever this happens, it results in major shifts in market conditions.

How much are 1,10,100 BTCs worth today?

According to data tracked by Santiment, BTC’s Age Consumed recorded a significant jump on 29 August. This was followed by a decline in the coin’s value, suggesting that the coin reached a top at $27,727.

This movement of dormant coins also coincided with when the Securities and Exchange Commission (SEC) announced its decision to extend the dates within which it will consider all pending Bitcoin Spot ETF applications before it. This move further dampened market sentiment and forced BTC’s price downward.