Bitcoin price hikes by +5% after softer-than-expected U.S CPI report

- U.S CPI data rose to 0.3%, slightly below the expected 0.4% in April.

- Market saw some relief after April’s slow inflation reading, with BTC jumping by +5%

Risk-on markets, including Bitcoin [BTC], saw some relief after United States’ CPI data revealed that inflation didn’t get much worse in April.

According to the U.S Bureau of Labor Statistics (BLS), CPI (Consumer Price Index) rose 0.3% in April, slightly lower than the expected 0.4%. CPI is a key data point for Fed rate decisions and tracks what consumers pay for goods and services to gauge inflation.

In fact, the reading suggested that inflation cooled slightly in April, giving the markets a much-needed breather after a lot of muted price action.

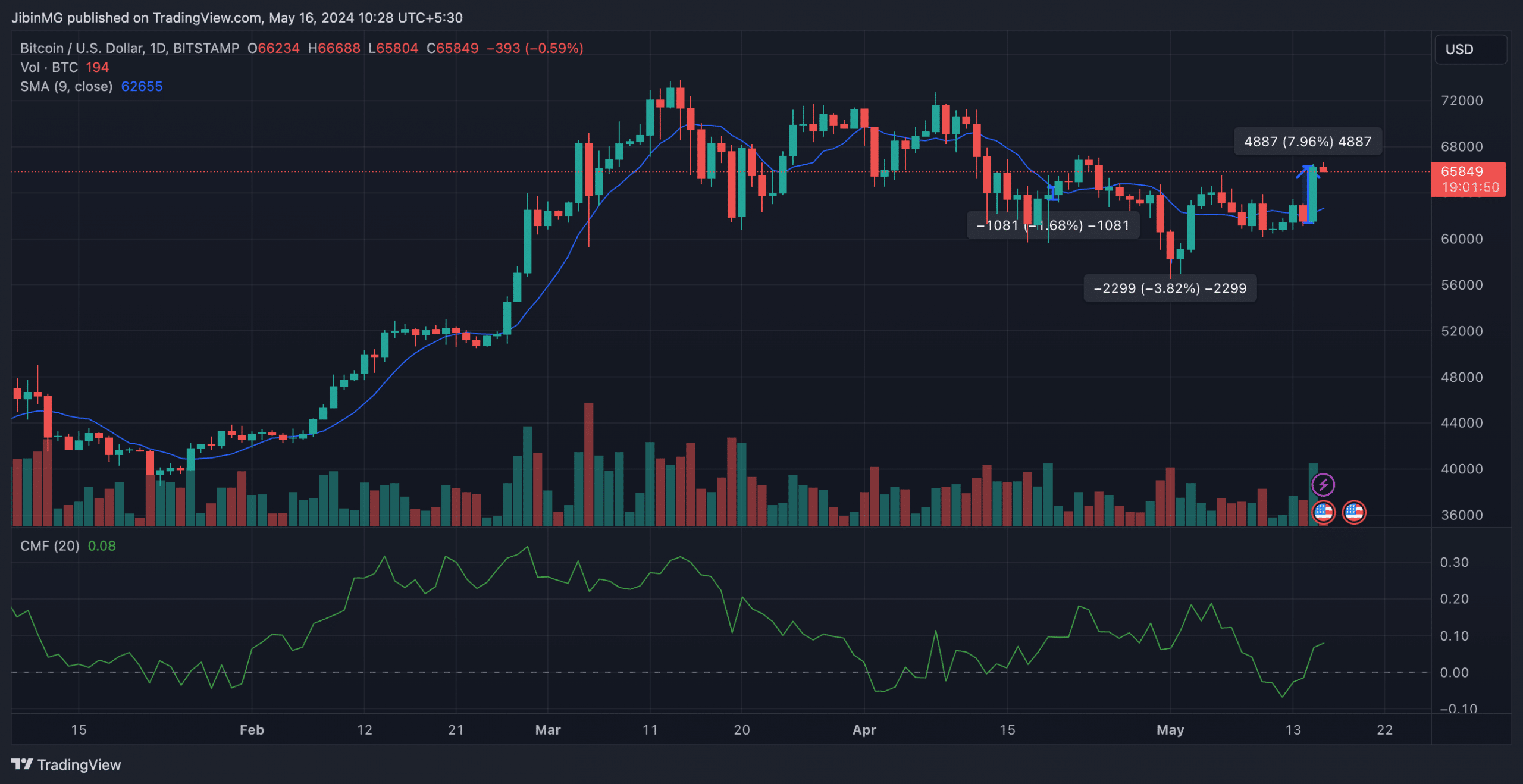

Bitcoin swings, eyes the short-term supply at $65K

AMBCrypto recently covered how this week’s Fed calendar and larger macro events could affect BTC price action. The lower reading from the CPI boosted risk-on markets, with BTC leading the fray.

On the price chart, the king coin rallied by over 5% and cleared its short-term spot supply (resistance) level at $63k. At the time of writing, it was trading at a value well past $65,000.

The aforementioned move could flip BTC’s market structure to bullish on the lower timeframes (LTF), especially on the 4H chart, if the candlestick closes above it. It’s worth noting, however, that the market structure on higher timeframes remains bearish unless BTC decisively closes above $66k.

Pseudonymous crypto-trader and analyst, Skew, shared a similar projection after the CPI data was released. After Bitcoin appreciated past $63,000, the trader noted,

“Spot supply around $65K now. Thin spot books, so spot taker flow will be vital in order to trend with bullish pricing so far in risk assets”

Additionally, the trader marked $63k and $63.5k as key price levels for a downside move.

Wait and watch

Despite the slightly lower CPI reading, the Fed could wait for a confirmation of slow inflation before cutting interest rates though.

Since BTC’s price action is fixated on Fed rate expectations, a clear price direction can be picked after June’s Fed meeting. In the meantime, BTC could extend its choppiness within the $60K—$70K range until the next Fed rate decision.