Bitcoin: Quantifying the chances of a run to $100K based on S2F

Bitcoin has been looking rather bullish in the fourth quarter. Ergo, the big question on everyone’s mind is – What will the top crypto’s price be when the year ends?

Unfortunately, while there are no universally accepted assessments, Bitcoin’s Stock to Flow (S2F) model has emerged as a leading quantitative model that intends to do just the same.

Demystifying stock-to-flow?

Bitcoin’s price projections have been largely debatable owing to the hypersensitivity of the coin with respect to market FUD and external macroeconomic factors. The stock-to-flow model, devised by the pseudonymous Dutch analyst PlanB, treats Bitcoin as being comparable to commodities such as gold or silver that are known as ‘store of value’ commodities.

Such commodities retain value over longer timeframes due to their relative scarcity.

‘Scarcity’ being the keyword here, this was the first model that attempted to quantify the relationship between the relative scarcity of the first-ever digital currency and its price. While the S2F model is merely an evaluation framework for Bitcoin, it is safe to assume its accuracy has made it popular in the past.

Divergences invalidating the model?

At the time of writing, Bitcoin was trading at $56.6k with impressive weekly and daily gains of close to 18.91% and 2.68% respectively. Alas, according to the S2F model, BTC’s price should have been around $109,877.09.

When Bitcoin hit its all-time high of $64,000 in mid-April, according to PlanB’s calculations. that level was not the peak of the current bull run. Notably, from mid-2018 up until the April ATH, PlanB’s S2F model has been more or less accurate barring a couple of divergences.

The year 2021, however, has been a year of extremes for the crypto.

One of the few reasons why S2F projections failed to meet the market price was the high volatility wave BTC rode after May 2021. The China FUD, Elon Musk’s comments and environmental concerns, as well as scrutiny from the Fed, all fueled BTC’s untimely fall from May.

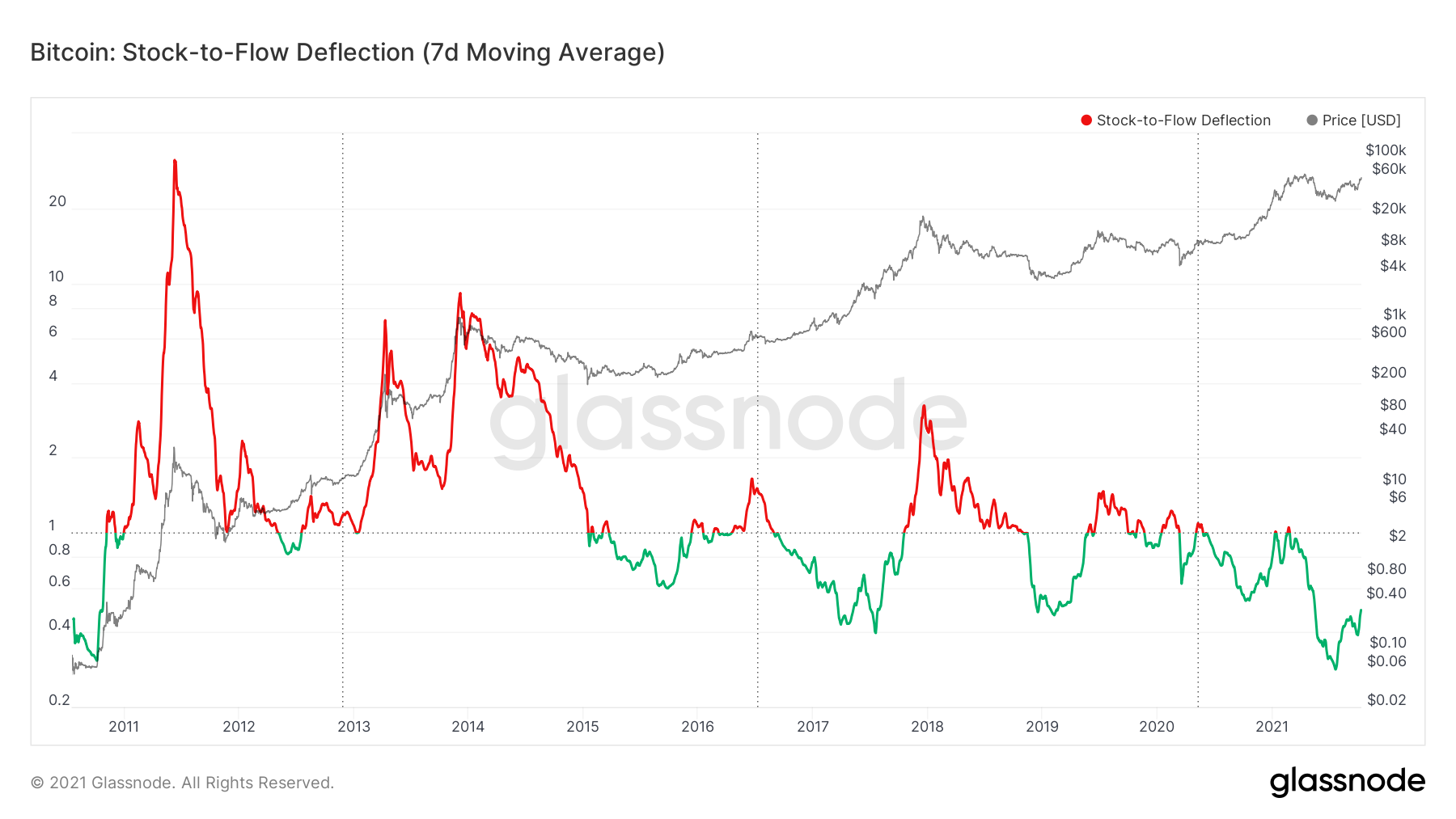

Stock-to-Flow Deflection | Source: Glassnode

Now, with the crypto finally recovering from its summer losses, hopes that BTC will follow the S2F model have heightened.

However, a look at the S2F deflection chart suggests that despite the recent rally, the metric places BTC as being undervalued. In fact, in spite of a close to 1500% hike in price since 2018, the king coin has spent most of its time in the undervalued territory, according to the indicator.

Optimism remains, but will S2F do justice to BTC?

Bitcoin’s exchanges reserves saw a considerable fall as HODLer behavior increased. All this fueled BTC’s scarcity narrative as Q4 began.

According to analyst Lark Davis, considering the lengthening cycle and diminishing returns theory, “we could see Bitcoin going up to $200k for a blow-off top for this cycle sometime in late 2021, but more likely early 2022.”

What’s more, PlanB too seemed highly optimistic about BTC rising to $150k by the end of the year.

With the S2F deflection noting a sharp uptick recently, it makes sense that analysts like PlanB and Lark Davis are optimistic.

So, with supply shock narratives building, scarcity going up, and positive comments from the SEC Chief in favor of a Bitcoin ETF, could S2F finally do justice to the king coin? Well, S2F has been accurate before. With Bitcoin’s status as a traditional asset strengthening the likelihood of BTC above $100k by end of the year, these projections won’t be too unbelievable.

The last quarter of this rather volatile year is set to make big changes for the top digital asset. Whether they will be good or bad, only time can tell.