Bitcoin records uptick as whales return: What this means for the king coin

- Bitcoin saw over 50,000 in Coin Days Destroyed.

- The Aroon indicator, however, pointed to the absence of pending price reversal.

There are indications that Bitcoin’s [BTC] recovery remained active at press time, and that it may soon surpass the $23,000 price level. The fact that these transactions appeared to be increasing suggested that it was caused by the movement of whales.

Read Bitcoin’s [BTC] Price Prediction 2023-24

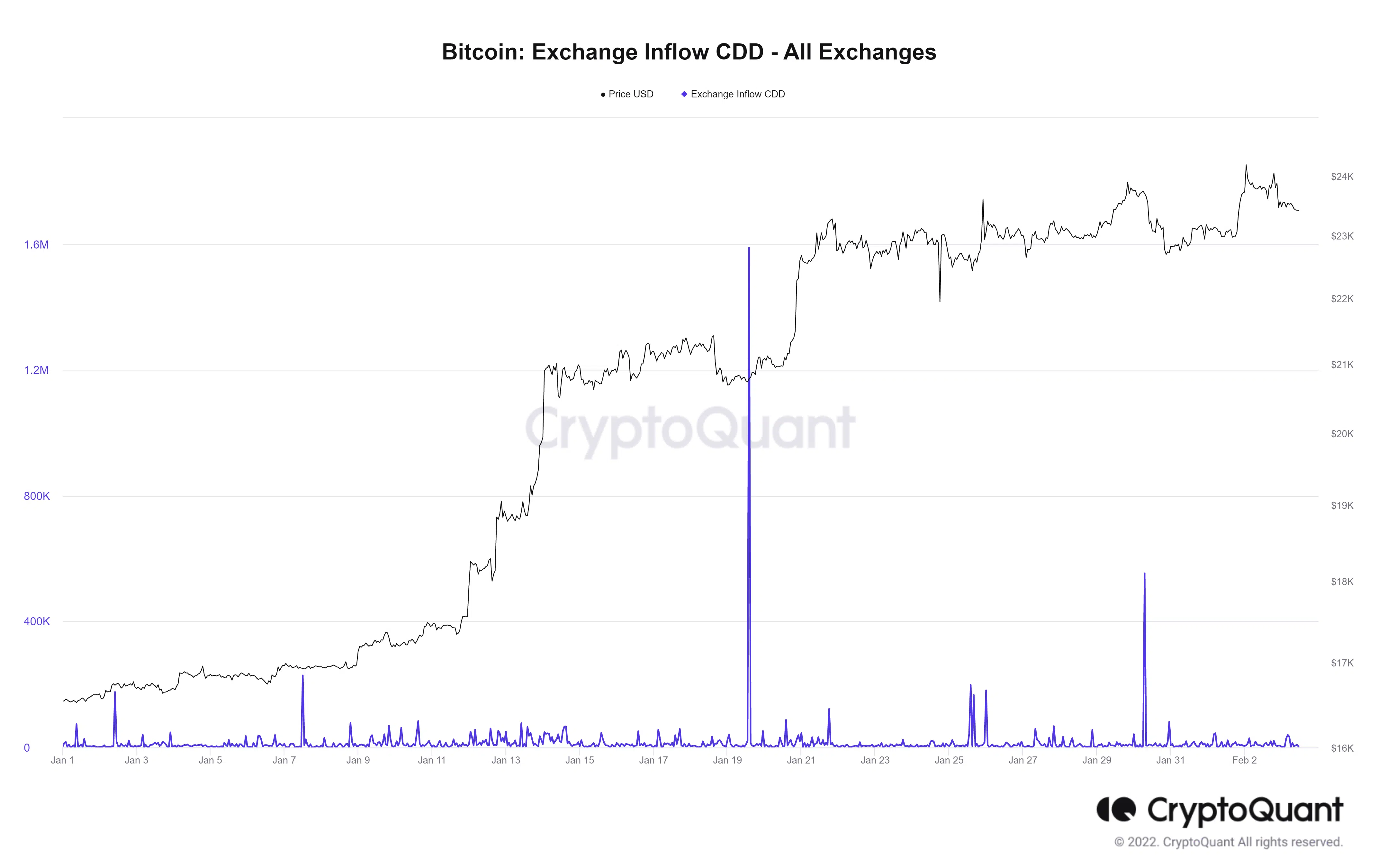

Analyzing the Coin Days Destroyed

An examination of Bitcoin’s Coin Days Destroyed (CDD) on 2 January revealed that nearly 50,000 coins were destroyed, according to CryptoQuant’s metrics. The Exchange Inflow CDD revealed that there had been movement. Moreover, the number of coins that had been kept in storage for a while had reduced, and the CDD flow was without a significant spike.

The volume of value transferred over a cryptocurrency network can be measured in terms of Coin Days Destroyed (CDD). It is determined by taking the daily average of coin transactions and multiplying that figure by the number of days since the last coin transaction. If the CDD value is high, then there is probably a lot of economic activity happening on the network.

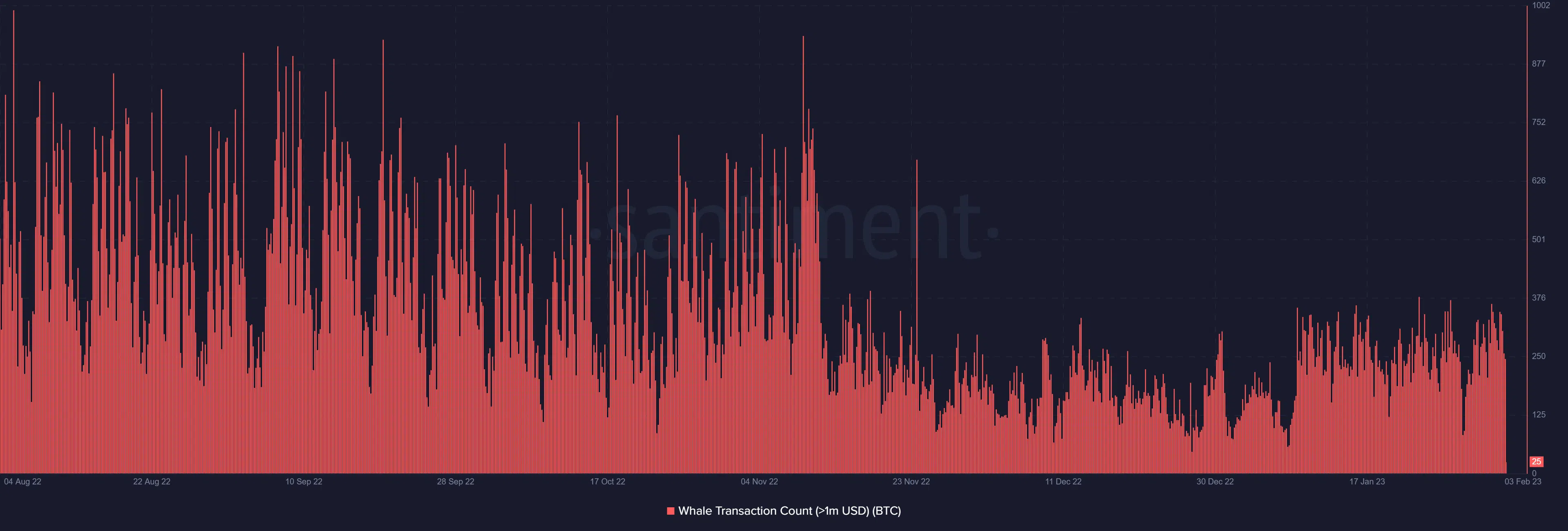

Whale activity increases, but ratio declines

Whale activity over $1 million increased in January 2023 compared to December 2022, according to Santiment. Selling pressure on exchanges also intensified because of the rising whale activity.

The Exchange Whale Ratio statistic from CryptoQuant also indicated a rise in whale activity despite a decreased whale ratio on exchanges. Moreover, the ratio’s decline may indicate sinking whale movement on exchanges.

Bitcoin breaches $24,000

A daily timeframe analysis of Bitcoin revealed that the coin was trading at about $23,500 at press time. The coin recovered after suffering a loss of almost 1% during the previous trading session.

Further examination revealed what was noteworthy: Bitcoin had reached $24,000 in the previous trading session, indicating a likely move into that price range. A glance at the volume indicator also revealed that, despite the apparent whale activity, there had not been a significant increase in sell pressure.

Is your portfolio green? Check out the Bitcoin Profit Calculator

Additionally, as of the time of writing, the Aroon Indicator indicated that the Up Aroon was approximately 92.86% and the Down Aroon was approximately 14.29%. This indicator’s percentage suggests that there was no imminent price reversal for BTC.

Despite the volume of CDD and whale activity, it was determined that there was no immediate threat to BTC’s price.