Bitcoin reversal trend incoming or breakout imminent? Here’s a breakdown of the chances

Holding 43% dominance over the entire crypto market, Bitcoin has been the center of attention for a while now. Bitcoin gained a bad rep of being easily manipulated by the community (Or Elon Musk); the coin lost over 39.9% of its price within the last 2 months. At press time the coin was trading north of $40k.

Popular trader and analyst Rekt Capital in his recent video discussed the potential head and shoulder pattern formation on Bitcoin’s charts and the implications of the same. Considering hypothetically that it is, that would lead to a bearish trend reversal for the coin and cause a price drop. In that case, the neckline would be established at $33,938 due to the presence of higher lows. A breakdown from that neckline would lead to a corrective period for Bitcoin.

Source : Rekt Capital

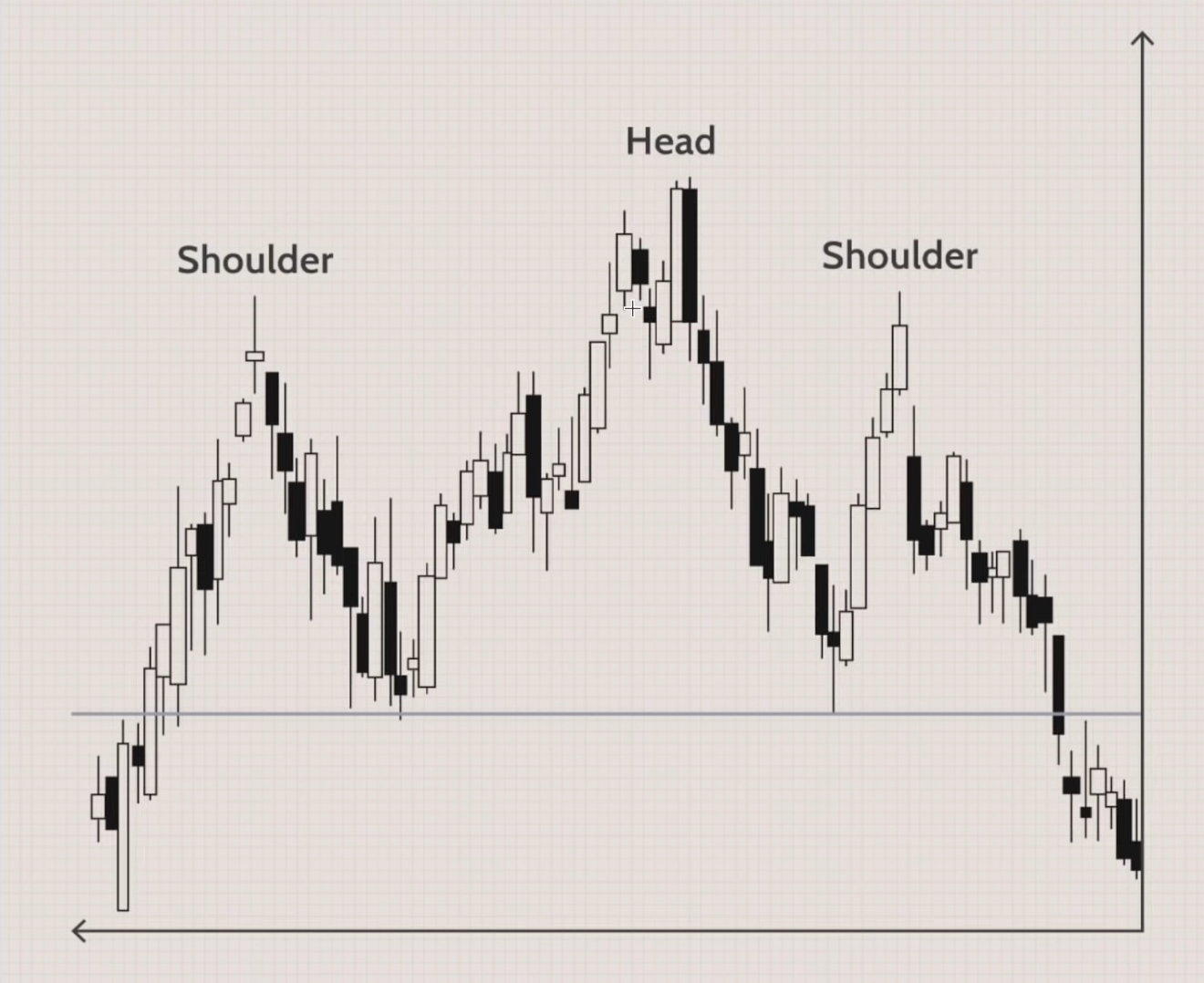

But Rekt Capital made it clear that the formation cannot be considered as a head and shoulder due to the fundamental difference between the structures. Seen below is what a typical classical head and shoulder chart looks like. Rekt Capital reiterated,

“This [ left shoulder ] is barely a shoulder to begin with as it is so low compared to the head and when we consider the right shoulder, we don’t even have any candle bodies to actually build that shoulder…”

Classic head and shoulder formation | Source : Rekt Capital

He further added:

“The head should be a volatile V-shaped formation…whereas the head was a 3-month long distribution range and can be thought of as a Wyckoff distribution range.”

Furthermore, the volume profiles as well are quite unusual for a head and shoulder formation. Since the right and shoulder don’t match either, Rekt Capital said that calling it such a structure would be inaccurate. Instead focusing on the active support and resistance levels should be the priority. Rekt Capital stated,

“It would be better to pay attention to key levels right here [$29,407 – support] and over here [$38,824 – resistance] as well because we are currently in macro consolidation…”

Bitcoin moving forward

In a more recent analysis, Rekt Capital showed how the current EMAs would continue to act as support and resistance going forward, and the present BTC breakout has pushed back the potential death cross by at least 2 weeks. On the looming death cross, Rekt capital further stated:

“Price increases from here would further postpone it, and if BTC is able to rally above $55K-$60K soon then BTC could avoid the cross altogether.”

These two EMAs will continue as support/resistance in for #BTC in the coming weeks

They mark out an extrapolated triangular market structure

But EMAs offer dynamic support/resistance so will shift with price changes

Already, we're seeing the EMAs deviate from the extrapolation https://t.co/Lp6Rsk2s8R pic.twitter.com/6z8dPTphi7

— Rekt Capital (@rektcapital) June 14, 2021

Fantastic upside movement from #BTC lately

The $BTC breakout has pushed back the potential Death Cross by two weeks

Price increases from here would further postpone it

And if $BTC is able to rally above $55K-$60K soon then BTC could avoid the cross altogether#Crypto #Bitcoin pic.twitter.com/JEEJlleoJ0

— Rekt Capital (@rektcapital) June 14, 2021

Lastly in a recent tweet, he mentioned the important BTC retest areas based on the coin’s previous movement saying,

Important #BTC retests $38K-$39K area as support (red)

In the past, $BTC would often fail to turn $39000 into support & this would lead to break downs (red circles)

That said, BTC has had better luck with turning the $38000 into support to precede further upside (green circle) pic.twitter.com/hFaNVJ9Np4

— Rekt Capital (@rektcapital) June 14, 2021

At the time of writing, Bitcoin managed to break through the $39,000 barrier and continued to move upward. This rally could help with the much-needed market correction and pull up other altcoins as well.

Still going well for #BTC, Daily Candle Close prints outside the wedging structure

Following the blue path well#Crypto #Bitcoin https://t.co/h5xk4o5fsP pic.twitter.com/rnDZhjn0ed

— Rekt Capital (@rektcapital) June 14, 2021