Bitcoin: Sharks, Crabs lag as BTC Shrimps create staggering shift

- Addresses holding between 0 to 1 BTC increased holdings, thus, hitting an ATH.

- The coin might be undervalued considering the 365-day trend of one metric.

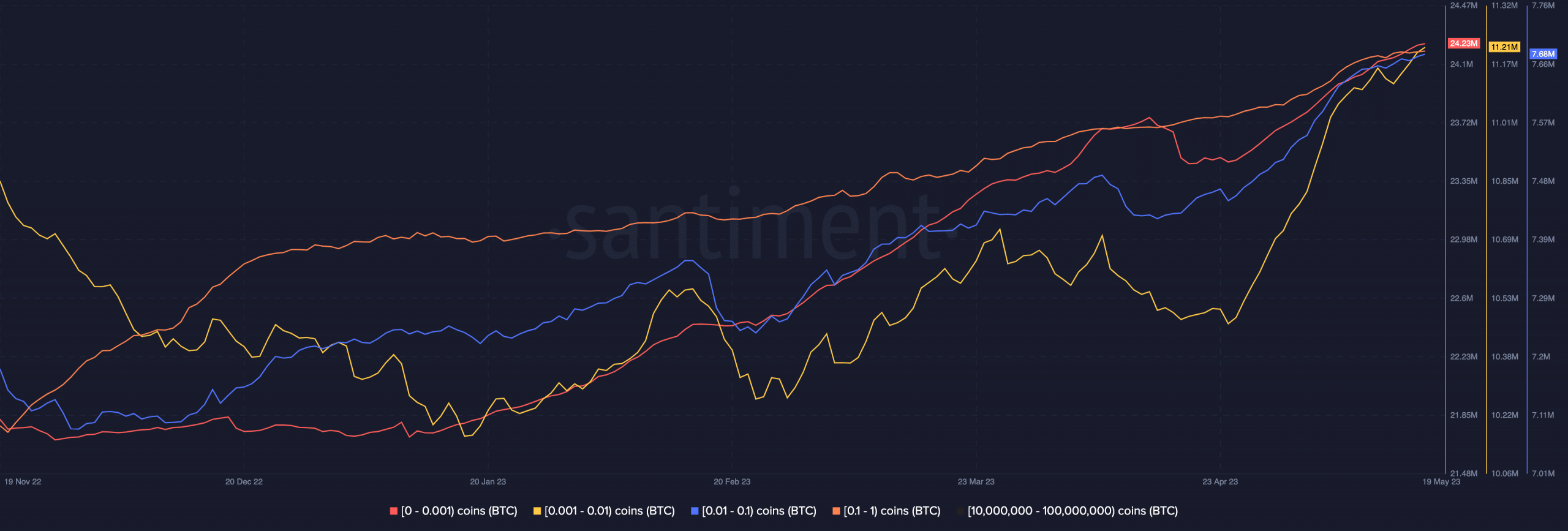

Bitcoin [BTC] Shrimps, a term used to describe relatively small investors who hold less than one BTC have been accumulating. This has led their holding to hit an All-Time High (ATH). Often characterized by the ability to navigate market volatility, Glassnode noted that the holding of this set surpassed others.

The #Bitcoin supply held by Shrimp Entities (<1 BTC) continues to relentlessly rise, expanding to an ATH of 1.31M coins.

The cohort is currently experiencing a significant expansion of +26K coins per month, with only 202 (3.9%) trading days recording a larger monthly growth. pic.twitter.com/Fa2QCHxZPO

— glassnode (@glassnode) May 18, 2023

Read Bitcoin’s [BTC] Price Prediction 2023-2024

The bottom of the chain rises

As stated above, the supply held by Shrimp entities was 1.31 million. Furthermore, the on-chain platform pointed out that the holders have had an average monthly supply increase of 26,000 coins.

While they may not possess the same financial firepower, their collective influence ensured that the hike was greater than other groups.

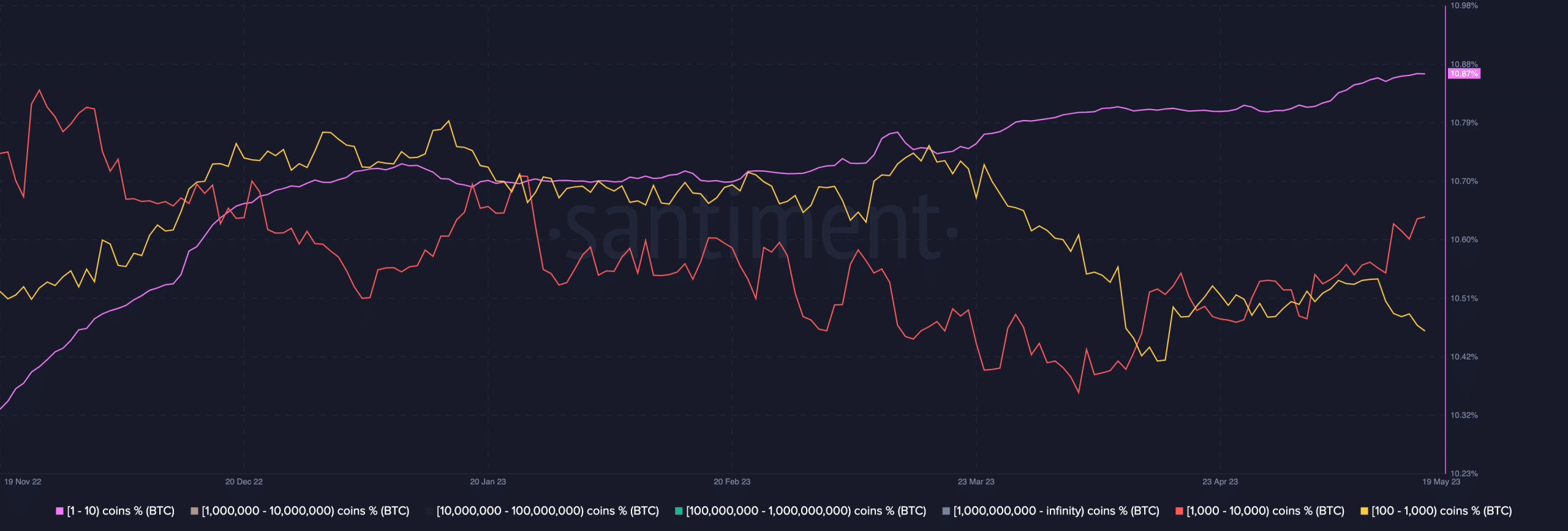

Crabs, whose demographic is those who hold between 1-10 BTC, have also increased supply by 10.87%, Santimet revealed. However, Bitcoin whales have not been able to catch up despite a recent increase in balance.

Sharks, typically early Bitcoin adopters, hold around 500 to 1000 BTC. For them, it has been a rollercoaster to the lower side of the plot.

The stunning shift in accumulation could be attributed to several factors. For one, the accumulation had been occurring for the last 365 days. Therefore, this implies that this cohort was of the viewpoint that BTC was undervalued.

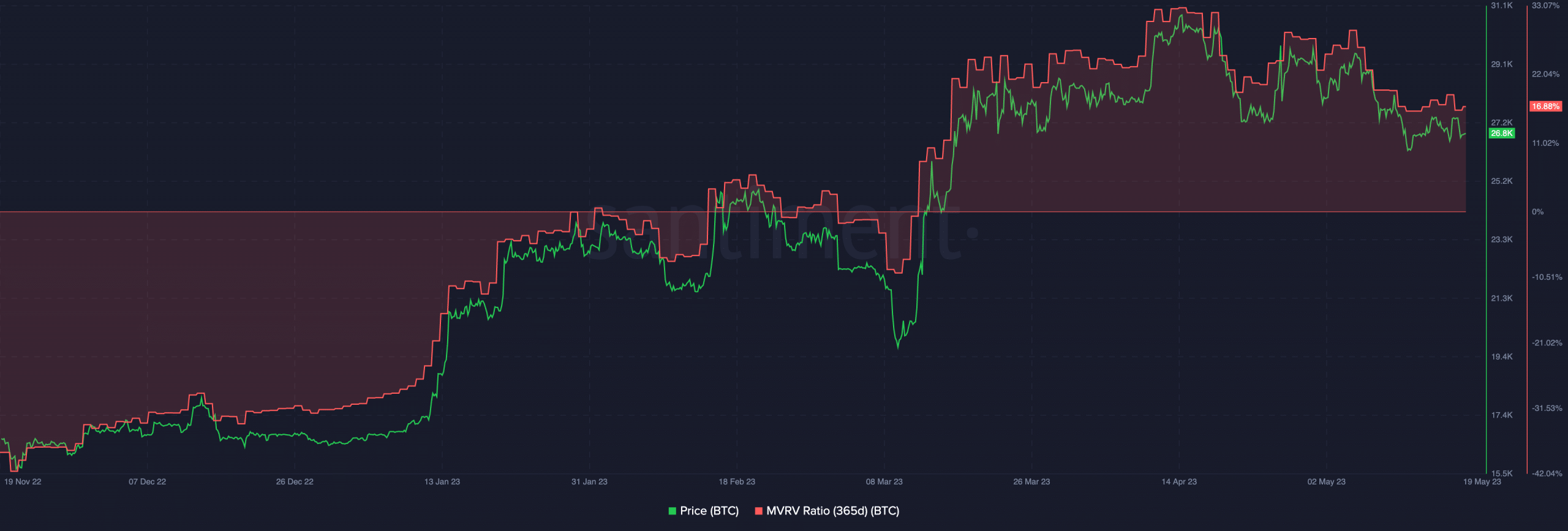

Despite Bitcoin’s price increase in the new year, Shrimps remained steadfast that BTC’s peak was not yet nearby. But on looking at the 365-day Market Value to Realized Value (MVRV) ratio, on-chain data showed that a chunk of BTC holders was in gains.

The MVRV ratio refers to the asset’s capitalization divided by the realized capitalization, used to indicate investor profitability and asset fair value. At the time of writing, the metric was 16.88%.

Snatching the chance before…

Therefore, the current state of MVRV aligns with the Shrimps’ resolve to continue holding. This also depicts a potential growth in BTC’s value.

Is your portfolio green? Check the Bitcoin Profit Calculator

Likewise, the balance on Shrimp addresses was not the only one affected by an increase. As of this writing, the cohort welcomed new members. This was because the number of investors holding 0-1 BTC significantly increased.

Due to this, it could be said that retail holders consider BTC solid enough to be profitable in the long term, thereby seizing opportunity. Subsequently, BTC’s price in the last year ended with a 11.21% decrease, thanks to the notable recovery in the first quarter of the year.