Bitcoin struggles to go past $28K – Is a reversal likely?

![As Bitcoin [BTC] struggles to break past $28,000, is a trend reversal likely?st $28,000, is a trend reversal on the cards](https://ambcrypto.com/wp-content/uploads/2023/05/BTC-4.png.webp)

- Bitcoin’s sum coin age distribution chart displayed a strong decline since 2 May, 2023.

- BTC’s exchange reserve declined while supply outside of exchanges went up.

The overall crypto market took a sideways path recently, restricting most cryptos from showing high price volatility. Bitcoin [BTC] was also not spared, as its price kept hovering below the $28,000 mark for quite some time.

Read Bitcoin’s [BTC] Price Prediction 2023-24

Interestingly, CryptoQuant’s analysis pointed out a factor that could have influenced BTC’s relatively restricted price movement over the past few weeks.

The BTC price movement was discouraging as after the last price pump, several expected a further hike. However, are there chances for a northbound surge anytime soon? Let’s take a look.

This was restricting Bitcoin…

AxelAdlerJr, an author and analyst at CryptoQuant, published an analysis highlighting a key reason behind BTC’s price not being able to cross the $28,000 mark.

As per the analysis, the issue was profit-taking by investors who acquired Bitcoin at a level of $28,600. This cohort held the coins for a period ranging from 3 months to 6 months.

The author used the Bitcoin: Sum Coin Age Distribution chart to establish his point. After 2 May 2023, a strong decline was seen on the chart, indicating that the group of investors must have liquidated their holdings in large quantities.

This suggested that Bitcoin buyers who made their purchases during the stated time frame probably wanted to realize their profits. And due to the rise in market sales volume, there was pressure on the price. Therefore, restricting BTC’s price from moving up.

Bitcoin whales were up to something

While the market remained less volatile, BTC whales were reacting differently. As per Glassnode, the largest whales, those with more than 10,000 BTC, changed from an accumulation-heavy regime to one with evenly balanced inflows and outflows.

When assessing the #Bitcoin Accumulation Trend Score by Cohort, we note that the largest of Whales (>10K BTC) have transitioned from a regime of heavy accumulation to one of equally balanced inflows and outflows.

With all other major cohorts aggressively distributing coins, the… pic.twitter.com/mzoORrDyhs

— glassnode (@glassnode) May 17, 2023

While the largest whales moved from an accumulation phase to a balanced phase, the rest of the market seems to be accumulating BTC since the price dip in early May.

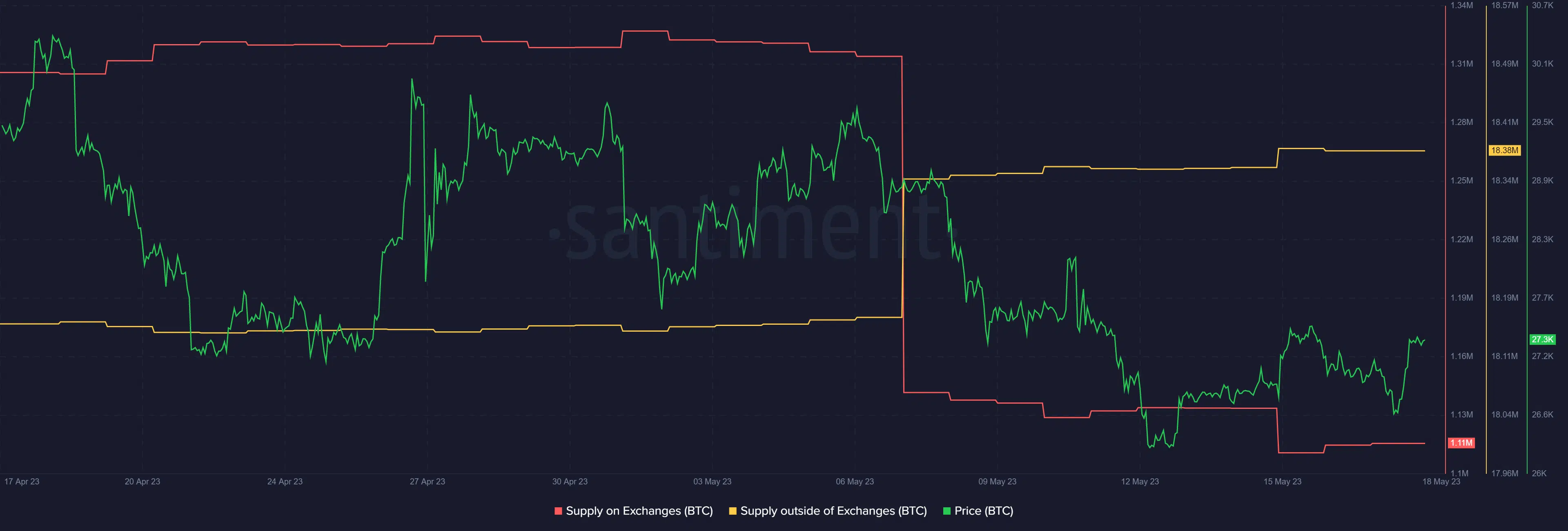

As per Sentiment’s chart, BTC’s supply on exchanges has sunk while its supply outside of exchanges has risen. This was in general positive, as it reflected investors’ trust in the king of cryptos.

Additionally, BTC’s number of addresses holding 0.1+ coins also reached an ATH of 4,372,629.

BTC to touch $28,000 soon?

Considering the unpredictable nature of the crypto market, nothing can be said with certainty. However, a look at BTC’s metrics suggests that the possibility of BTC crossing $28,000 can’t be ruled out.

For instance, BTC’s exchange reserve was decreasing, indicating that the coin was not under selling pressure.

Is your portfolio green? Check the Bitcoin Profit Calculator

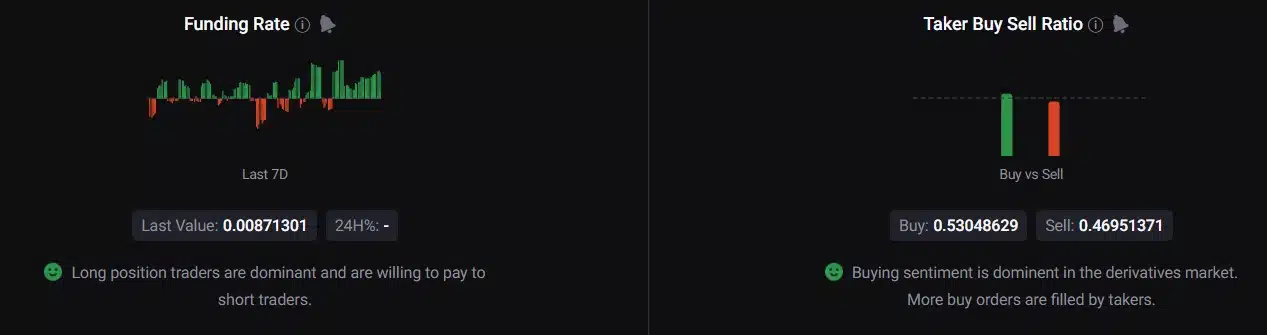

Additionally, Bitcoin’s taker buy/sell ratio pointed out that buying sentiment was dominant in the derivatives market. BTC’s funding rate was also green.

This indicated that long-position traders were dominant and were willing to pay short-position traders.