Bitcoin: Short-term holders play it safe as positive sentiment declines

- BTC’s long-term holders have increased accumulation, while short-term holders have gradually let go of their bags in the last year.

- BTC’s Bollinger Bands and Stochastic Oscillator hinted at a price rebound.

While Bitcoin’s [BTC] long-term holders (LTHs) intensify accumulation amid waning positive sentiments, the leading coin’s short-term holders (STHs) have adopted a more risk-averse approach.

1/ Long-term holders are persistently accumulating Bitcoin. The amount of $BTC held by short-term holders (<12 months) is currently less than prior to the 2021 bull run and continues to decrease. An increase in short-term holders has often coincided with surging prices #BTC pic.twitter.com/x5Ek9UhuqT

— IntoTheBlock (@intotheblock) July 28, 2023

Per data from IntoTheBlock, the amount of BTC held by this cohort of investors within a 12-month period sat below the amount they held during the 2021 bull market.

Historically, upticks in the leading coin’s price have been accompanied by an increase in the count of its STHs. However, the recent price surge to above $32,000 did not lead to a rise in the count of these investors. “Instead, long-term holder growth continues,” IntoTheBlock noted.

The on-chain data provider stated further that this situation contrasts with 2019, where BTC’s return to $11,000 led to a significant boost in short-term holders.

Is your portfolio green? Check out the Bitcoin Profit Calculator

BTC might be in trouble in the short-term

At press time, the leading coin exchanged hands at $29,363.01, per data from CoinMarketCap. At press time, BTC’s weighted sentiment was -0.421. This metric has lingered beneath the zero line since the beginning of June. Poor sentiment has caused the coin’s price to oscillate within the $29,000 and $32,000 tight range since April.

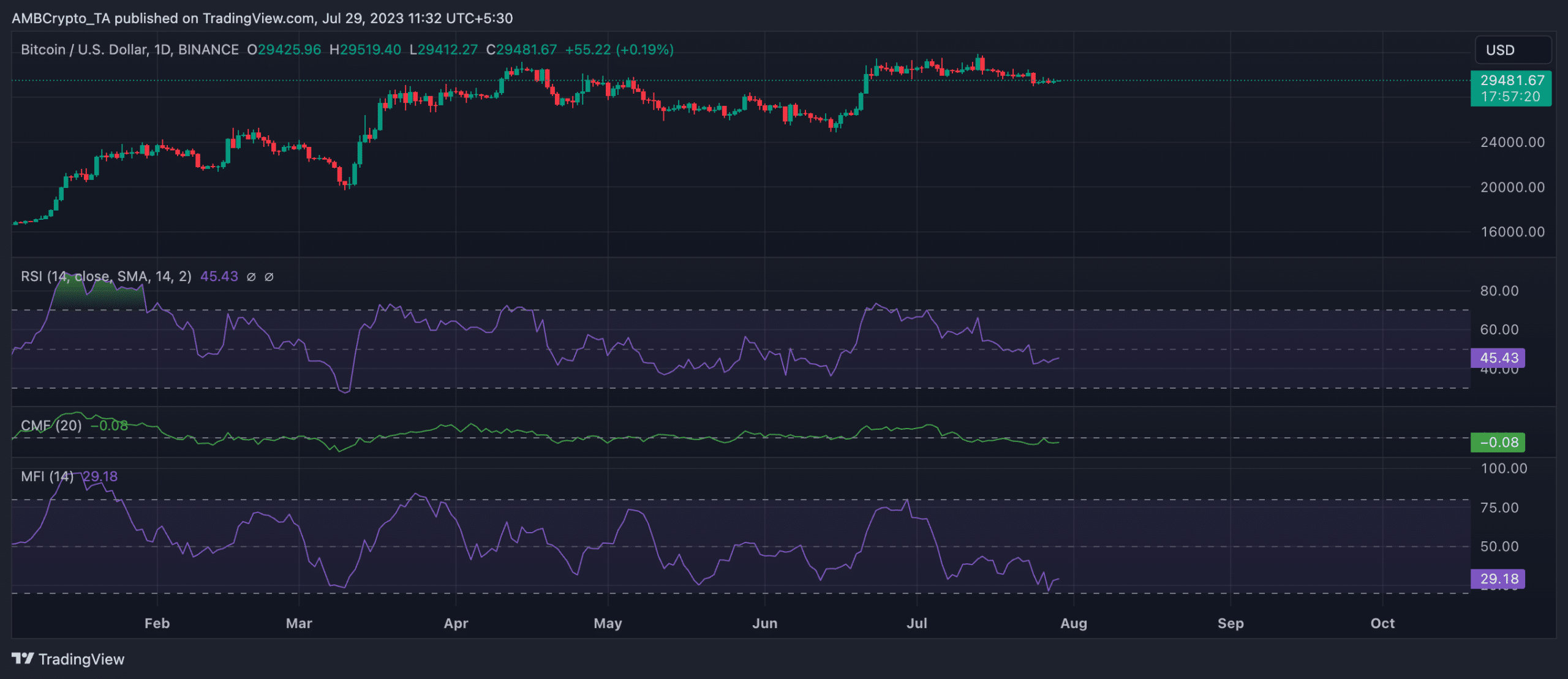

As more traders exit their trade positions to seek safety, BTC accumulation has declined on the D1 chart. At press time, key momentum indicators rested beneath their respective center lines.

When these indicators post a value below 50, this suggests that BTC’s price continues to weaken as the selling pressure outweighs buying pressure. It also implies that the overall sentiment is bearish, and the price might be on a downward trend for a while longer as it struggles to regain positive momentum.

At press time, BTC’s Relative Strength Index (RSI) was 45.43. Its Money Flow Index (MFI) was buried deeply in the oversold territory at 29.18.

Signaling a growing liquidity exit from the Bitcoin market, its Chaikin Money Flow (CMF) returned a negative value of -0.08 at the time of writing.

But here is the catch

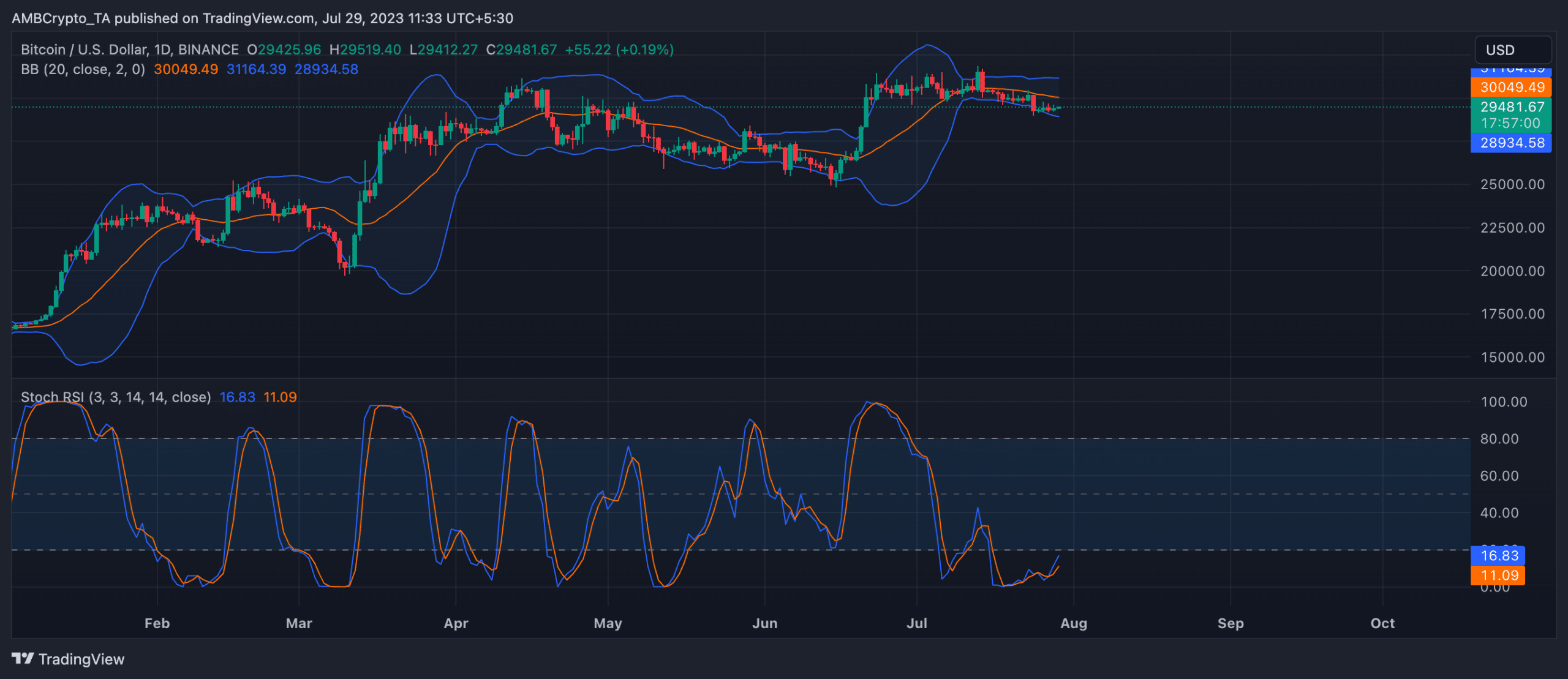

While the above indicators suggested that BTC’s sale has outpaced accumulation in the past few weeks, a closer look at the coin’s Bollinger Bands and Stochastic Oscillator indicators showed that it was oversold, and a price recovery might be on the horizon.

Bollinger Bands measures an asset’s price volatility and potential overbought or oversold conditions. Similarly, the Stochastic Oscillator indicator generates signals based on overbought and oversold conditions by comparing the closing price of an asset to its price range over a specific period.

How much are 1,10,100 BTCs worth today?

At press time, BTC’s price rested on the lower band of its Bollinger Bands indicator. This suggested that the coin was oversold at its current price and might experience a price correction upwards.

Regarding the Stochastic Oscillator, the K line (blue) was positioned above the D line (orange) in the oversold zone (below 20). This also lent credence to the position that the coin’s price might rebound.