Bitcoin: Short-term holders unmoved by market mayhem

- Compared to catastrophic incidents of 2022, BTC’s short-term holder supply sent to exchanges remained low.

- Most of the investors in this cohort have been selling at a loss on average.

The ongoing market mayhem triggered by U.S. regulators’ actions has significantly impacted the performance of Bitcoin [BTC] and other altcoins, with FUD becoming the order of the day.

How much are 1,10,100 XRPs worth today?

Generally, periods like this test the resilience of short-term holders (STH) who are the first to jump ship in response to market fluctuations. While this has been true to some extent, the bigger picture narrated a different story.

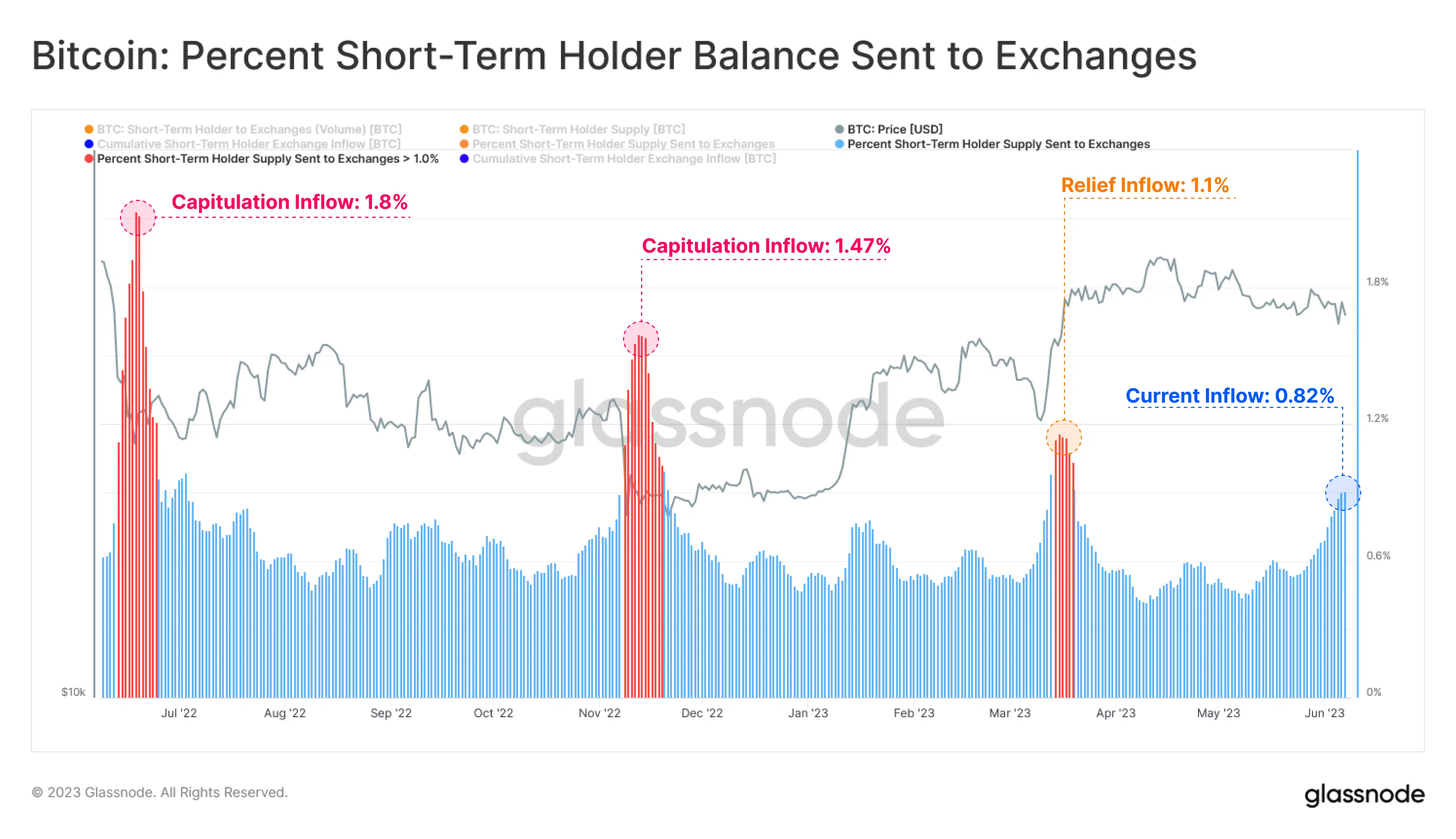

As per the on-chain analytics firm Glassnode, the percentage of STH supply sent to exchanges has increased steadily to 0.82% over the past week. This indicated their willingness to cash out their tokens.

However, as depicted in the graph below, this remained less when compared to the inflows witnessed immediately after collapse of Terra [LUNA] in May and bankruptcy of crypto exchange FTX in November, the two market implosions in 2022.

June bucks the trend?

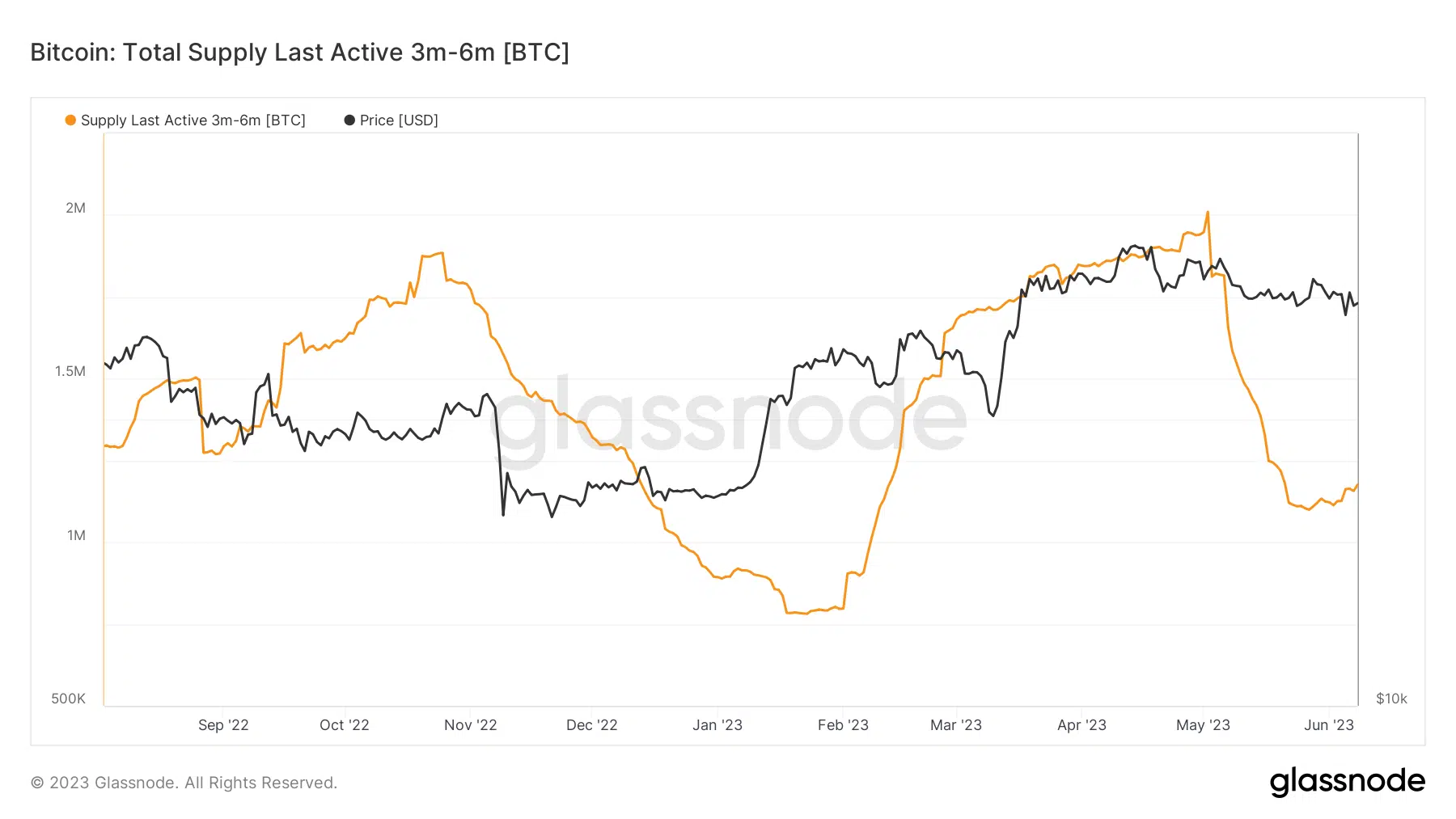

Short-term holders are the participants who keep possession of coins for less than 155 days, as per Glassnode. During the low volatility phase throughout May, STHs were actively selling their tokens, as evidenced by the sharp drop in supply held between 3 – 6 months.

However, the beginning of June saw a slight uptick in hodling activity for this age band, lending credence to the deductions made earlier.

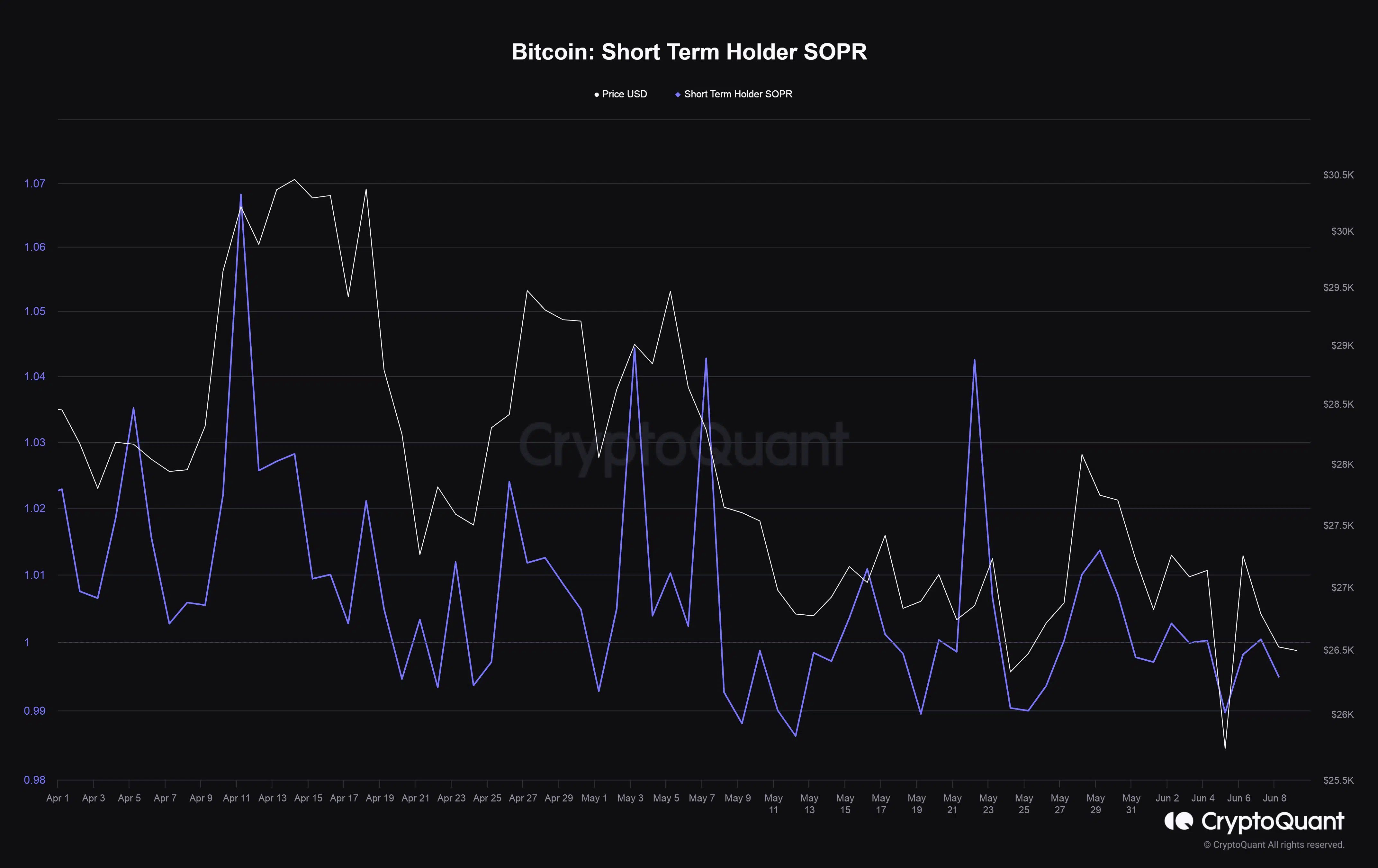

The faith shown by short-term holders reflected the market’s positive trend. However, most investors in this cohort have been selling at a loss on average.

According to CryptoQuant, the Short Term Holder SOPR has been less than 1 since the FUD that was sparked at the beginning of the week.

What is the trigger for Bitcoin?

At the time this article was written, Bitcoin was trading hands for $26,551.61, having dropped by 3% on a week-to-date (WTD) basis, as per CoinMarketCap. The market mood was balanced between greed and anxiety.

Are your BTC holdings flashing green? Check the Profit Calculator

Thus, STHs could continue holding coins in the near-term.

However, a macroeconomic trigger or other unforeseen events could invalidate this narrative. The Federal Reserve’s upcoming meeting could be one of those. So, many analysts have been anticipating a 25-basis-point hike in the interest rate.

Bitcoin Fear and Greed Index is 50. Neutral

Current price: $26,574 pic.twitter.com/EB0zg7ln35— Bitcoin Fear and Greed Index (@BitcoinFear) June 8, 2023