Bitcoin, Solana lead the way as crypto inflows rise after 5 weeks

- Bitcoin contributed $144 million to the investment, while Solana had $5.9 million.

- Ethereum’s struggles with regulatory uncertainty triggered outflows from its products.

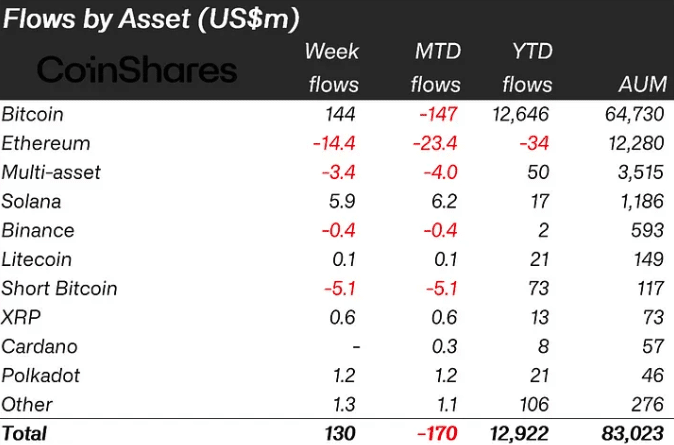

Bitcoin [BTC] investment products have finally broken the five-week streak of outflows and attracted $144 million in weekly inflows, according to a recent report by CoinShares.

Every week, the digital asset management firm released a detailed about investments in crypto products. For the last five weeks, all of them have ended in massive outflows, despite the initial strong start to the year.

Volume falls, capital rises

But last week, the products were able to amass inflows totaling $130 million. The report linked the hike to the growing interest in crypto products in Hong Kong.

Also, ETFs in the U.S. registered low outflows. However, Bitcoin was not the only cryptocurrency that ensured the record ended in a net positive value.

According to CoinShares, Solana [SOL] also had a hand in it as it registered $5.9 million in inflows. Despite the improvement, the ETP volume dropped when compared to the average weekly volume in April.

ETP stands for Exchange Traded Products. In April, the average volume was $17 billion. But the metric was not able to match that last week, as it only hit $8 billion.

The decrease indicated a declining interest in interacting with crypto products, with the report noting that,

“These volumes highlight ETP investors are participating less in the crypto ecosystem at present, representing 22% of total volumes on global trusted exchanges relative to 31% last month.”

At press time, Bitcoin’s price was $62,579. This was a 2.72% increase in the last 24 hours. Solana, on the other hand, changed hands at $148.22— a 7.44% increase within the same period.

BTC and SOL are leaving ETH behind

With this price performance, it could be possible that committing capital to Bitcoin and Solana-related products was a wise choice.

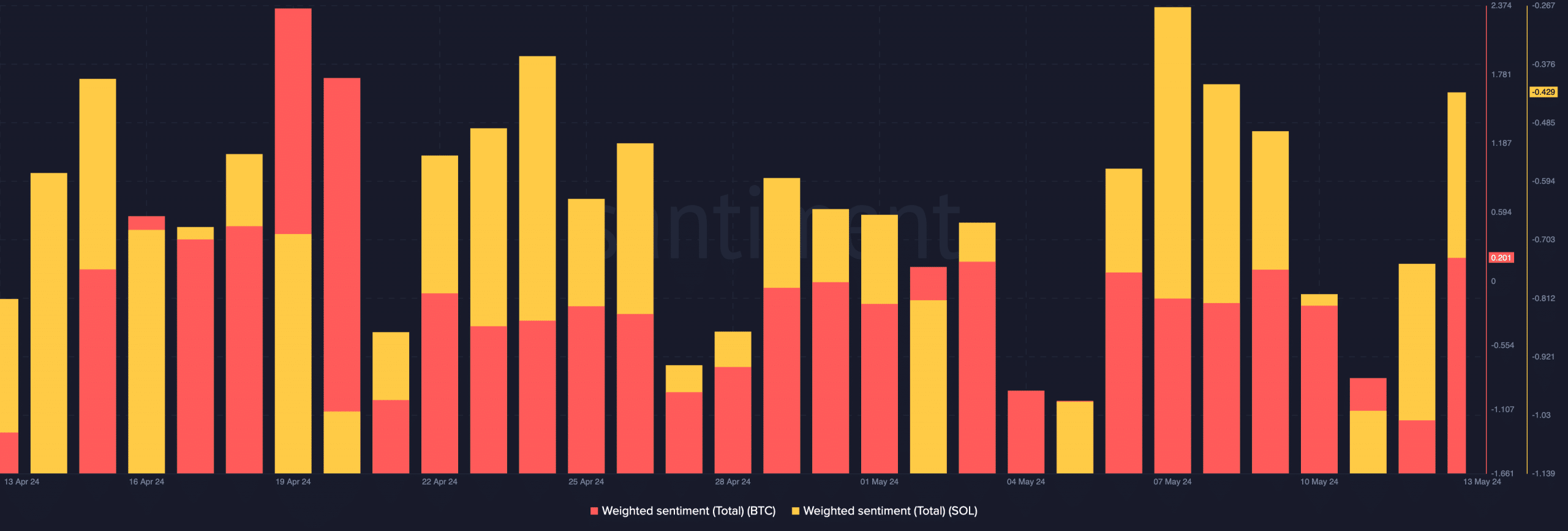

Furthermore, it seemed that the market was getting more and more confident about BTC and SOL. This was evident from the state of their Weighted Sentiment.

Using Santiment’s on-chain data, AMBCrypto noticed that Bitcoin’s Weighted Sentiment was 0.201. This reading implied that comments about the coins have been largely positive.

For SOL, it was -0.429. However, this was a notable improvement from what the metric was on the 12th of May. As such, this was confirmation that the bearish bias around Solana was waning.

Meanwhile, Ethereum [ETH] was also on the radar. But this time, it was on the losing end, considering that AMBCrypto reported how the altcoin got more inflows in the previous week.

Realistic or not, here’s SOL’s market cap in BTC terms

Based on the latest data, Ethereum products had outflows worth $14.4 million.

The fading optimism about the approval of the Ethereum ETF application was the major reason for the decline, with CoinShares explaining that,

“Low interaction by the US regulators with ETF issuer applications for a spot Ethereum ETF has increased speculation that the ETF approval is not imminent, this has been reflected in outflows which totaled US$14m last week.”