Bitcoin struggles to hold above $100K as Powell’s comments stir market

- BTC drops below $100K amid Powell’s Fed comments, triggering sell-offs and market-wide uncertainty.

- Whale activity spikes as traders monitor BTC resistance at $105,400 to confirm recovery trends.

Bitcoin [BTC] dropped below the $100,000 mark on Wednesday night, the 18th of December, following comments by U.S. Federal Reserve Chair Jerome Powell.

Speaking at a press conference, Powell stated that the Federal Reserve is not allowed to hold Bitcoin and has no intention of seeking a change in the law to do so.

Responding to a query about a potential U.S. government Bitcoin reserve, Powell clarified,

“We’re not looking for a law change.”

At the time of writing, Bitcoin was trading at $101,292, down 2.01% over the past 24 hours and 0.18% over the past seven days.

Powell’s comments and FOMC projections spur market uncertainty

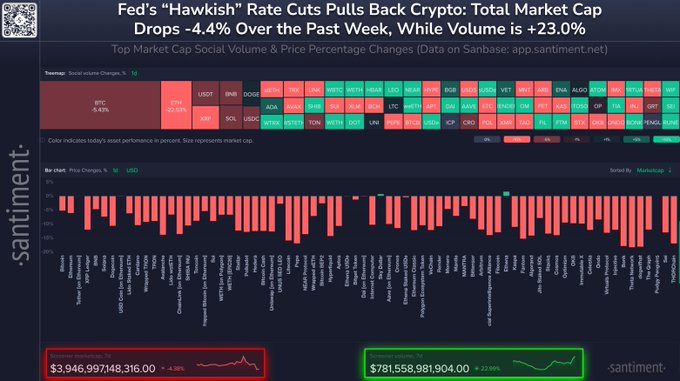

The broader crypto market reacted negatively to Powell’s remarks and the Federal Open Market Committee’s (FOMC) rate cut projections for 2025.

Powell indicated that the number of rate cuts expected in 2025 would be halved compared to earlier projections, leading to unease across both cryptocurrency and equity markets. According to Santiment, the announcement triggered widespread sell-offs.

Altcoins were hit hardest, with Avalanche, Chainlink, and Litecoin losing 16% each, and Pepe falling 17% over the past 24 hours.

Ethereum [ETH] fell by 6%, while XRP saw a 10% drop. Bitcoin itself broke below the $100K psychological threshold, fueling bearish sentiment.

Technical analysis: Bitcoin’s critical resistance levels

Crypto analyst Ali noted that Bitcoin appears to have broken out of a head-and-shoulders pattern, which could project a bearish target of $99,000. However, Ali emphasized that Bitcoin must surpass $105,400 to invalidate the bearish outlook.

The current price movement suggests that traders are closely monitoring these levels for further confirmation.

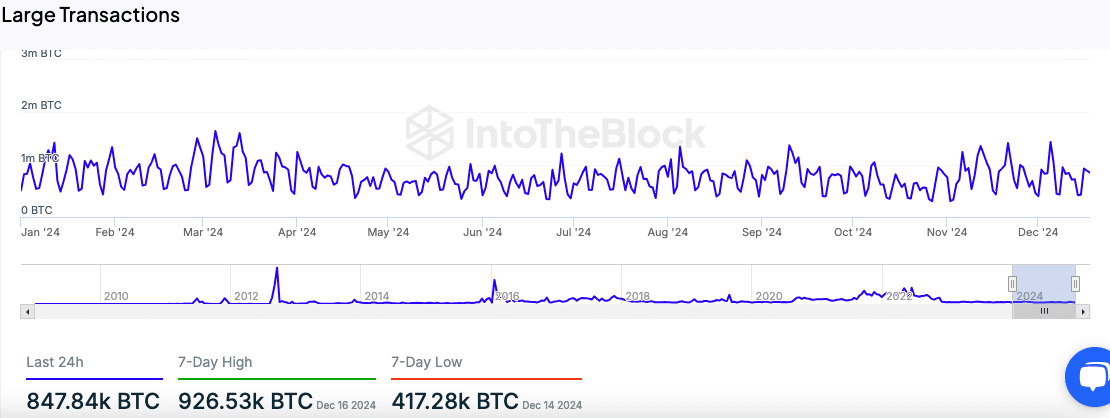

Despite the bearish sentiment, market participants remain active. Data from IntoTheBlock showed that large Bitcoin transactions, exceeding $100K, remain consistent throughout the year.

Whale activity reached a seven-day high of 926.53K BTC on 16th December, suggesting continued institutional interest.

Source: IntoTheBlock

Market trends: Trading volume, open interest, and netflows

Coinglass data showed a 39.05% rise in trading volumes, which reached $150.01 billion, reflecting heightened activity. However, open interest dropped slightly by 1.10%, now at $67.77 billion.

Options markets showed an increase, with options volume rising by 33.15% to $4.28 billion, while open interest in options saw a marginal increase of 0.84%, reaching $41.68 billion.

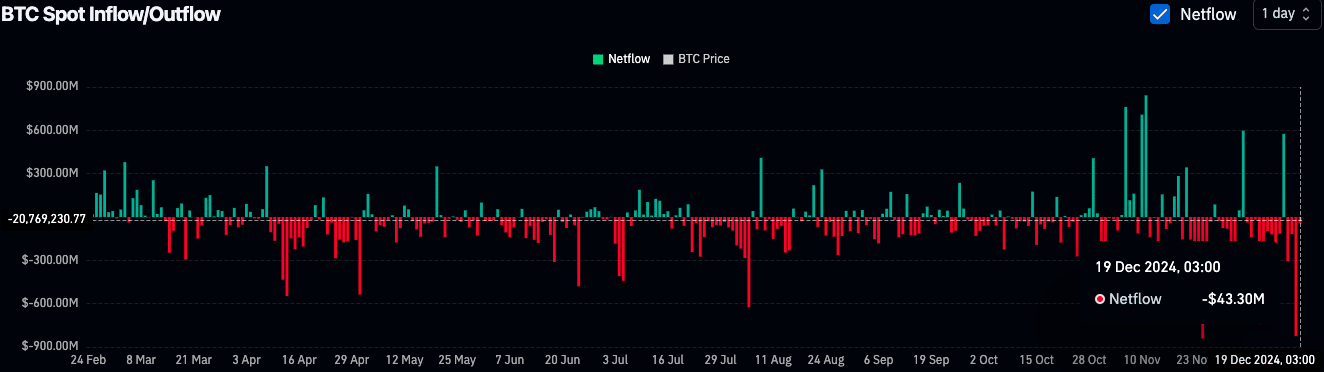

Exchange netflows indicate strong accumulation trends. BTC outflows dominated in 2024, with consistent red bars reflecting reduced sell pressure.

On 19th December, net outflows of $43.3 million suggested traders moving BTC into cold storage, signaling confidence in the asset.

Read Bitcoin’s [BTC] Price Prediction 2024-25

The overall crypto market capitalization dropped by 5% to $3.44 trillion, while trading volumes rose by 40%, hitting $251 billion.

The combined data shows that while Bitcoin and the broader market face headwinds, traders remain actively engaged, positioning themselves for the next significant move.