Bitcoin below $26.8K – All you need to know

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

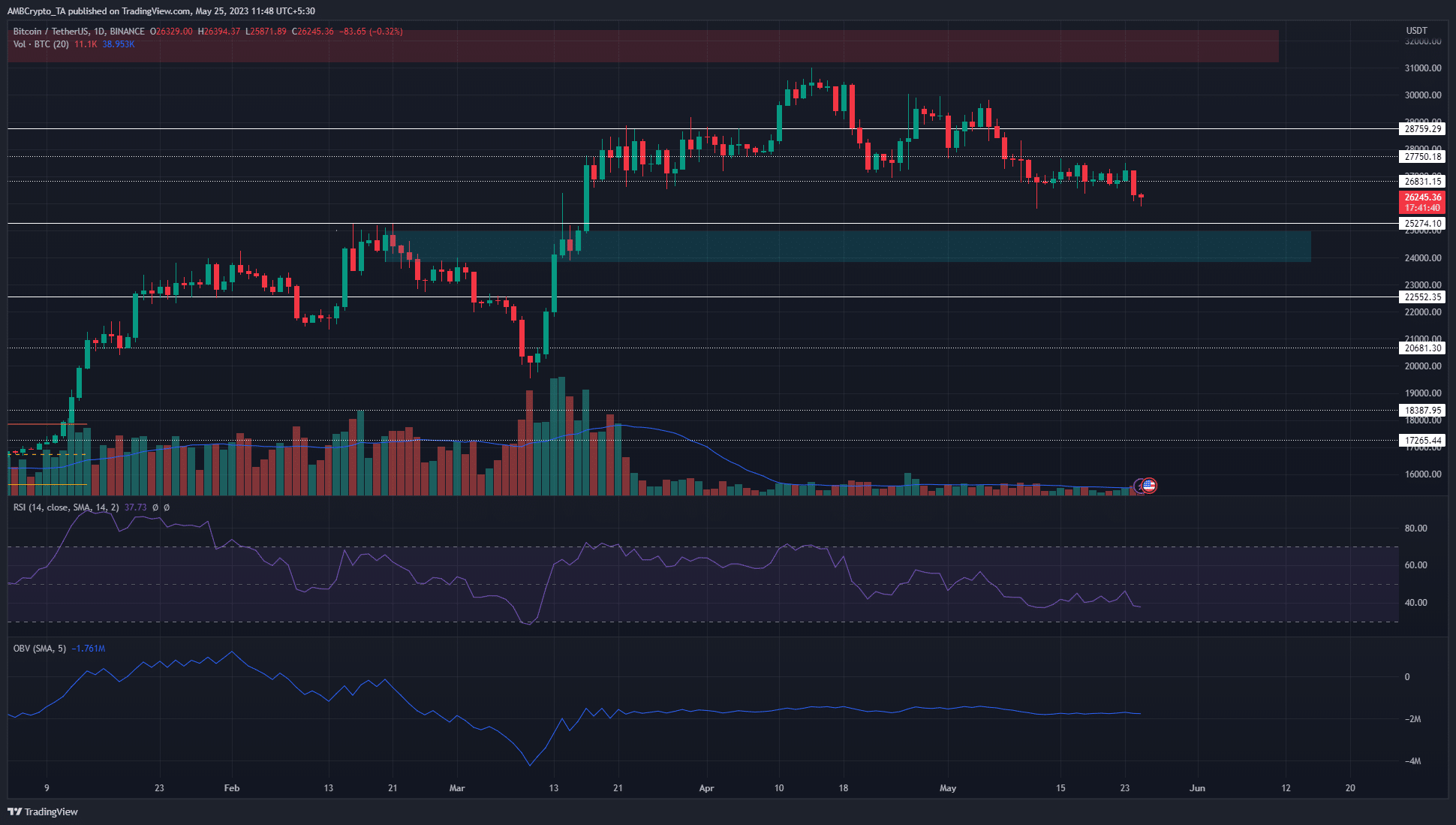

- The market structure has been bearish since late April.

- The breaker block from February could see heavy activity from BTC bulls.

After the powerful gains Bitcoin [BTC] registered in January and March, investor sentiment behind BTC has shifted from utter dejection to hope and optimism. This was especially true after the rally in March, following the retest of the $20k support zone.

Read Bitcoin’s [BTC] Price Prediction 2023-24

However, the bulls were unable to breach the $30k mark. A recent report highlighted that the downturn in prices was a response to the network overheating. Can the buyers exert a reversal, and where could it occur on the charts?

The fall below $26.8k handed power to the bears

The rally in March meant Bitcoin had a bullish market structure until the latter half of April. On 21 April, BTC fell below $27.7k, flipping the market structure to bearish. It has remained that way in the past month.

Over the past two weeks, the bulls tried desperately to defend the $26.8k-$27k area but were overcome on 24 May. Investors in traditional markets seemed to be worried about the U.S. debt ceiling, which in turn negatively impacted the crypto markets.

To the south, a bullish breaker block (cyan) on the 1-day timeframe sat in the $24k-$25k region. It was formerly a bearish order block that was breached during the March rally. This region has confluence with the $25.2k and $24.3k levels, marking it as a significant support zone.

The Relative Strength Indicator was below neutral 50, showing a bearish trend in progress. However, the On Balance Volume indicator was flat over the past two months, despite the downturn in prices.

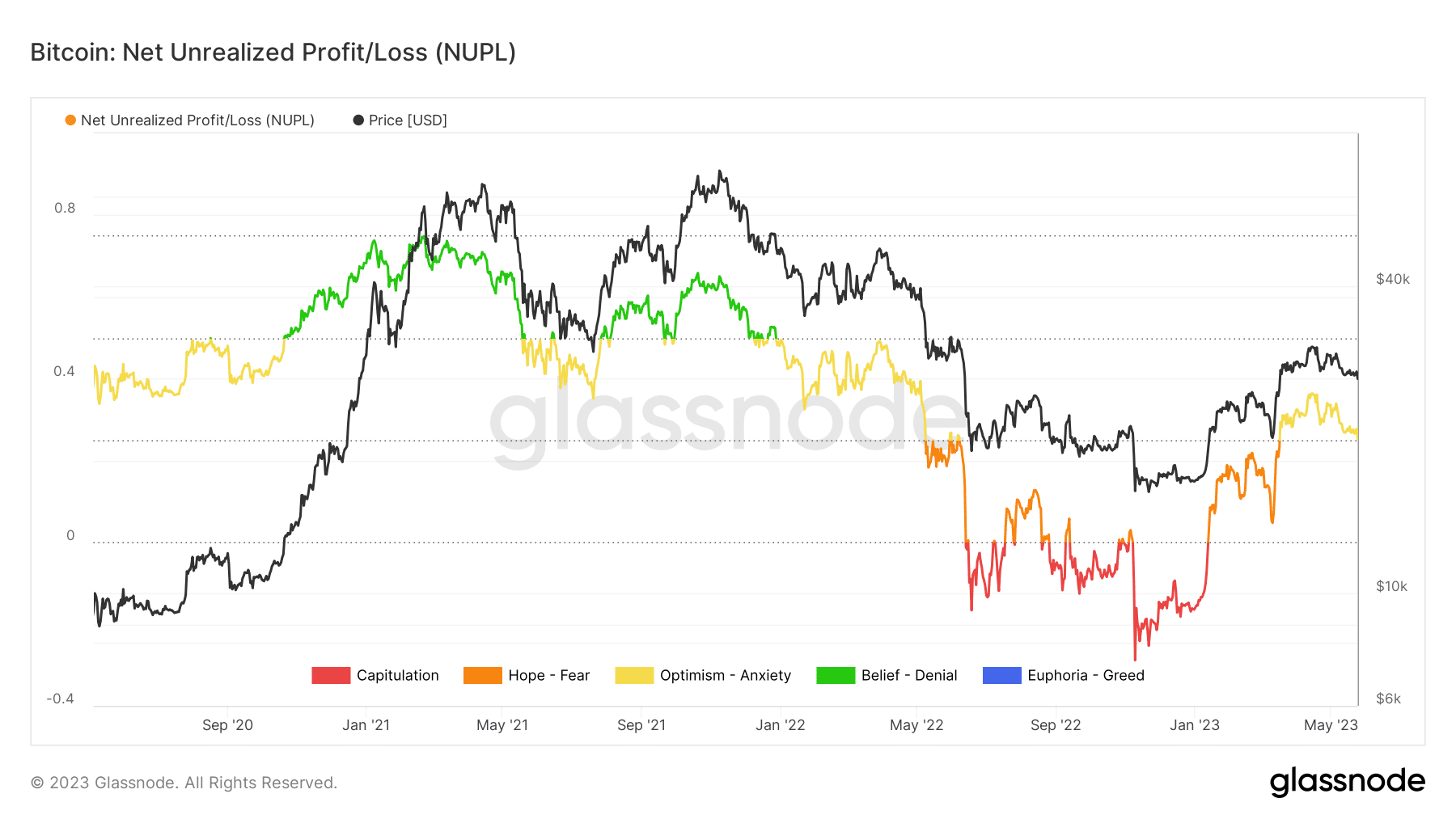

Investors noted a rise in paper gains in recent months as sentiment began to shift toward hope

Source: Glassnode

The NUPL metric showed that the network as a whole was in a state of profit. The despondency from November and December 2022 began to wear off in January.

A closer examination of the NUPL values in 2023 suggested that investors began to enter the markets after the $20k level was breached. This highlighted the critical importance of $20,000 psychologically.

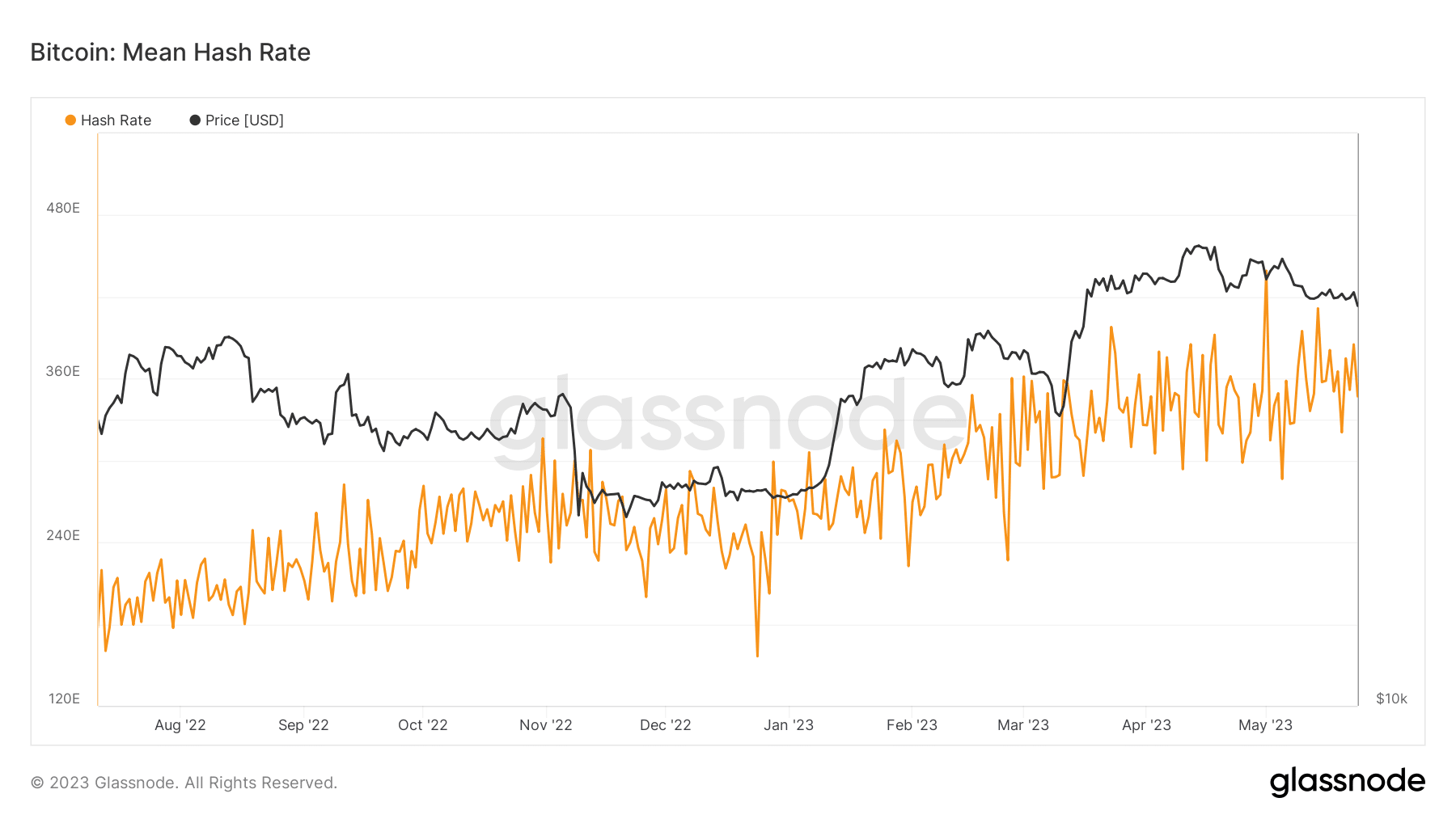

Source: Glassnode

Another factor that long-term investors can take heart from is the rising hash rate.

Is your portfolio green? Check the Bitcoin Profit Calculator

Despite trends in price action the hash rate has continuously trended upward. This showed the network health was good and its security was not under immediate threat.

From a technical perspective, the $24k-$25k area can offer buyers an opportunity to enter the markets. Risk-averse traders can exercise caution and wait for a strong bullish reaction in terms of price and volume before entering.