Bitcoin SV Price Analysis: 19 January

Disclaimer: The findings of the following analysis are the sole opinions of the writer and should not be taken as investment advice

Bitcoin SV’s price was stuck in a low volatility zone, with 4-hour candles varying between -3% to +3% returns. While the trend seemed to be continuing, BSV seemed to have retained its bullishness as well. With a 5% surge on the horizon, BSV looked set to hit a critical resistance level, breaching which would push Bitcoin SV up by 20 to 25% on the price charts.

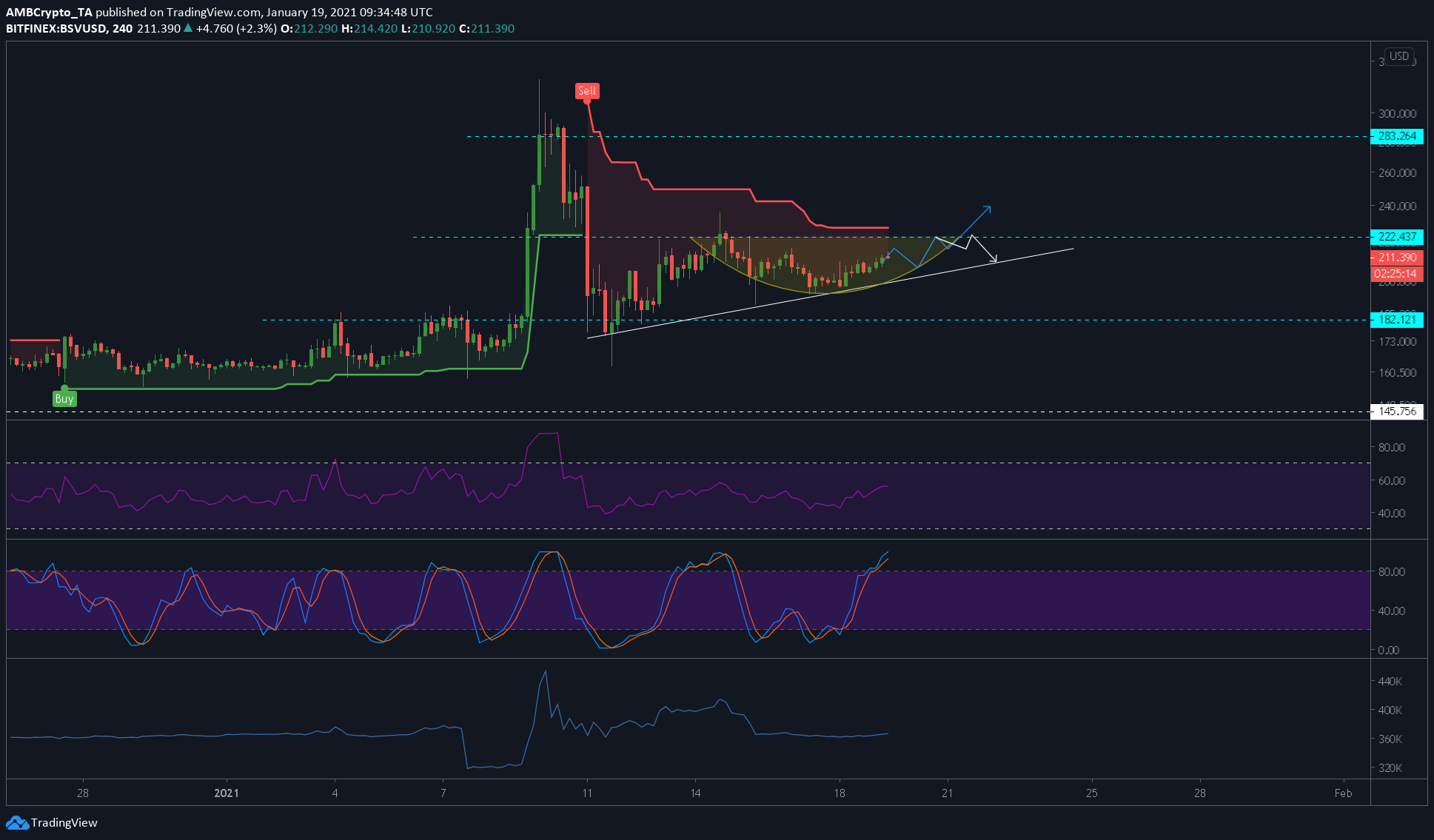

Bitcoin SV 4-hour chart

Source: BSVUSD on TradingView

At press time, BSV was riding the inside of a rounded bottom with the price nearing the neckline. A breach and a successful retest of this neckline will push the price higher on the charts. However, until the neckline, BSV seemed safe for a quick 5% scalp. A breach of the neckline at $222 is the bullish confirmation needed for the next 20% to 25% surge.

The RSI indicator showed that there was more room for the price to grow, further confirming the move up to the neckline.

Further, the OBV indicator noted a lack of volume, which may be why the price was not volatile and was stuck with +/- 3% 4-hour candles.

Finally, the Stochastic RSI was in the overbought zone, suggesting that a quick reversal was possible for BSV. In this case, we can expect the price of BSV to hit the rounded bottom curve. A breach of this curve seemed like a possible scenario, and if this does come to play, we can expect BSV to test the inclined trendline which has been a strong support level since 11 January.

Conclusion

A surge above the neckline in the short-to-mid term looked unlikely, at least until the SuperTrend indicator was breached. Hence, a rebound into the rounded bottom pattern was more likely. The rebound will contribute to the formation of an ascending channel, one which also has a bullish bias. With the exception of the near-term bearishness, BSV looked ready for a 20% to 25% surge.

However, it is only possible if the SuperTrend and the Neckline levels at $220 to $225 are breached successfully. Alternatively, a dip below $182 will invalidate the aforementioned bullish scenario.