Bitcoin takes on a bullish structure but is expected to face resistance here

Disclaimer: The findings of the following analysis are the sole opinions of the writer and should not be considered investment advice

Data from skew Analytics showed that aggregated daily volumes for Bitcoin were at their highest on 16 March, when BTC broke above the $40k mark. In the days since then, trading volume has not been particularly high and fell back toward the three-month average. Does this mean the uptrend had stalled? News of Do Kwon, co-founder and CEO of Terraform Labs, buying $1b worth of BTC since the end of January has fueled the enthusiasm of the bulls.

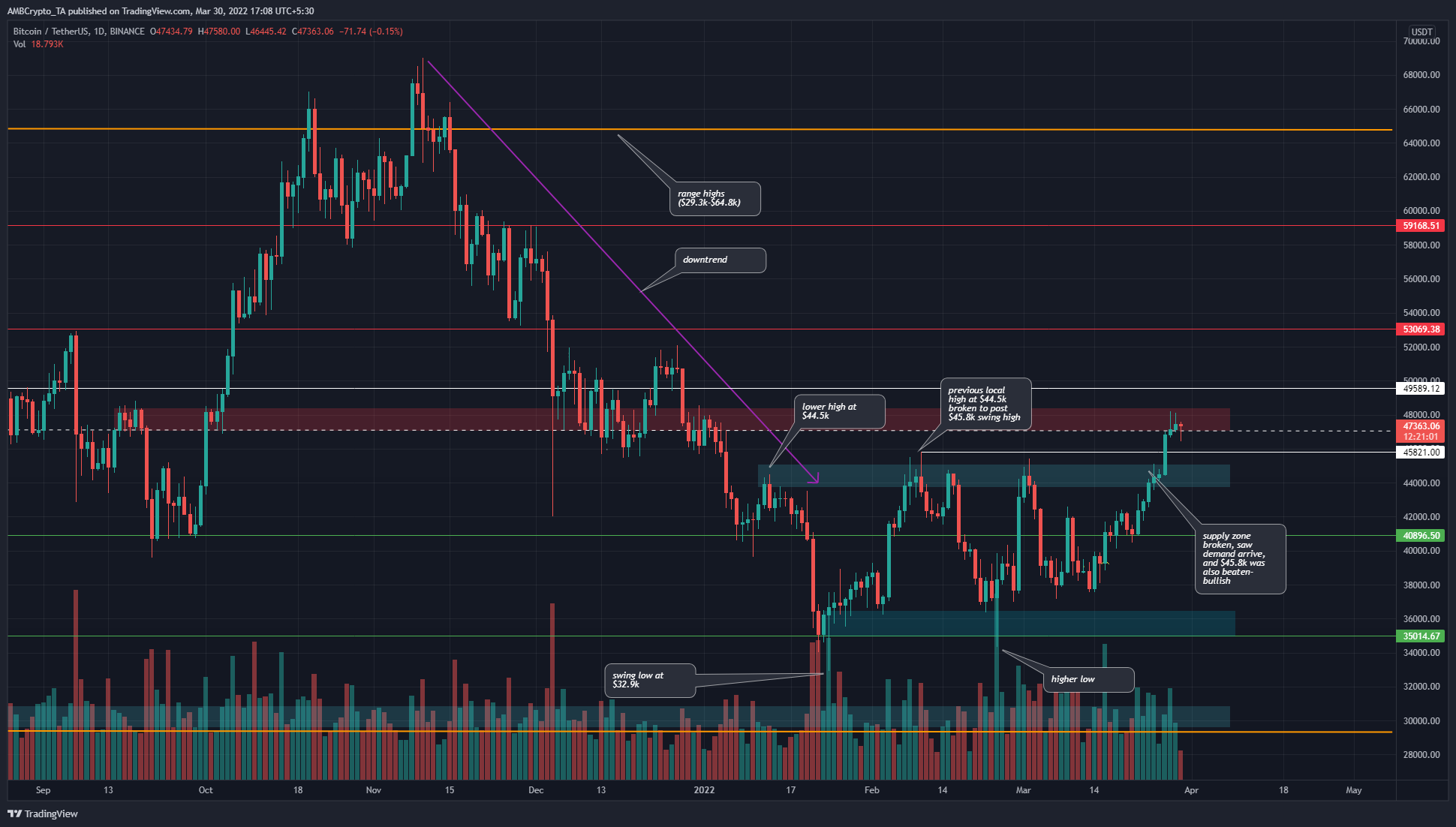

BTC- 1D

The region marked in orange is a nearly 15-month range that Bitcoin has traded within, with highs and lows at $64.8k and $29.2k respectively. At the time of writing, the price has climbed past the mid-point of this range, which was technically a bullish development. At the same time, it should be remembered that the $47.2k-$48.4k area (red box) has acted as a zone of supply in the past.

The market structure shifted to a bullish bias when BTC climbed past $44.4k to reach $45.8k, and also succeeded in posting a higher low on the chart in the month of February. In the past few days, the price has climbed past $45.8k as well.

This meant that the bias for BTC is bullish, but at the same time, a dip toward $45.8k, or even as far south as $44k and $42k can not be ruled out.

Rationale

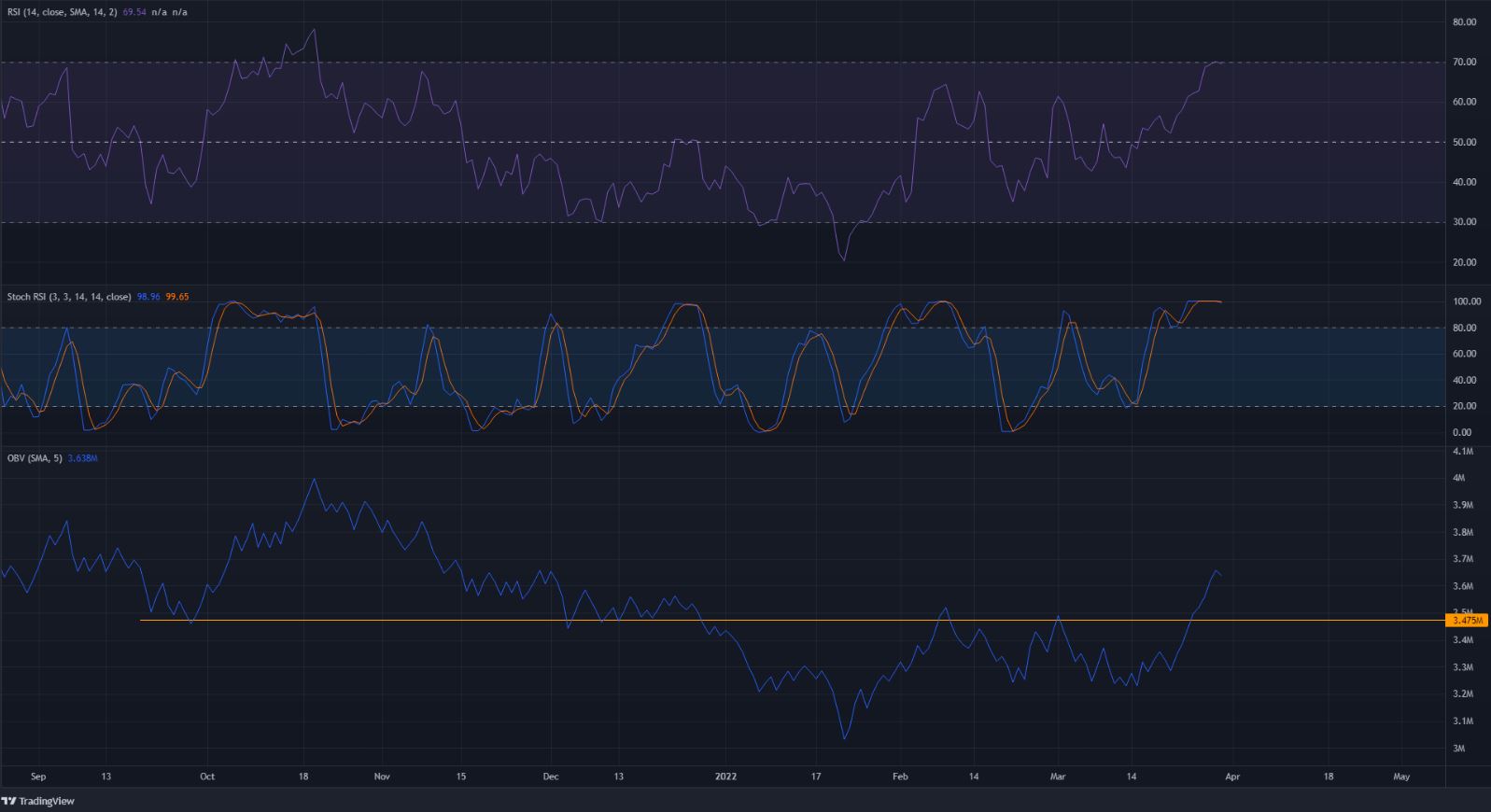

Was such a drop likely? Not really. Momentum indicators such as the RSI and the Stochastic RSI showed strong bullish momentum behind BTC and no bearish divergence yet to signal an imminent pullback. The OBV has also broken above a level of importance (orange) to show that steady demand was indeed behind the rally of Bitcoin.

Conclusion

The market structure was bullish, evidence of demand was present and the momentum was also in favor of the bulls. Institutional investment, which was a mythical thing years ago, was at its highest in the last three months. Any dips toward $45k or $42k can be scooped up, and the $51k-$53k can be used to take profit.