Bitcoin: The woes of BTC miners continue as prices crash

- As BTC’s price crashed, it caused a big dent in miners’ total earnings.

- Miner reserve increased substantially indicating a hoarding mentality.

Bitcoin [BTC] miners’ predicament was set to continue as revenue earned through creating new blocks on the chain sank to new depths.

Read Bitcoin’s [BTC] Price Prediction 2023-24

As per an update shared by on-chain analytics firm Glassnode dated 19 August, the total transaction fees paid to miners fell to a new 5-month low of $21,256. This drop was worse than the previous 5-month low, recorded more than a month ago.

? #Bitcoin $BTC Total Fees Paid (7d MA) just reached a 5-month low of $21,256.10

Previous 5-month low of $21,272.32 was observed on 13 July 2023

View metric:https://t.co/651pr49pgN pic.twitter.com/epdqmcV3Xv

— glassnode alerts (@glassnodealerts) August 19, 2023

Miners’ woes continue

The fall in fee revenue came even as Bitcoin recorded its steepest drop of 2023 over the last week. After wiggling in a tight trading range for more than a month. the king coin broke steeply to the downside with weekly losses of 11% at press time, data from CoinMarketCap revealed.

It is a known fact that miners rely on fiat currency to finance their ever-increasing hardware and other infrastructure costs. Hence, they convert their BTC holdings into cash frequently.

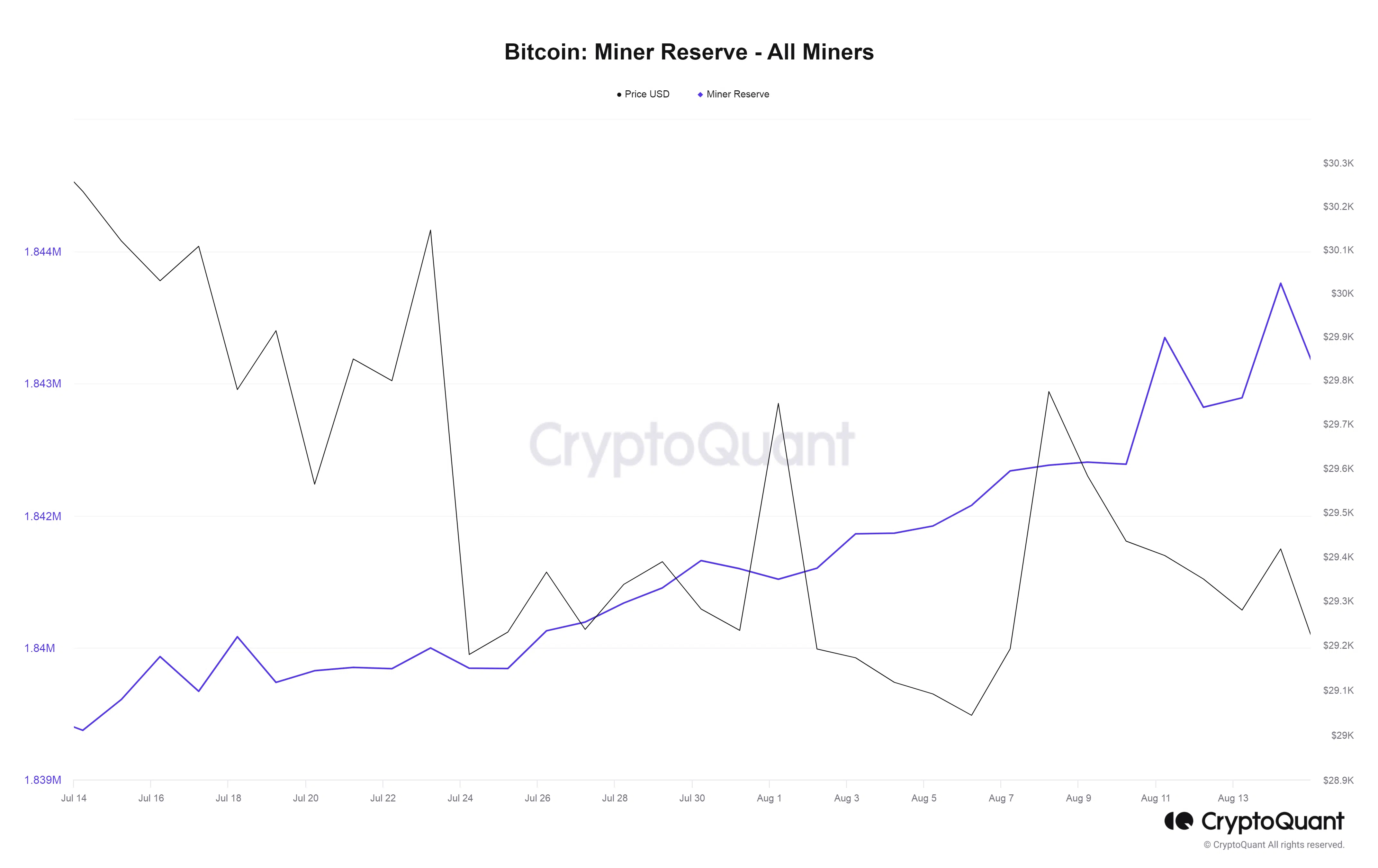

However, as prices crashed, it caused a big dent in miners’ total earnings, as reflected in the graph below.

Notice how the drop in revenue came abruptly following a sustained period of increase. This possibly threw their liquidation plans into disarray.

As per CryptoQuant, the amount of BTC held by miners increased substantially over the past week, forming a negative correlation with the price. As a result, miners developed a hoarding mindset and waited for prices to rebound slightly before dumping their stashes.

Hash rate continues to rise in the long-term

Despite the ebbs and flows of the mining sector, it was pertinent to note that the overall hash rate for Bitcoin has only trended upwards over the years. A higher hash rate is imperative for the overall security and decentralization of the blockchain. It helps in preventing malicious players from launching assaults like the 51% attack.

The hashrate doesn't care about the prices of last year, month or day. It's just going up, up, up ⛏https://t.co/ptrEnBSiP7 pic.twitter.com/LcV6UufeuX

— Maartunn (@JA_Maartun) August 19, 2023

Is your portfolio green? Check out the Bitcoin Profit Calculator

However, a rising hash rate demands installation of sophisticated and expensive mining equipment. With the decline in revenue as highlighted earlier, less-efficient miners might be eventually forced to shut down their rigs.