Bitcoin: This may be the strongest bullish signal in 3 weeks

Bitcoin’s second attempt at making it past $40,000 failed last week, with all eyes now on the cryptocurrency’s next big move. Interestingly, while BTC was trading at $34,855 at press time, outflows from spot exchanges were up too.

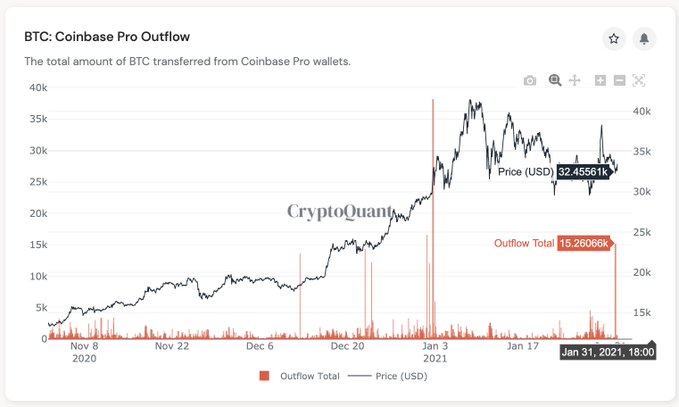

In fact, 15,000 BTCs have flown out of Coinbase at the $32,400-price level. Such significant Bitcoin outflows signal a bullish shift in the price rally as Bitcoin outflow transactions have hit custody wallets that support incoming only. They do not support withdrawals, which could mean that these transactions represent OTC deals from institutional investors. This may be the strongest bullish signal in the last three weeks.

Source: Twitter

A few of the significant transactions mapped in the chart can be found here and here. This metric is crucial since Coinbase outflows are significant and have proven useful in determining a change in sentiment since there is no specific way to estimate OTC transaction volume by institutional investors. However, on-chain indicators like these can help estimate OTC deals.

Following the data on these indicators, one can observe that large OTC deals are on Coinbase. Potentially, some institutions are still buying Bitcoin. Further, based on the on-chain analysis, the BTC net flow at press time was -$682.3 million. It is a positive sign when outflows increase since that would mean exchange reserves are dropping and there is a scarcity in play.

The outflows at press time were $1.6 billion against inflows of $900.6 million, based on data from Glassnode. DeFi and ETH may be making all the headlines, however, the direction of investment flow has not changed entirely or to the anticipated extent, and Bitcoin’s dominance remains as high as 62.3%.

With increasing outflows from other spot exchanges, the bullish sentiment may show on the price and trade volume chart, and price recovery may help a climb above the $35,000-level.

Further, Visa preparing its payments network to handle a full range of cryptocurrency assets may boost the demand and volatility even more. Since Visa identifies digital currencies as two segments – digital currencies like Bitcoin and Ethereum and fiat-backed currencies like stablecoins, the investment flow to Bitcoin may remain uninterrupted.

Overall, the institutional investment story is building a bullish narrative for Bitcoin in the short-term with high exchange outflows and increased demand.