Bitcoin to $100K still very likely, but here’s the catch

Bitcoin’s price rallied this month from a daily low of $40k to a high of above $47k. In this market, however, nothing is constant. The king coin noting weekly losses, before recovering somewhat at press time, was a case in point.

Bitcoin bulls have always made an optimistic case for the asset, hoping its price will hit the six figure-mark by early 2022. While some would say that’s unrealistic, its remarkable recovery since the local bottom of $29.7k says otherwise.

Bitcoin can repeat history

Many Bitcoin bulls, as well as analysts, have compared the current market cycle to the one in 2015. At the time, there was a local top in the early months followed by a blasting rally north during that cycle. If that is the case this time, then Bitcoin’s price too could see a major top or a new ATH in 2022.

Analyst Willy Woo also made some positive affirmations about the market, calling the current price range to be a market bottom. He said,

“Long-term investors are still climbing towards their peak accumulation, which marks bottoms. Early signs to me that the bull market may continue into 2022 and BTC is in the process of breaking free from the 4-year internal cycle from the halvenings.”

Notably, 82% of Bitcoin hodlers are making money at the said price. When such a large number of holders are profitable, the incentive for selling is low.

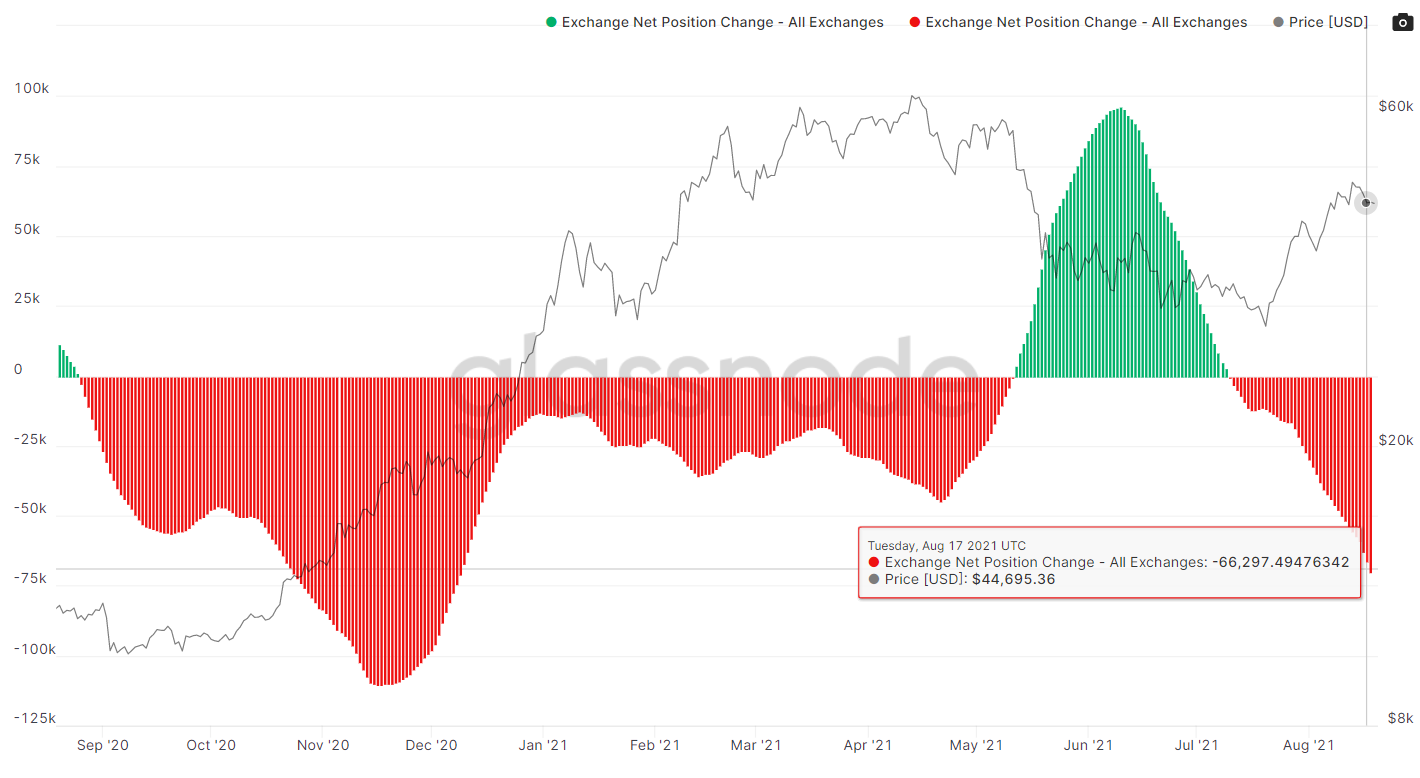

Another noticeable aspect of this rally has been record outflows.

The exchange net position change (all exchanges-30d moving average) highlighted a peak that pointed towards a return to accumulation. These levels were last seen in December 2020. Such high negative values suggested that outflows have been dominant and there was a decrease in BTC supply for selling.

Absorbing cash inflows

While data suggested that accumulation is in fact peaking, could this be the new BTC bottom before the market blasts off? It is possible that $36.5k-$43k can act as solid support for this cycle if BTC manages to oscillate above this level for good.

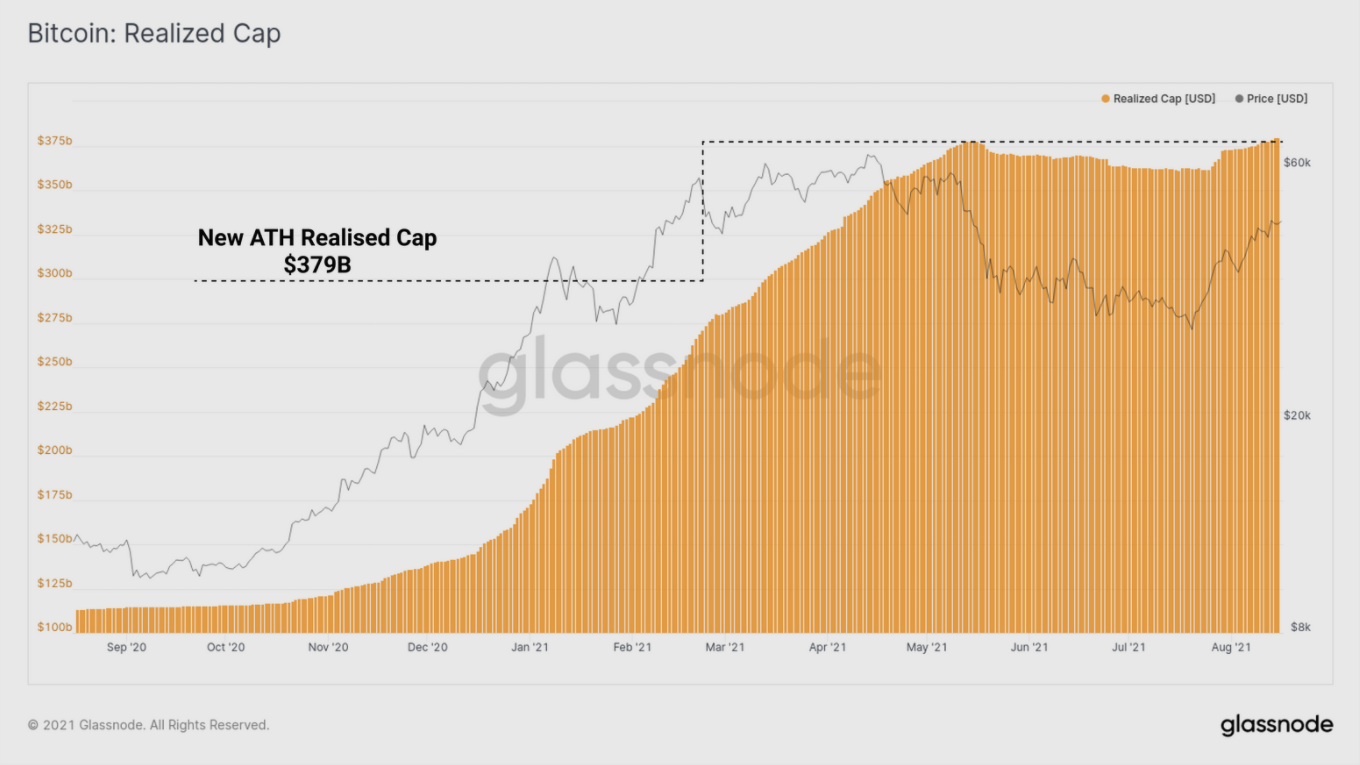

Further, a Glassnode report highlighted that the realized cap started trending higher in late July. It also observed that recently, it hit a new all-time high of $379B – indicative of new capital flowing into Bitcoin. What this also implied was that the market is capable of absorbing sell-side pressure. In such a case, even if sell-offs take place, the market would hold itself well.

While all this sounds like a Bitcoin bull’s dream come true, the possibility of this price level actually being a cycle bottom looks fair.

In hindsight, it is also notable that BTC took merely four months to go from $30k to $60k. Another jump to $100k in the next six months wouldn’t be impossible if BTC continues this rally. However, if the king coin is unable to hold on to the $36.5k-$43k range in the coming months, a 6-figure leap for Bitcoin might not be possible until 2023.