Bitcoin trader engagement on the rise: A new era for BTC?

- Bitcoin’s Open Interest grew materially as price of BTC declined.

- Long term holders begin selling their holdings, interest in ETFs remained high.

Bitcoin [BTC] witnessed a massive surge in open interest over the last few days, despite its price hovering around the $63,000 range.

Open Interest on the rise

More Open Interest often indicates more traders are entering the market using futures contracts. This can lead to higher volatility as these traders place bets on the future price of Bitcoin.

With more money on the line, price swings can become more pronounced as bulls and bears battle it out. This volatility can create opportunities for profit but also carries greater risk.

An increase in Open Interest can also improve liquidity in the Bitcoin market. With more Futures contracts outstanding, there’s a larger pool of buyers and sellers, making it easier to enter and exit positions.

This can be beneficial for the overall market health for BTC.

ETF saga

According to Coinglass’ data, the number of short positions taken against BTC had outnumbered the long positions. It remains to be seen whether the bears turn out to be right about their calls.

Another factor that could impact BTC would be the state of Bitcoin ETFs. According to SoSoValue’s report, Bitcoin spot ETFs experienced a total net outflow of $84.6581 million on the 10th of May.

Grayscale’s GBTC ETF saw a daily net outflow of $103 million, while BlackRock’s IBIT ETF had an inflow of $12.4363 million, and Fidelity’s FBTC ETF had an inflow of $5.3039 million.

The high amount of inflows could impact the price of BTC positively in the long run.

Long-term holders take a hike

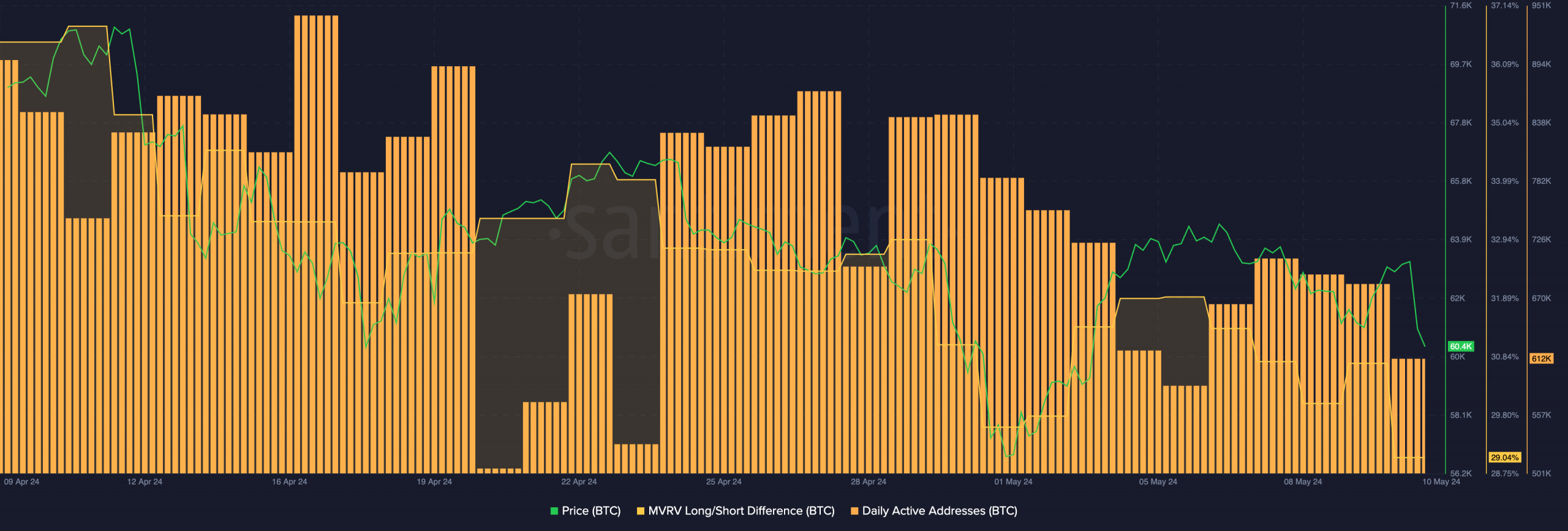

However, at press time, things were looking dire for BTC. The price of BTC had fallen to $60,833.76 due to a decline of 3.4% in the last 24 hours. The volume at which BTC was trading at had also declined by 1.8%.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Surprisingly, the Long/Short difference of BTC fell along with the price. This indicates that the number of long-term addresses holding BTC had fallen.

Daily active addresses on the network also fell materially over the last few days, which meant that the overall interest in the Bitcoin ecosystem was also waning, which could further impact BTC’s price negatively.