Bitcoin trading on Coinbase sees another decline – Why?

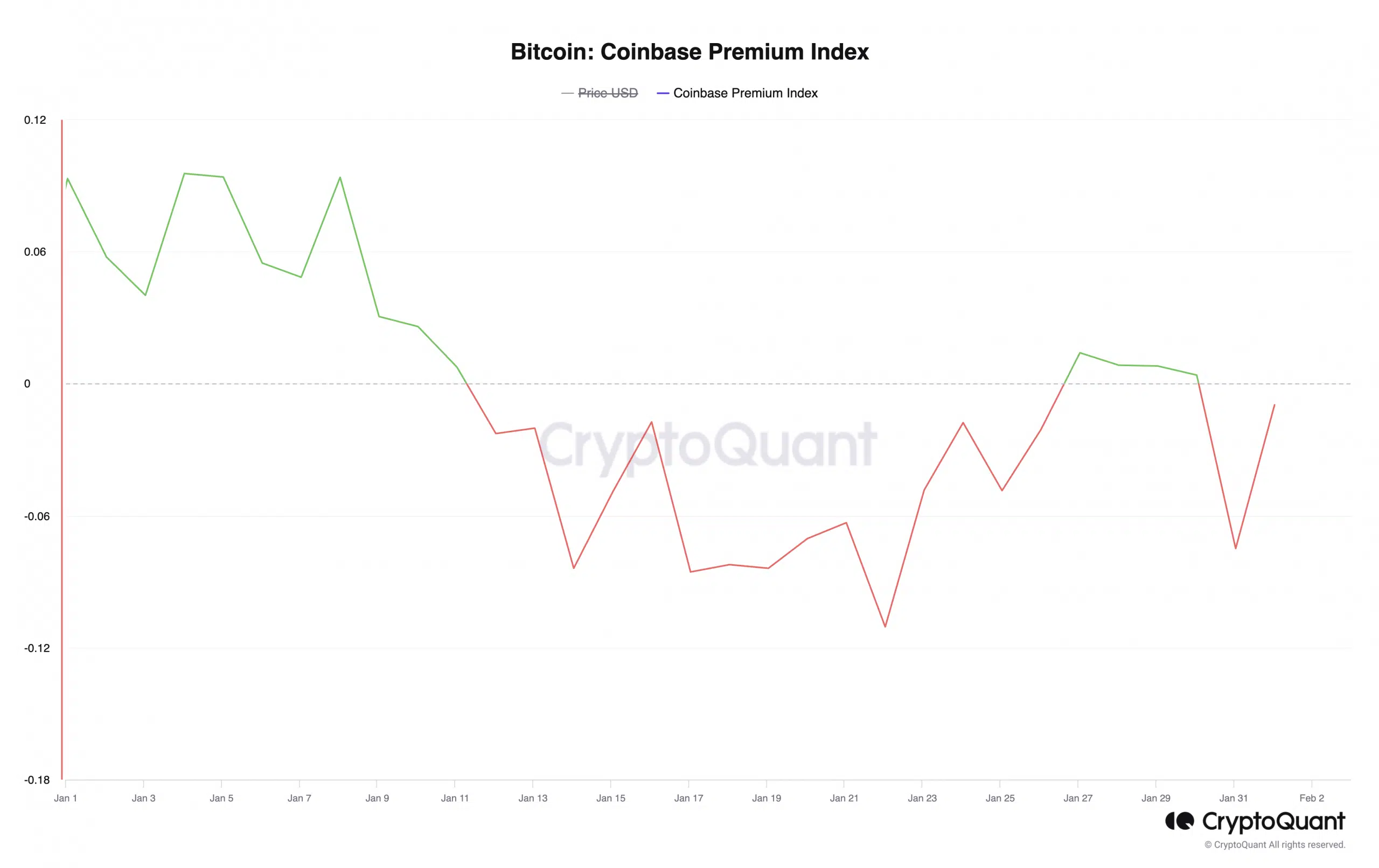

- Bitcoin’s Coinbase Premium Index has dipped into negative territory.

- The coin’s Awesome Oscillator suggests that while price momentum remains weak, the market is yet to be overrun by bearish sentiments.

Following a brief moment of interest between the 27th and 30th of January, US-based investors are pulling back from trading Bitcoin [BTC] on Coinbase.

The coin’s Coinbase Premium Index (CPI), which tracks the difference between its prices on Coinbase and Binance, has dipped back into negative territory, suggesting less trading activity on the US-based exchange.

According to data from CryptoQuant, due to the decline in BTC’s value, its CPI value was negative for most of January. Soon after the ETF approval on the 10th of January, BTC’s CPI turned negative and so remained till the 27th of January.

Between the 27th and 30th of January, the index briefly turned positive, signifying a potential increase in US investor activity.

However, as the coin’s price continues to face significant resistance at the $43,000 price mark, its CPI has fallen back into negative territory. At press time, BTC’s CPI was -0.009.

Confirming this, the coin’s Coinbase Premium Gap (CPG) trends similarly, per CryptoQuant’s data. When BTC’s CPG is negative, it means that the coin trades at a much lower price on Coinbase than on Binance due to a plethora of reasons ranging from market imbalance and liquidity issues.

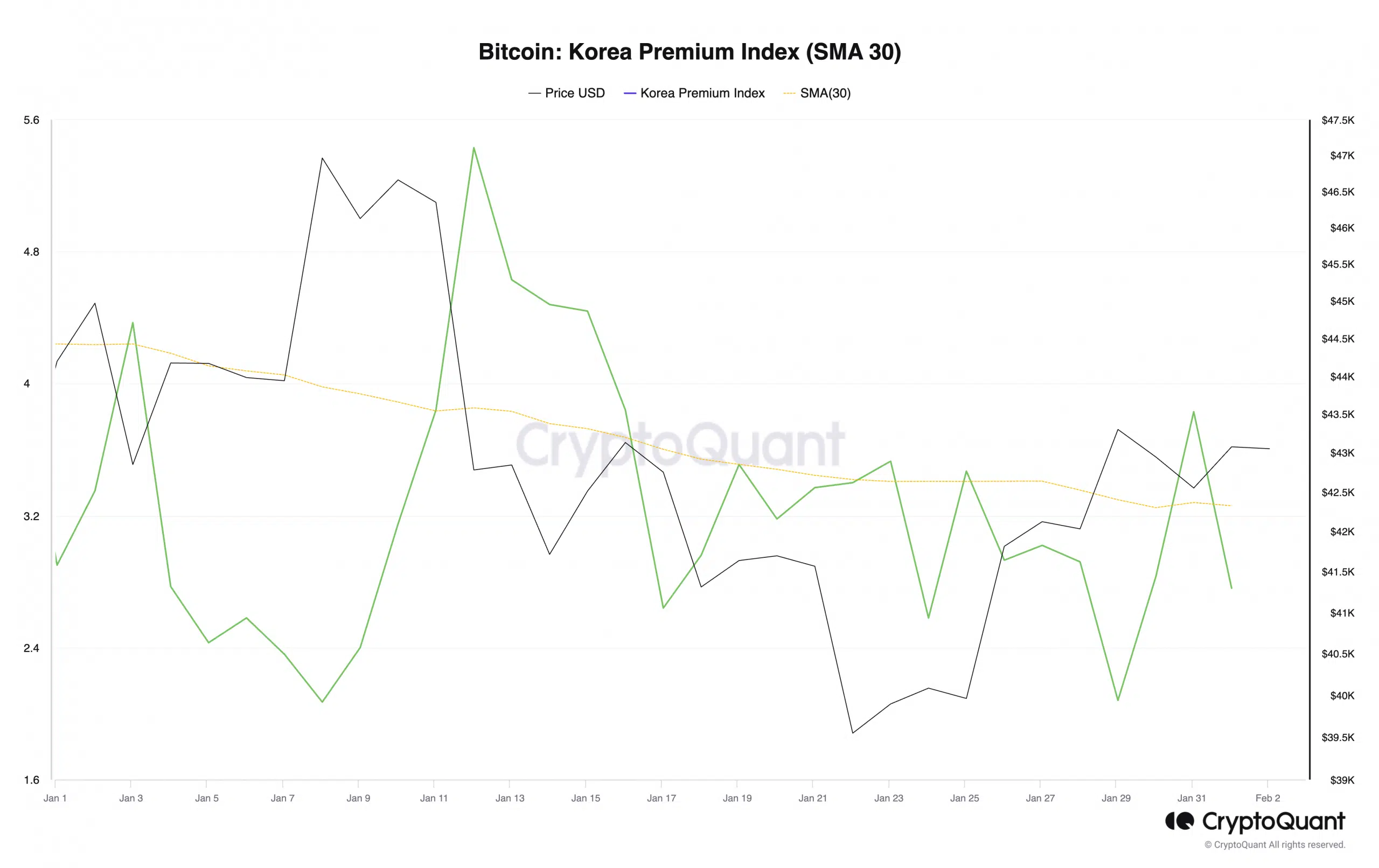

While US-based investors shy away from trading the leading coin, Asian investors have adopted the opposite approach.

BTC’s CPI comparison with its Korean Premium Index (KPI) – which measures the price gap between how much the coin trades on South Korean exchanges compared to global exchanges, showed that Asian investors continue to intensify accumulation efforts.

Although, when observed on a 30-day moving average, BTC’s KPI has trended downward, it remains in the positive territory, suggesting that Asian investors continue to favor accumulation.

High sell-offs, but bearish sentiment is key at bay

Readings from BTC’s Awesome Oscillator observed on a 24-hour chart showed that after an extended period of posting downward-facing red histogram bars, the trend changed on the 27th of January. Since then, the indicator has returned only downward-facing green bars.

How much are 1,10,100 BTCs worth today?

Red bars on an asset’s Awesome Oscillator are often interpreted as a bearish sign, suggesting a hike in selling pressure. This was the case with BTC, which witnessed significant sell-offs post-ETF rally.

However, the emergence of green bars in the past few days signaled that while the short-term momentum remains weak, bearish sentiments remain minimal.