Bitcoin: Uncovering 2 major reasons behind BTC’s new liquidity wave

- As the U.S. Dollar weakens, China looks to strengthen its Yuan currency.

- Investor confidence grows steadily as BTC breaks out of micro channel.

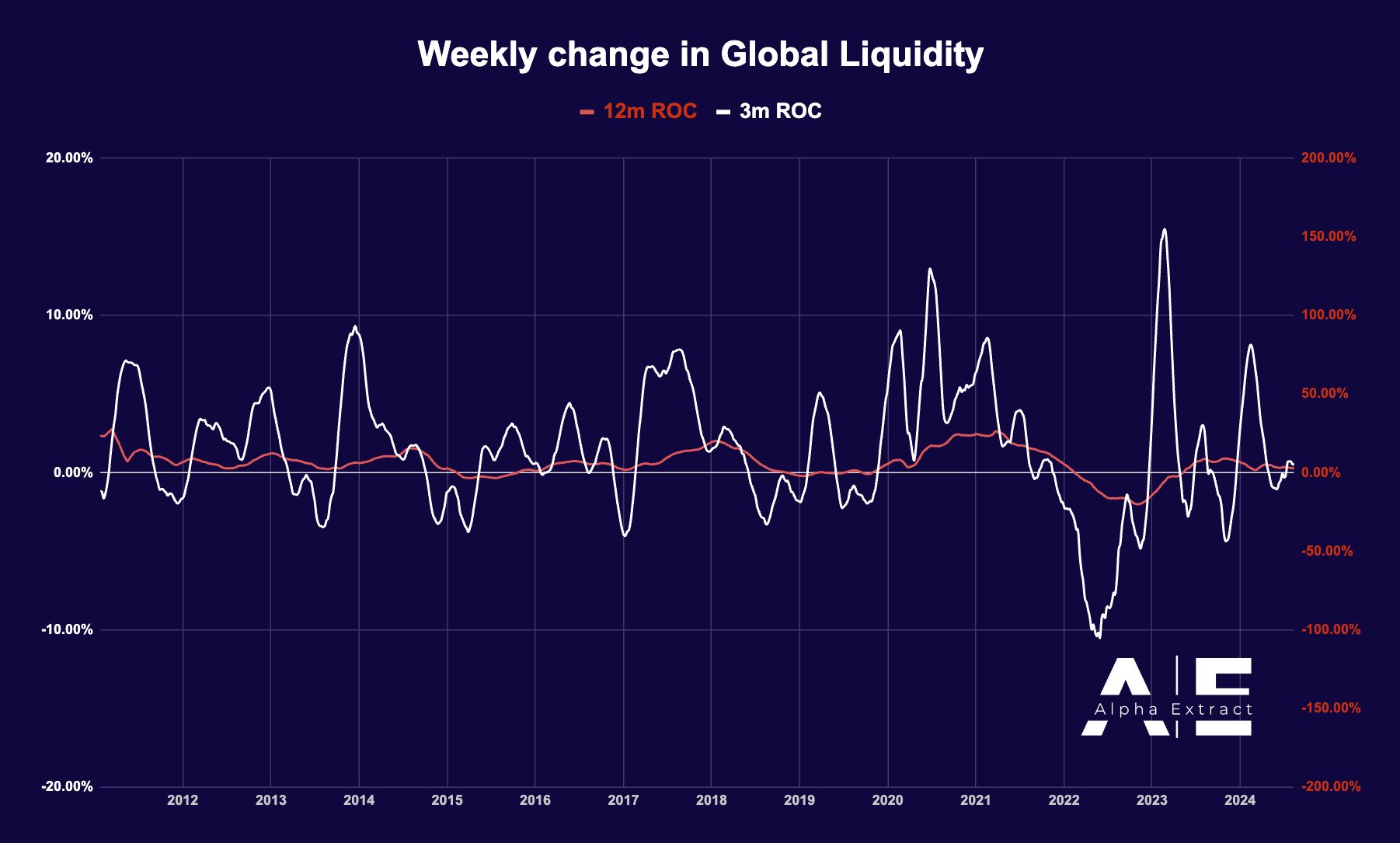

Investor risk exposure due to recession fears is decreasing, as global liquidity in crypto is still on the rise.

Alpha Extract on X (formerly Twitter), cited that China is actively stimulating its economy without significantly devaluing the Yuan against the U.S. Dollar.

The U.S. plays a crucial role in liquidity, especially with ongoing bill issuance. So, a weaker dollar can lead to increased liquidity from other central banks.

The Federal Reserve’s reserve bank credit dropped by $10 billion last week, but rising collateral values caused a slight uptick in the Global Liquidity Index (GLI), now at $125.975 trillion, a 0.165% increase.

The Adjusted Economic Rate of Change (AE RoC) remained positive.

Other metrics, coupled with the interplay between China’s stimulus and U.S. dollar weakness, could impact Bitcoin [BTC] prices in the long run.

Investor confidence growing significantly Bitcoin saw a big Coinbase discount again during the sell off that happened during previous week’s market crash.

However, it recovered quickly, closing with more than 23% gain from its week’s low.

$BTC now has a Coinbase premium again, which is generally positive as it shows positive investor sentiment from the U.S. and ETFs.

This also signifies that BTC could rally as a result of China’s stimulus and a weakening USD.

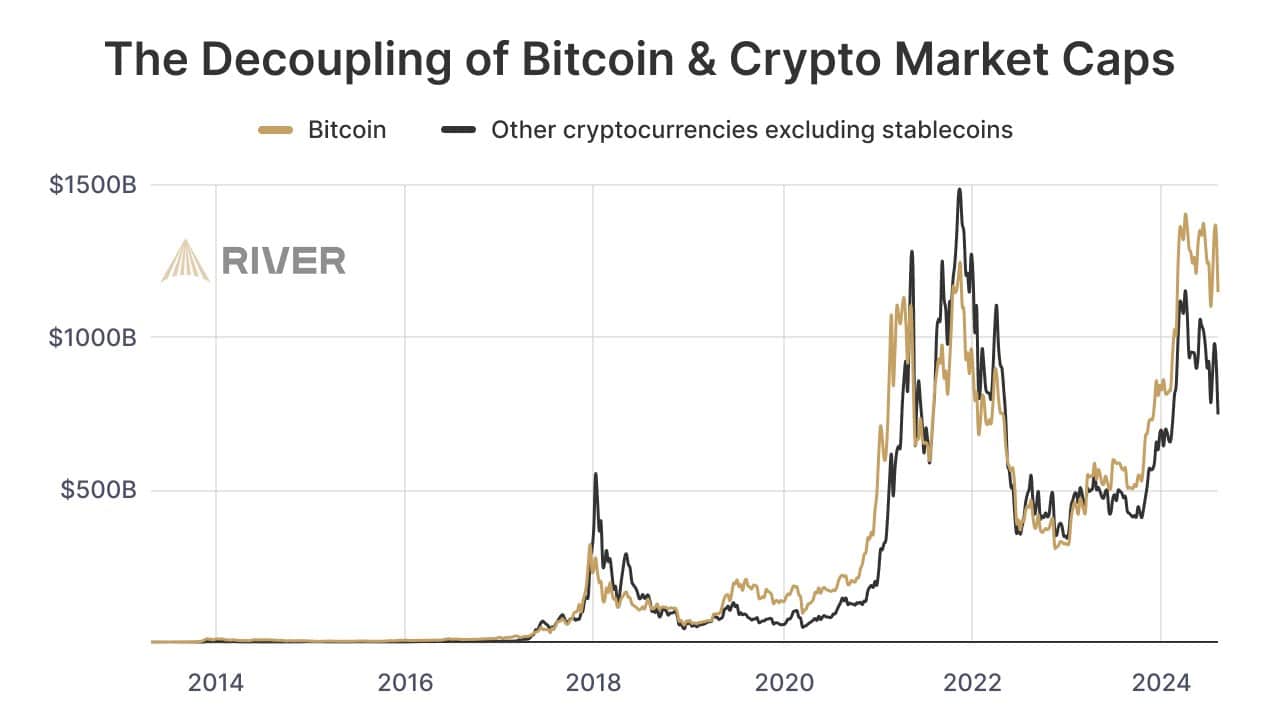

Decoupling of BTC and altcoin market caps

Three years ago, Bitcoin’s market cap was around $835 billion, while other cryptocurrencies, excluding stablecoins, matched that.

Today, Bitcoin’s market cap has risen 37% to $1.15 trillion, while other coins have dropped 11%.

This shift highlighted Bitcoin’s dominance and questioned the wisdom of those blindly diversifying in crypto.

With China’s stimulus and the U.S. dollar weakening, Bitcoin could potentially reach new all-time highs, emphasizing its strength in the market.

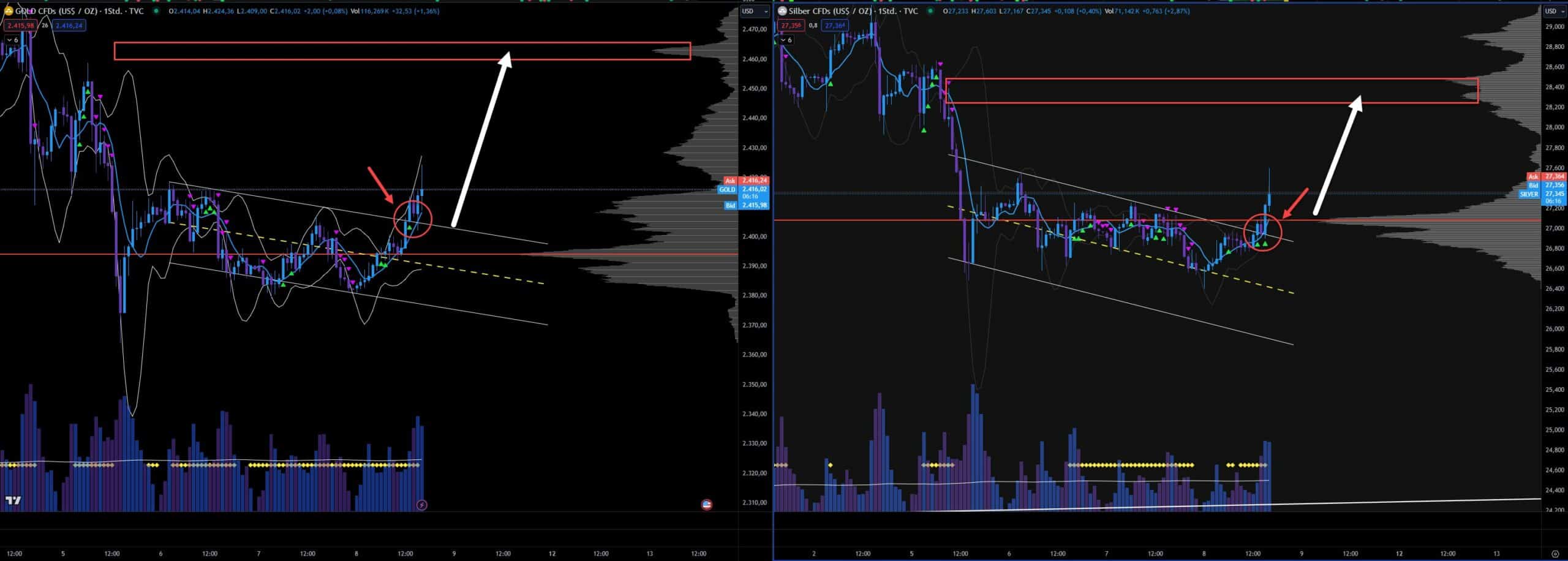

Bitcoin breaks a micro downward trend

Bitcoin has broken out of its recent downward trend, and showing potential for a rally.

Is your portfolio green? Check out the BTC Profit Calculator

If Bitcoin stays above $58,000, it could rise further to $61,000, triggering short liquidations. The next key level to watch is how it reacts at $61,000.

Coupled with China’s stimulus and the weakening U.S. dollar, Bitcoin could see a significant rally in the coming days.