Bitcoin: Understanding the reasons behind the spike in BTC transaction fee

- Bitcoin transaction fees climbed to the highest in months, with over $9 million.

- BTC breaks beyond the $37,000 price zone.

A recent report indicates a notable increase in Bitcoin’s transaction fees. Although the surge has been attributed to the ETF, various other factors also contributed to this upward trend.

Bitcoin transaction fees spikes

As per a CryptoRank post, Bitcoin has experienced a surge in transaction fees. The upward trend, evident since November, has become more pronounced in recent days.

According to Crypto Fees data, transaction fees reached over $9 million on 9th November, marking the highest in four months.

The fees decreased to over $6 million at press time, indicating a visible decline. Despite this decrease, the fees remain higher than those observed in the preceding months.

Possible reasons for the Bitcoin fee spike

The recent surge in Bitcoin transaction fees may be attributed, in part, to the recent listing of Ordinals (ORDI), a BRC-20 token.

Binance announced the listing of ORDI paired with USDT on 7th November. Consequently, this led to increased activity in Ordinals transactions, as indicated by a Dune Analytics chart.

The chart revealed a rise in ordinal inscriptions starting in November, preceding the listing, with the current count exceeding 300,000.

Furthermore, the Dune Analytics chart illustrated a notable increase in Ordinals transaction fees over the past few days.

On 9 November, the fees reached a peak, surpassing $3 million. This spike in Ordinals transaction fees significantly contributed to the overall transaction fees observed on the Bitcoin network.

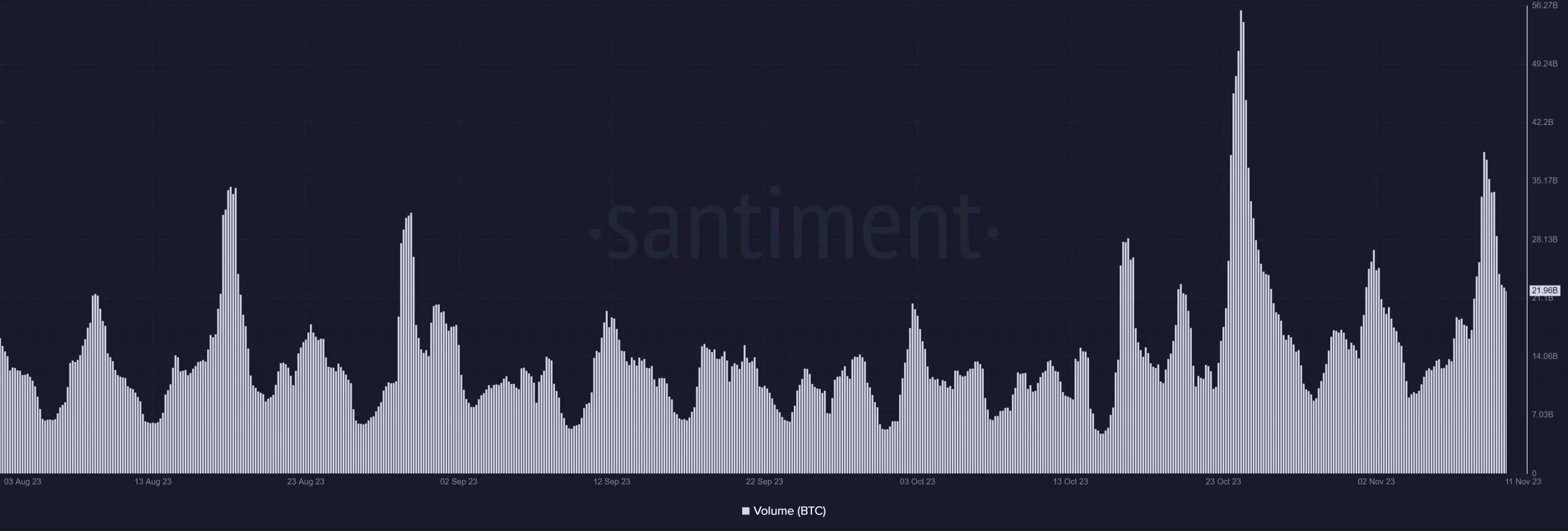

Additionally, an analysis of Bitcoin volume on Santiment further supports the uptrend, showing an increase in volume over recent days. On 9 November, the volume surged to over $38 billion, marking the highest for the month thus far.

As of this writing, the volume stands at around $22 billion. What these two metrics demonstrated was that the rise in interest in Ordinals and the recent price trend have contributed to the rise in fees.

BTC marching to $40,000?

As of the closing bell on 10 November, Bitcoin has entered the $37,000 price range, per its daily timeframe chart.

The chart revealed a 1.71% increase, closing trading at over $37,000. At the time of this update, Bitcoin was experiencing a slight decline of less than 1%. Despite the decline, it continued to trade above the $37,000 mark.

Is your portfolio green? Check out the BTC Profit Calculator

With the current price movement, the immediate support line had shifted to the $34,000 and $33,000 price ranges.

Furthermore, Bitcoin maintained a position above its short Moving Average (yellow line). Also, this line acted as support in the vicinity of the $30,000 price region.