Bitcoin v. crypto-stocks – Why it’s not worth betting on just one

2008’s recession managed to completely change the financial landscape. In fact, it allowed Bitcoin and other cryptocurrencies to gradually make their way into the mainstream. The emergence of the same also affected how many see traditional assets.

Traditional assets like stocks have been around for ages, with the class able to offer mass confidence to its investors. Nonetheless, according to Bitcoin maximalists, the history of stocks is irrelevant and it is only the future that matters. Most notably, stocks’ performance against inflation and the U.S dollar has been quite iffy of late.

According to Bitcoin proponents, the market’s largest crypto provides much better returns with lower risks, when compared to stocks.

So, has Bitcoin truly been able to outperform stocks? Well, yes and no.

Outperformed by…..?

Bitcoin’s YTD returns stood at 29.65%, at press time, while the same for the likes of Apple Inc., Amazon.com, and Netflix Inc. stood at 11.4%, 3.4%, and -5.5%, respectively. So, when compared to prominent stocks, yes, Bitcoin has been able to fetch fairly high returns.

However, there is one stock market sector that has collectively been able to steal Bitcoin’s thunder over the past few months. Yes, crypto-stocks have been the talk of the financial town for quite some time now and have been fetching compelling returns of late.

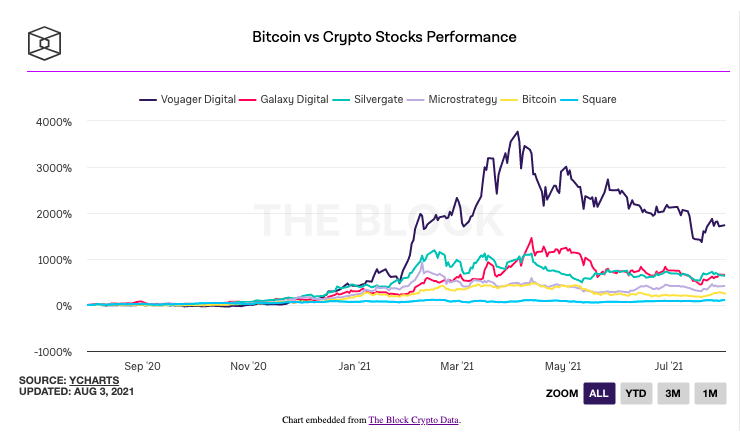

Now, as can be seen from the attached chart, during the last few months of 2020, the returns yielded by crypto-stocks’ investors and Bitcoin HODLers were around the same. However, things have taken a very different turn since March this year. Voyager Digital has consistently had the highest-valued stock among other crypto-companies in the space. In fact, its stock price has risen by more than 6,000% since February 2020.

Other crypto-stocks too, for that matter, have been overshadowing Bitcoin’s performance. Interestingly, even when the crypto-market’s king coin was at its $64k ATH in April, the likes of Silvergate, MicroStrategy, and Galaxy Digital managed to fare better.

Furthermore, most of the aforementioned companies HODL a fair share of BTC. According to the latest data, Microstrategy possesses over 100k BTC while the likes of Galaxy Digital, Voyager Digital, and Square hold 16,400 BTC, 12,260 BTC, and 8,027 BTC, respectively. Notably, MicroStrategy had extensively bought fresh Bitcoin during the recent dip as well.

So, as these companies grow in size, we can expect more funds being diverted into the crypto-industry. This will, in turn, help in sustaining Bitcoin’s price.

A binary proposition?

Even though these companies have, by and large, been able to “defeat” Bitcoin, it should be noted that the scenario might change going forward. At this stage, there is essentially no need for Bitcoin and stocks to appear together in the same sentence. According to some, the debate has been concocted by maximalists from both sides of the financial spectrum. There is ultimately no right or wrong in this debate.

Furthermore, if you’re an adherent proponent of portfolio diversification, voila, your portfolio would most likely boast of both crypto-stocks and Bitcoin.

Stocks have been around since the year 1611. They will continue to exist, alongside the likes of digital currencies. Bitcoin needs these companies, and parallelly, these companies too need Bitcoin’s shoulder to lean on in the long run.