Bitcoin whales are moving funds fast – What’s next?

Bitcoin whales who accumulated the crypto-asset at $33,000 and $31,000 price levels have moved their funds to unknown locations and private wallets. On the contrary, some have sold their holdings as the frenzy accompanying the price drop gathered steam.

Bitcoin, at the time of writing, was trading at $31,800 after recovering slowly from the drop to the $30,000-level on Thursday. Based on data from Whalemaps, several whale bubbles have formed on the charts. Further, based on info from the updated map of unspent Bitcoins, there are fewer bubbles in the $31,000 – $33,000 range, with the support at these price levels relatively weaker too.

Map of unspent Bitcoins || Source: Twitter

For a hike above the $34,900-price level, continuous demand generation from whales and institutions is critical. The percentage of whales with accumulation at price levels above $31,000 is critical to Bitcoin’s price and a rebound, especially since traders are looking for support.

Further, an interesting observation that can be made here is that other large wallet sizes have accumulated in the region above $31,000 as well, and they are still HODLing. There is still scope for a bounce-back above $31,000 and this may take relatively longer. However, accumulation by whales is likely to drive the price back soon enough.

The drop that wiped out millions from the market capitalization is still shy of the 2018 drop, and that is a signal that a comeback is likely. Though the exact reason behind the price drop is not clear, there are several metrics that do hint at a comeback. Rapidly increasing exchange reserves and active supply is a challenge, however, the accumulation by institutions like GrayScale is likely to support the price above $31,000.

Despite the corrections in 2018, there was a sustained price rally in 2019, even though it was relatively delayed. If a similar situation brews here, February might see the price rally return post the upcoming Options expiry on the CME.

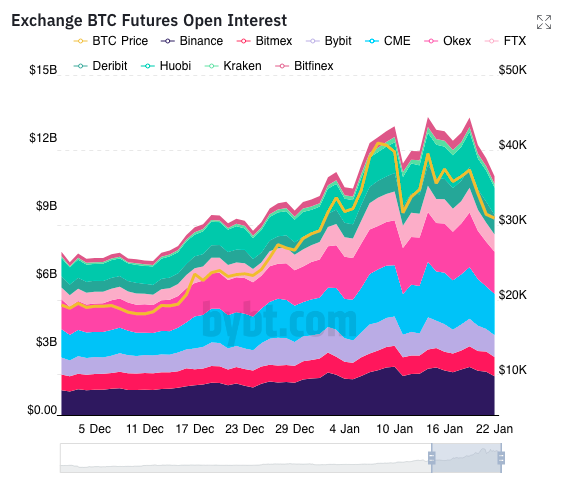

A signal for the same can be observed on the Exchange BTC Futures Open Interest chart by Bybt. The OI is still at a pre-ATH level or the first week of January level, and this is a positive sign for a comeback in Bitcoin’s price.

BTC Futures OI || Source: Bybt

While the OI crossed $12 billion following the new ATH and price discovery, a drop in price still has the figures for the same hovering above $10 billion. If it drops further to the levels seen in December 2020, price recovery may be delayed in the short-term. The funds moved by whales have had this impact on the price and interest on derivatives exchanges, and increasing whale activity may trigger a trend reversal in Bitcoin’s price.