Bitcoin whales: Unusual activity raises these questions

- Bitcoin whale activity saw an uptick, which usually does not occur during this part of the cycle.

- The realized price gradient oscillator showed bulls need to maintain their momentum.

Bitcoin [BTC] was gaining bullish momentum as prices approached the all-time high. It saw a 4% pullback in the past two days that retested the $69k support zone. The technical indicators remained bullish.

Accumulation continued apace, while prices stagnated in April and the first half of May.

In a recent AMBCrypto report, the data highlighted that Bitcoin might be readying to embark on a 300-day bull run. The evidence at hand further reinforced the bullish bias.

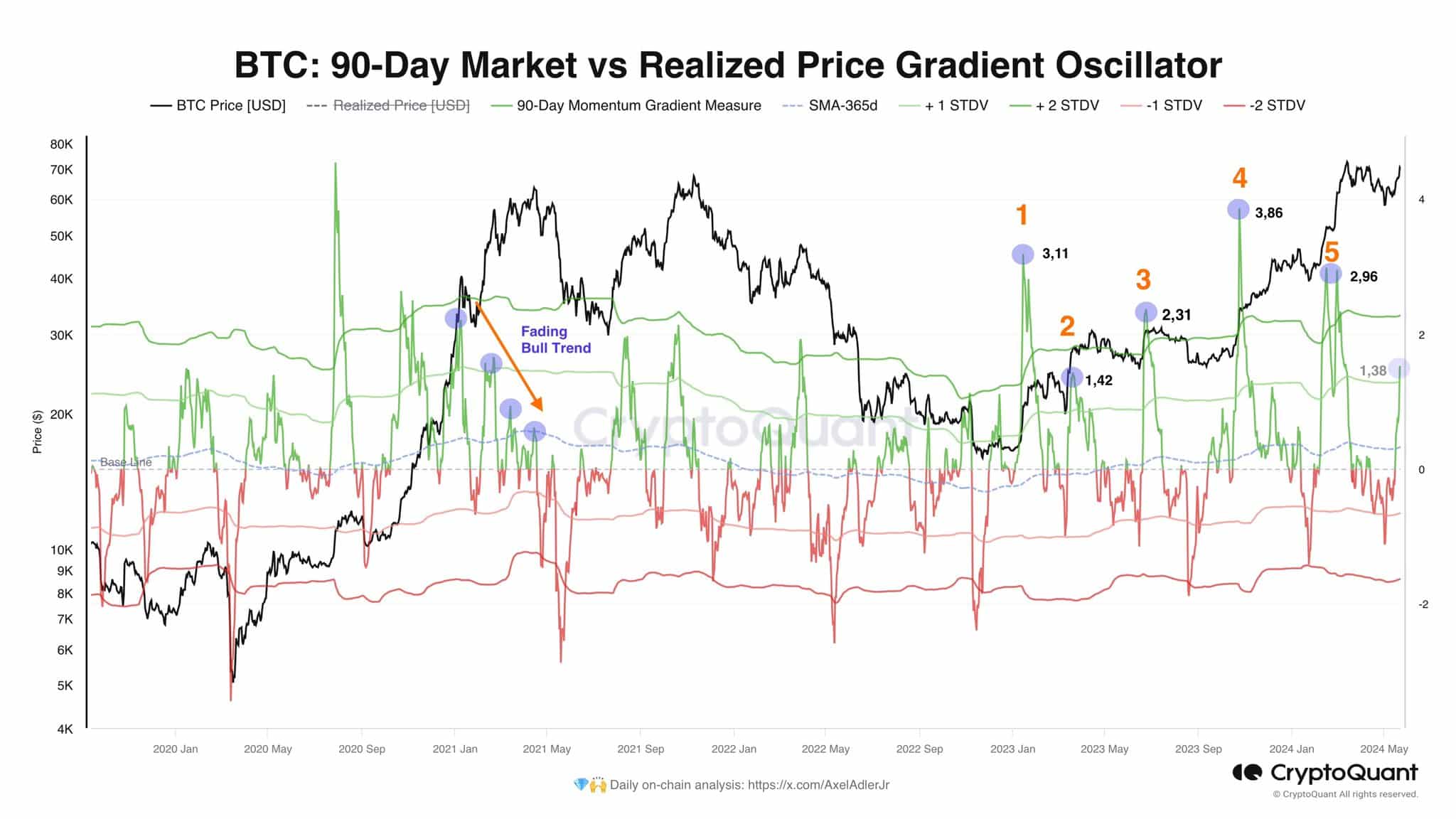

This momentum indicator shows bulls have to maintain the pressure or risk a slump

Source: AxelAdlerJr on X

Crypto analyst Axel Adler posted on X (formerly Twitter) a piece of on-chain analysis that highlighted the current momentum of Bitcoin and the values the gradient reached in the past 18 months.

The price gradient oscillator above measures how quickly the market cap grows compared to the realized cap.

During the 2021 rally, as BTC neared its eventual top, the oscillator formed lower highs which indicated a fading bull trend.

In 2024, the oscillator has formed a lower high at 2.96. Hence, a move past 3 would be desirable for bulls to avoid repeating the 2021 pattern, which would signal fading bullishness.

At the time of writing, the oscillator reading was at 1.38.

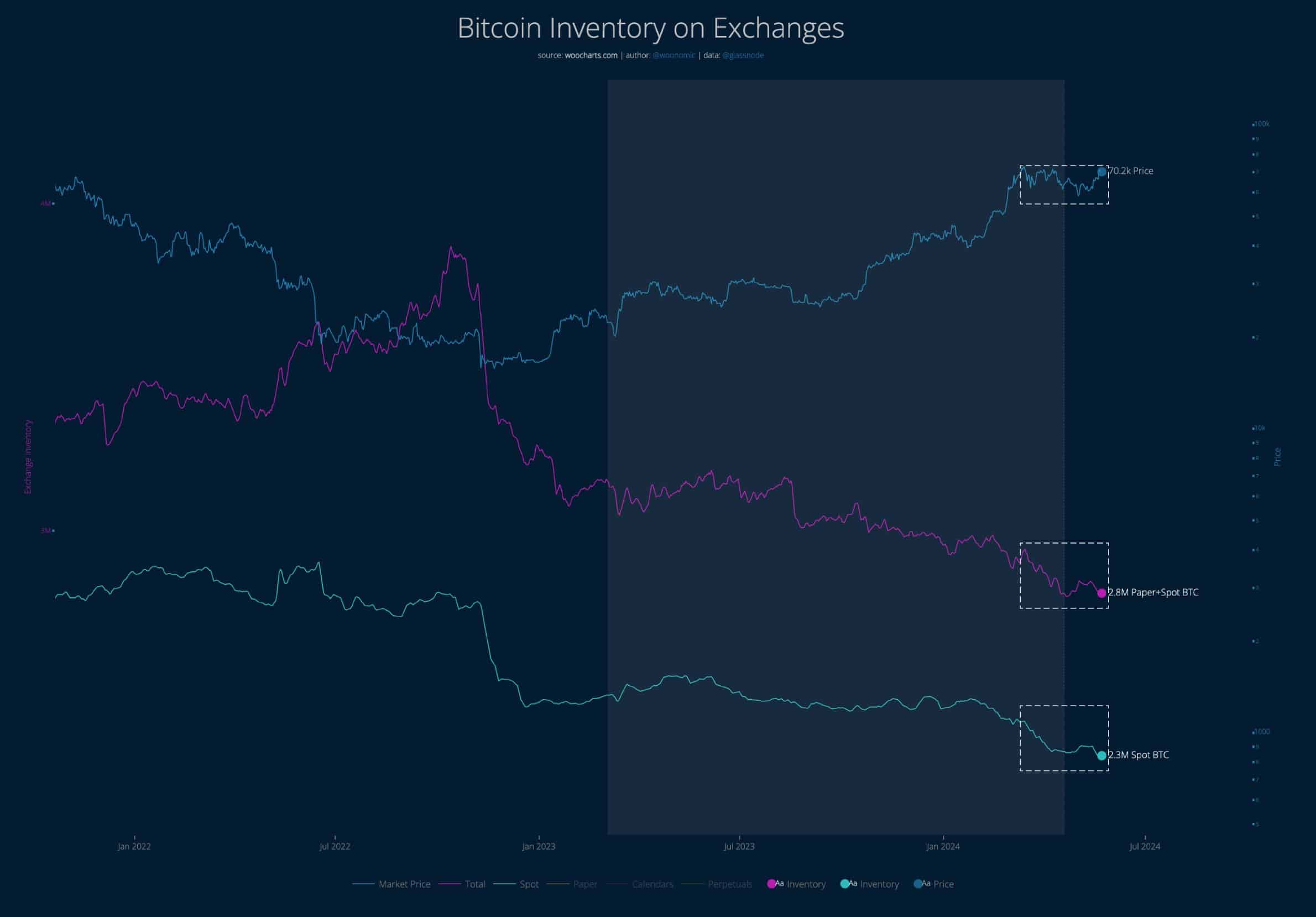

“It’s only a matter of time” for Bitcoin to hit all-time highs

Source: Woonomic on X

Analyst Willy Woo noted that the available Bitcoin was being scooped up during the past two months when the price lacked a true higher timeframe trend.

This led to panic among retail holders, but the spot BTC demand was sizeable.

The analyst believed that it’s only a matter of time before the prices climb past their all-time high against the US Dollar.

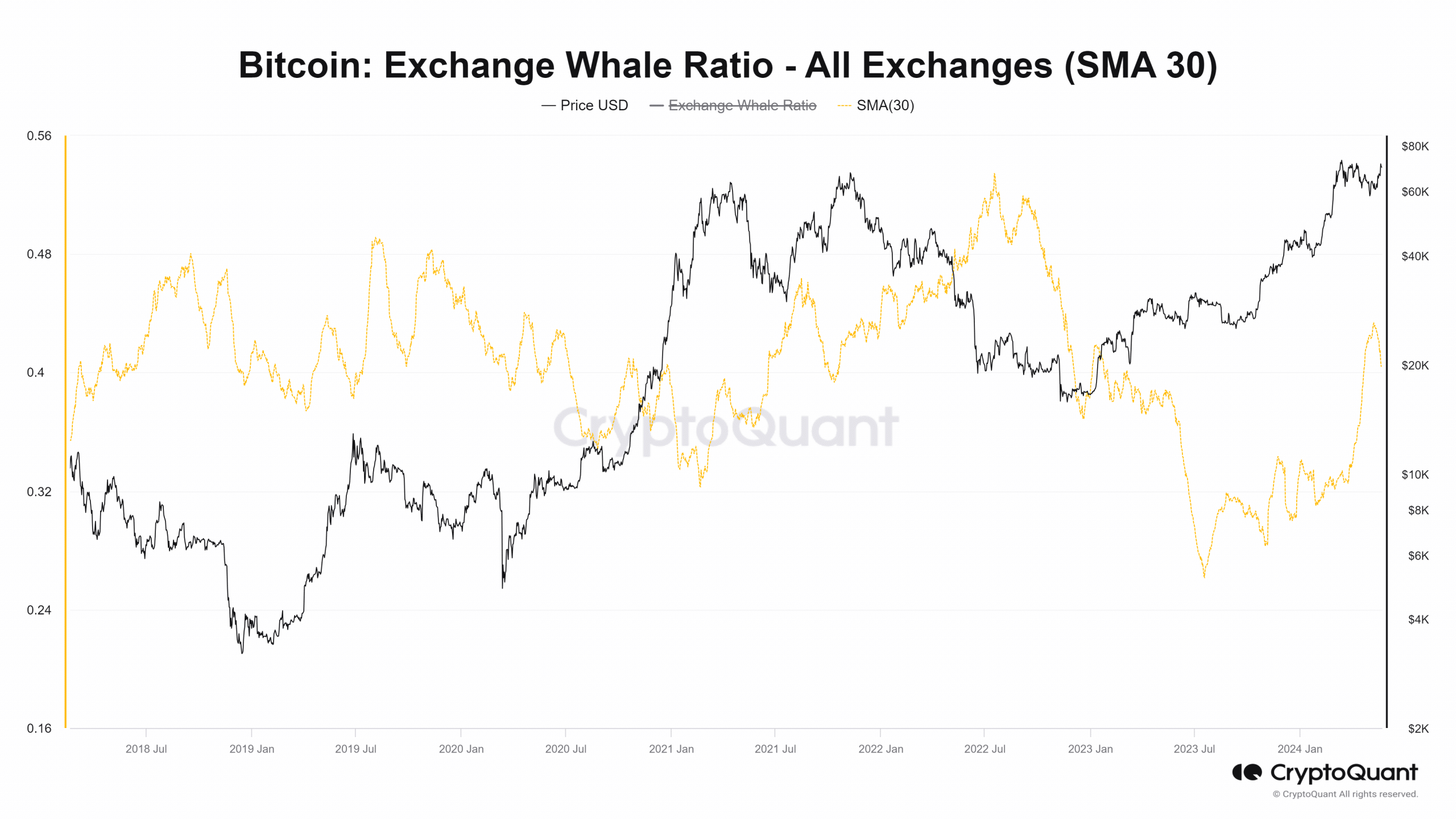

Source: CryptoQuant

The exchange whale ratio saw a rising trend in April and May. This indicated increased whale activity, which is abnormal during a bull run. Usually, during the bullish long-term trend, whale activity quietens down.

It picked up once the top was in and prices started sliding lower.

Read Bitcoin’s [BTC] Price Prediction 2024-25

The outflow from exchanges that Willy Woo highlighted earlier was a good argument against the top being in, but the rising whale activity can give investors pause.

However, the exchange whale ratio is not definitive, and the evidence at hand shows this bull run has further to go.