Here’s what Bitcoin miners are up to as they reel under sell pressure

- Drop in miners’ reserves comes alongside Bitcoin’s price gains.

- Miners’ daily revenue spiked to its second-highest level in history earlier this month.

The bloodbath in the market continued as Bitcoin [BTC] plunged to a two-week low of $60.9k in the last 24 hours of trading. Though the king coin recovered to $62k as of this writing, it was still under heavy selling pressure, having lost nearly 15% of its value over the week, according to CoinMarketCap.

Amongst other factors, increased liquidation of miners’ holdings might have contributed significantly to the slump.

Miners go on selling spree

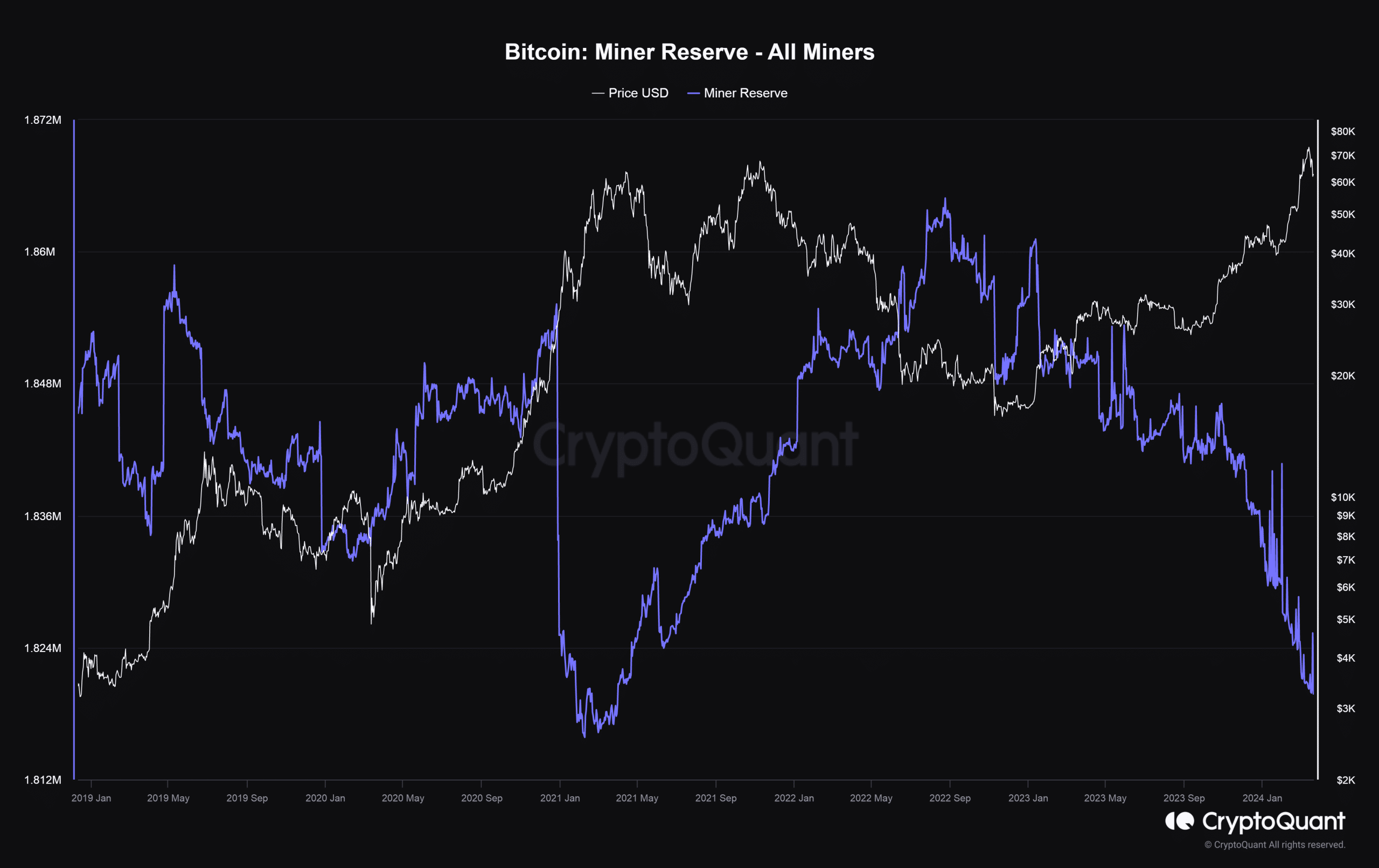

According to AMBCrypto’s examination of CryptoQuant’s data, the amount of Bitcoins held in miner wallets plunged to lows last seen nearly three years ago.

Miners, as we know, frequently liquidate their holdings to cover costs incurred in setting up mining infrastructure. However, such events end up exerting significant downward pressure Bitcoin;s price. This is because miners are one of the largest holders of the asset.

Evidently, the decline became steeper since November last year. This was the time when Bitcoin arguably started its bull cycle, and miners capitalized on the higher returns to boost their revenue.

Mining revenue surges

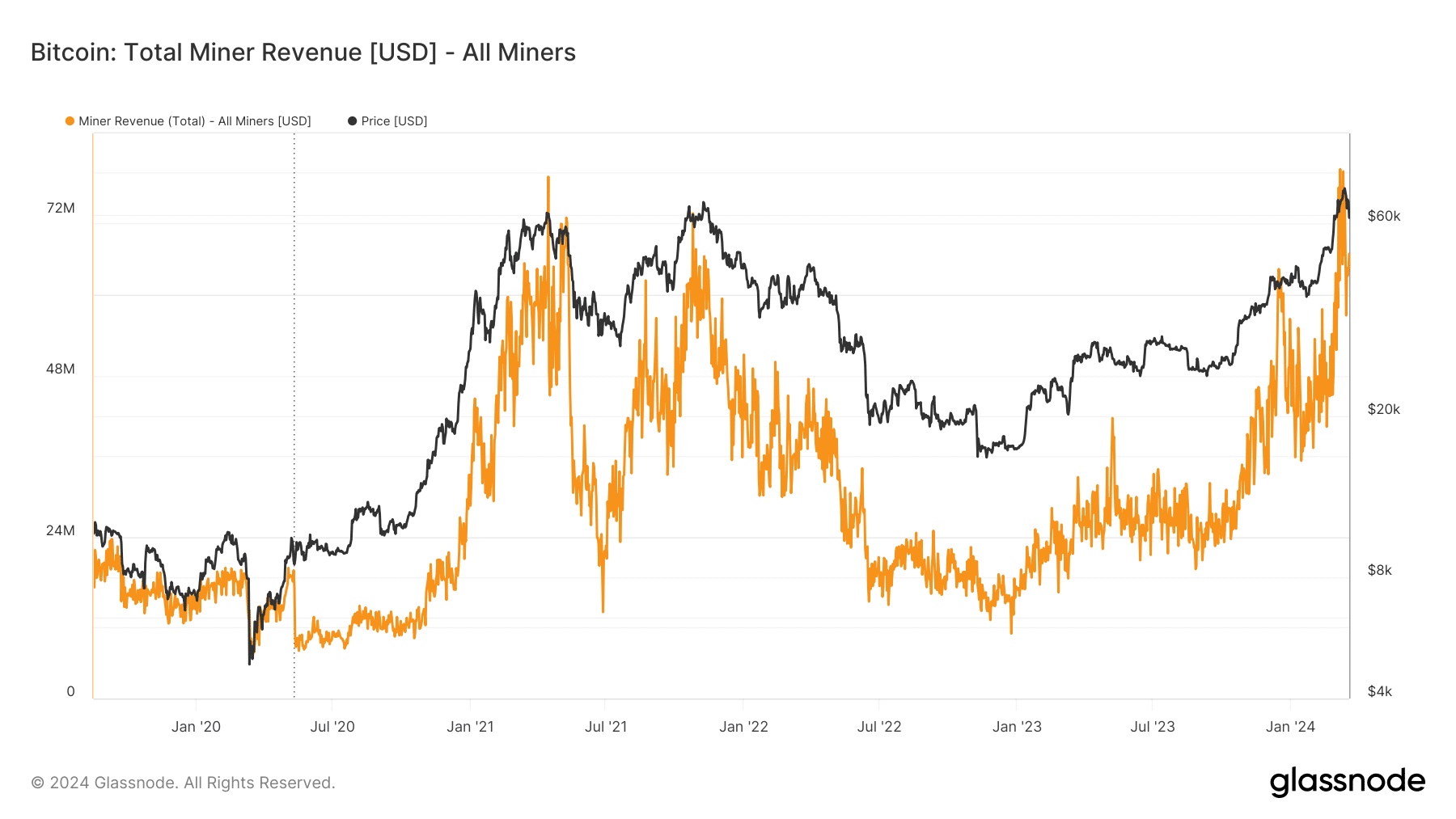

Miners’ earnings have soared substantially over the last four months, according to data from Glassnode. In fact, the daily revenue, comprising of transaction fees and fixed block subsidy of 6.25 BTCs, spiked to its second-highest level in history on the 7th of March.

However, with the upcoming halving set to reduce rewards to 3.125 coins per block, miners were expecting a significant hit to their revenue streams.

It was likely that miners were raising funds to buy more cost-effective mining equipment, which would help them offset the revenue loss after halving.

Read BTC’s Price Prediction 2024-25

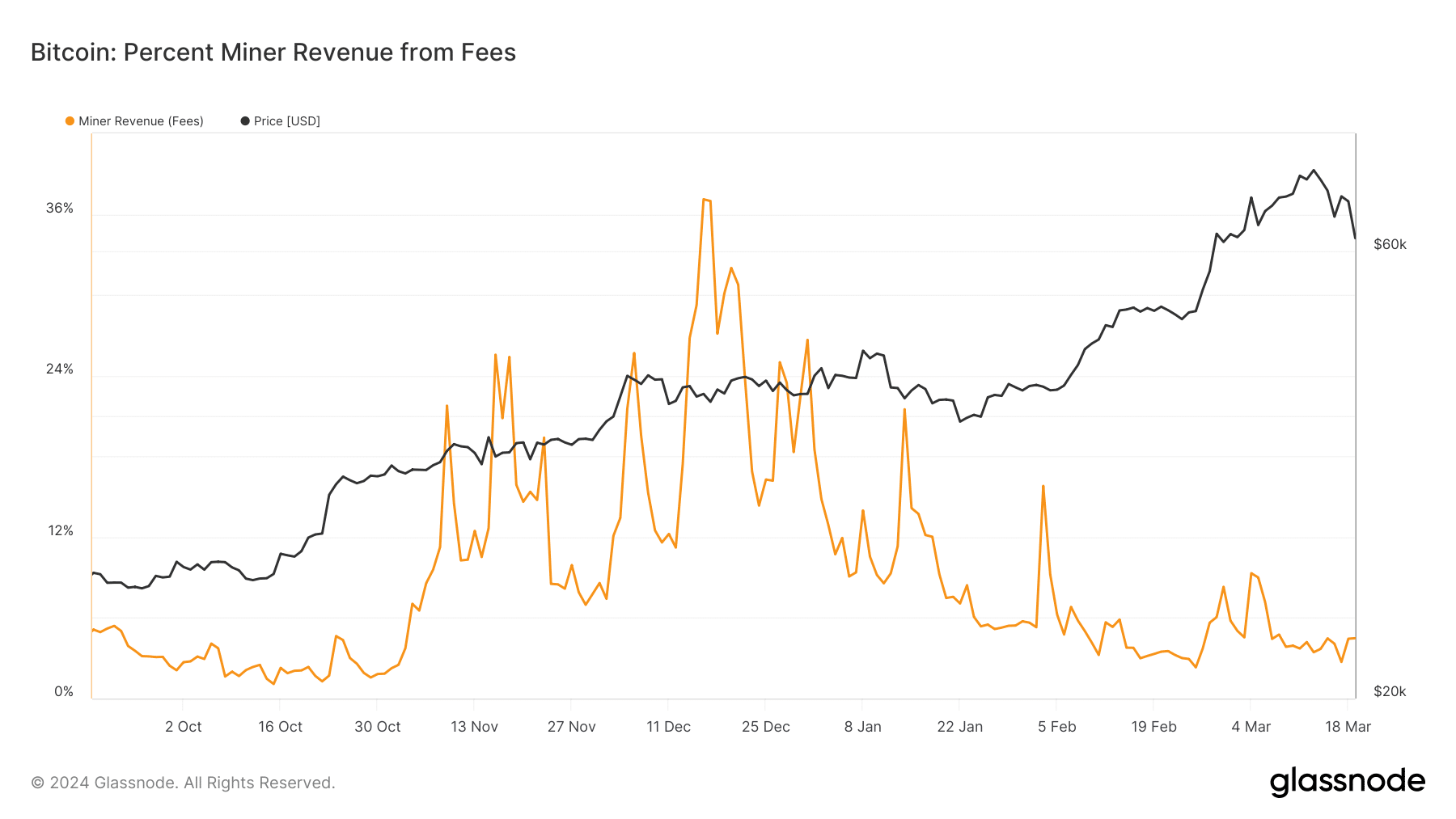

Miners not collecting enough fees

A bigger concern for them was the plummeting fee revenue. As of the 19th of March, transaction fees just made by 4.45% of the total miner revenue on the day, a sharp and progressive drop from over 36% recorded during Inscriptions craze last December.