Bitcoin: What surging volumes tell about BTC investors

- BTC’s on-chain volume climbed to a new high.

- 97% of all trades executed on that day exceeded $100,000.

Bitcoin [BTC] saw a surge in activity this week, with on-chain volume reaching its highest level since FTX collapsed in November 2022.

In a post on X (formerly Twitter), data provider IntoTheBlock found that on 10th January, when the U.S Securities and Exchange Commission (SEC) approved all the Bitcoin Exchange-Traded Fund (ETF) applications before it, BTC’s on-chain volume climbed to $60 billion.

Bitcoin's on-chain volume reached its highest since the FTX collapse.

Bitcoin recorded $60B in total volume on Wednesday, which was almost entirely driven by large transactions. 97% of the total volume, $58.76B, came from transactions of over $100k. pic.twitter.com/rMWh7zWMaS— IntoTheBlock (@intotheblock) January 12, 2024

IntoTheBlock further added that a whopping 97% of this volume, or $58.2 billion, originated from transactions exceeding $100,000.

The dominance of large transactions suggests significant participation from large investors, potentially drawn to trade the asset due to the legitimacy given to it by the SEC-approved ETF.

Where are US-based investors?

Interestingly, a regional assessment of where the trading activity emerged revealed a decline in institutional participation in the U.S. since the arrival of the ETF approval.

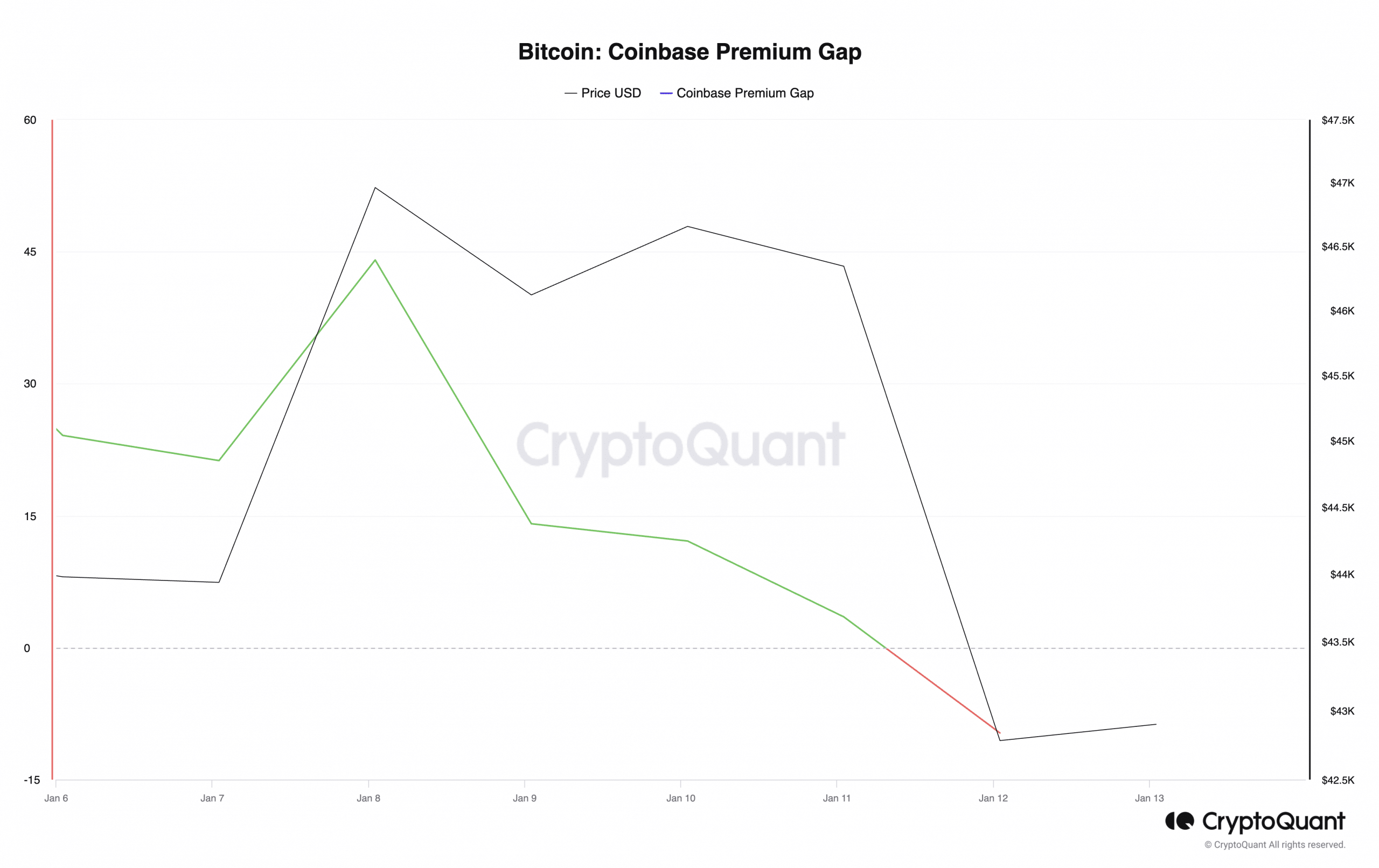

AMBCrypto found that there has been a decline in BTC’s Coinbase Premium Gap since 8th January. This metric tracks the difference between BTC’s price on Coinbase and Binance.

When this indicator returns a positive value and rises, it means that BTC is trading at a premium on Coinbase.

Conversely, when it declines, it means that the coin trades at a much lower price on Coinbase than on Binance, primarily due to a shift in sentiment or buying pressure between US-based investors.

This decline comes after the metric witnessed a surge in the first week of the year, as the market anticipated the ETF approval.

BTC’s Coinbase Premium Gap was -9.7 at press time, declining by over 170% in the past three days, according to data from CryptoQuant.

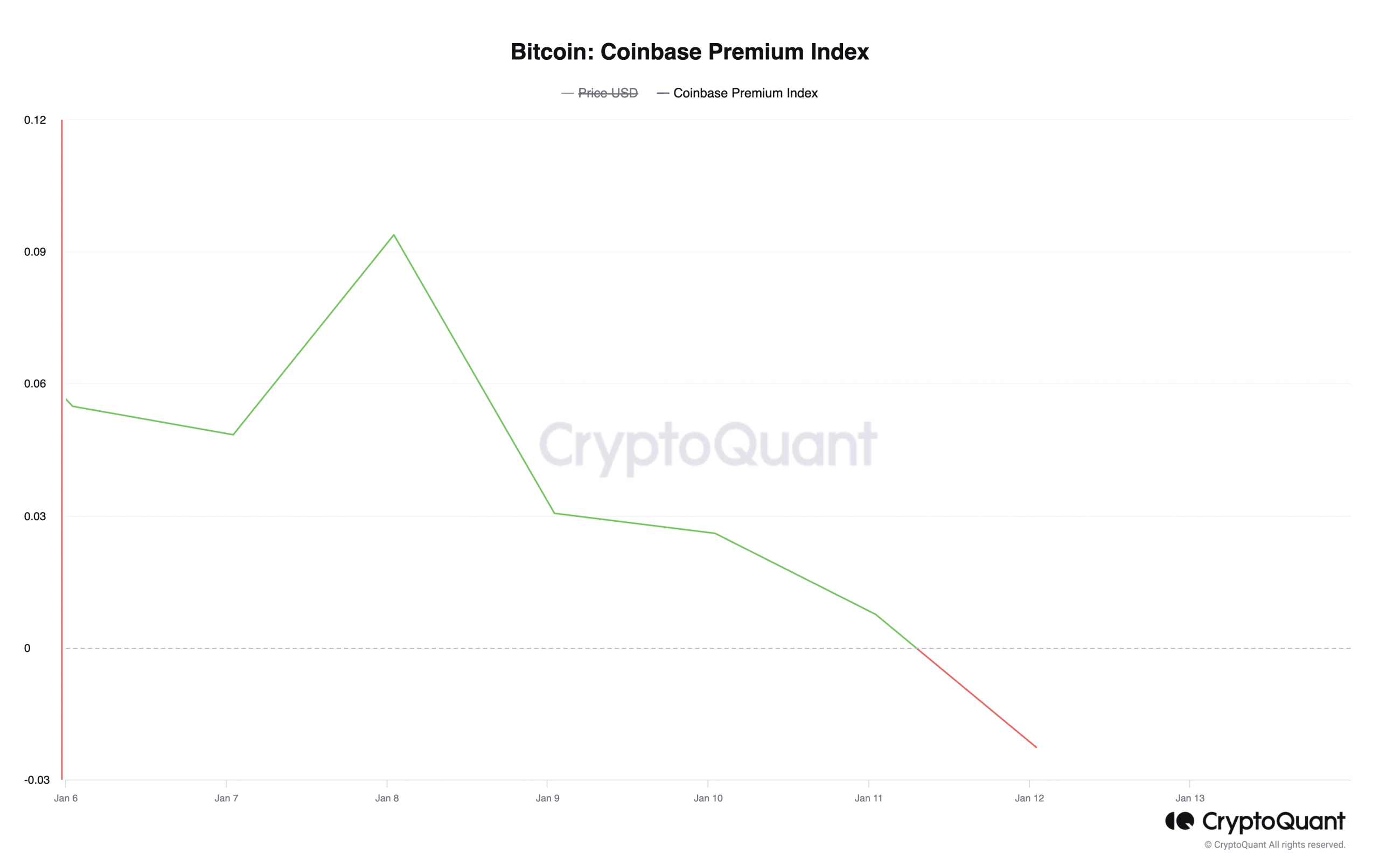

Confirming the decline in participation from American institutional investors since the ETF approval, the coin’s Coinbase Premium Index has also trended downward in the past few days.

With a negative value of 0.002 at press time, the metric suggested a weakness in US buying pressure since ETF arrived.

While the euphoria lasts…

The ETF approval pushed BTC’s weighted sentiment to a multi-month high of 4.49 on 10th January. However, positive sentiment has begun to wane as the ETF hype settles.

Trending south at the time of writing, the coin’s weighted sentiment was 0.523, poised to breach the center line and fall into the negative territory, according to data from Santiment.

Read BTC’s Price Prediction 2023-24

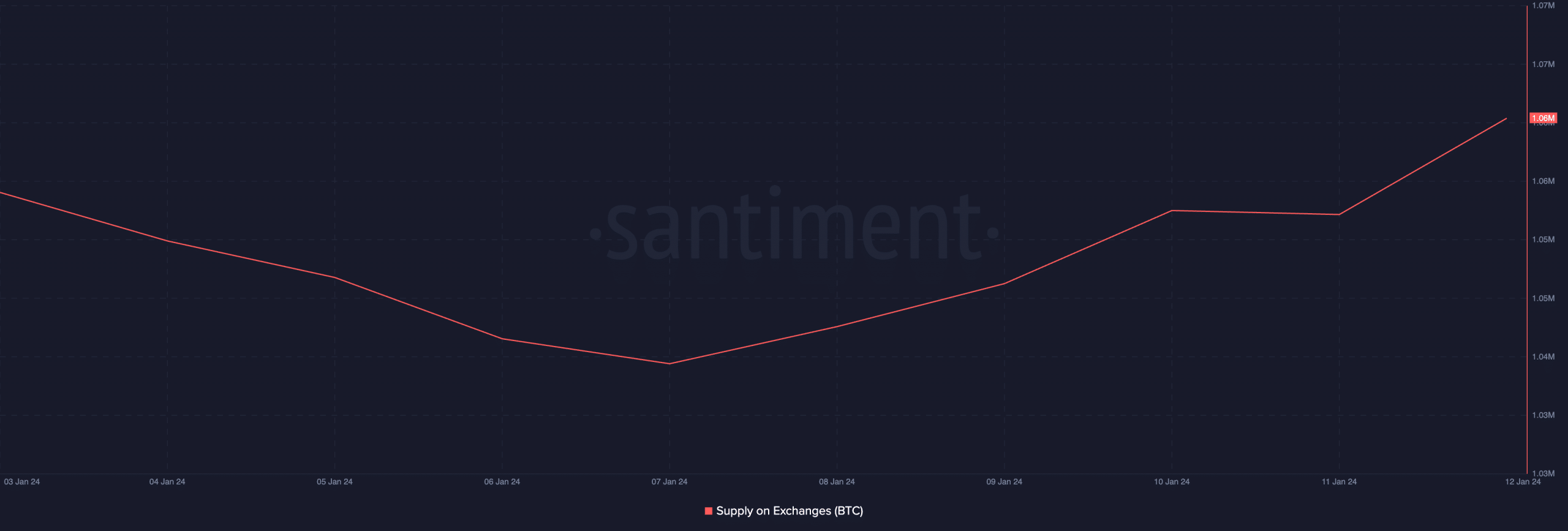

As the ETF led to a jump in BTC’s price, there has been a slight uptick in profit-taking activity in the past two days. The market has since seen a hike in the amount of coins sent to crypto exchanges for onward sales.

If sentiment dwindles further and sell-offs ramp up, BTC’s price might witness a pullback.