Ethereum’s Vitalik is ‘really impressed’ – Is Optimism warranted?

- Optimism allocated a massive amount of tokens for incentivizing growth in the community.

- Despite positive developments, OP faced challenges with declining price and increasing short positions.

In a recent move showcasing commitment to community support, Optimism [OP] distributed 30 million OP tokens to contributors building public goods for the Optimism Collective.

This strategic initiative aims to incentivize projects driving interest and utility within the Optimism protocol.

RetroPGF Round 3 results are here!

30M OP was granted to contributors building the public goods that power the Optimism Collective. pic.twitter.com/f4KicSz99t

— Optimism (@Optimism) January 11, 2024

Some praise

Vitalik Buterin, Ethereum’s [ETH] co-founder, publicly praised this decision on Twitter.

He specifically commended Optimism’s ongoing dedication to funding public goods, providing a pathway for developers and contributors to engage with Ethereum, even in the absence of a conventional business model.

Buterin’s endorsement emphasized the significance of adopting similar funding strategies for projects in the future.

Over $100m distributed in @Optimism RetroPGF round 3.

Really impressed to see their ongoing commitment to funding public goods, helping devs and others contribute to Ethereum even if they lack a business model.

Hope to see more projects doing QF and RPGF rounds in the future! https://t.co/igZCTsnNLt pic.twitter.com/JFGB1MNDDS

— vitalik.eth (@VitalikButerin) January 11, 2024

In terms of the overall state of the protocol, Optimism was doing relatively well.

Daily active users maintained consistency, signaling steady engagement. There was a massive surge on the transaction front, indicating growing activity and interaction within the Optimism ecosystem.

Moreover, Optimism’s Decentralized Exchange (DEX) volumes and Total Value Locked (TVL) both experienced considerable growth. This positive trend not only signified increased interest but also pointed toward the expanding utility and adoption of the network.

Challenges ahead

Despite these positive developments, OP’s market performance wasn’t as cheerful. The token’s recent price movement saw a decline of 0.97%, with OP trading at $3.85 at the time of reporting.

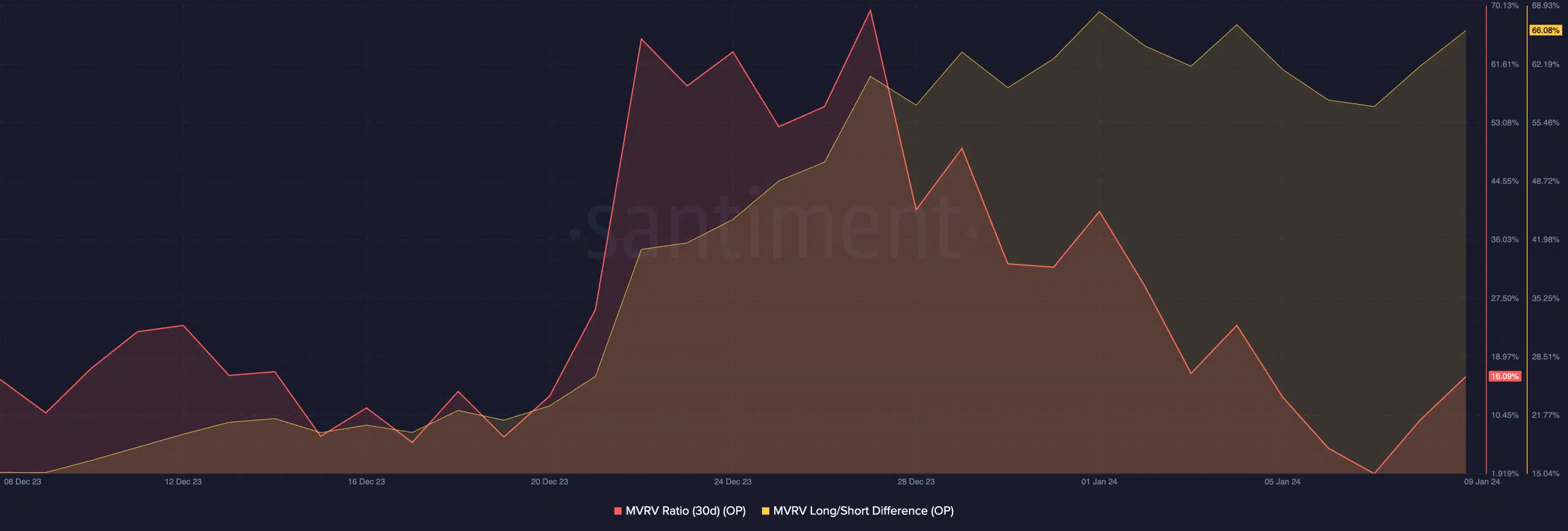

The Market-Value-to-Realized-Value (MVRV) ratio, however, remained high, indicating that existing token holders were still in a profitable position.

While this suggests a positive outlook for current holders, it also raises concerns about potential sell-offs.

How much are 1,10,100 OPs worth today?

Traders’ behavior further complicated the picture as short positions around OP increased, constituting 52.14% of overall positions.

This prevalence of short positions indicates a significant portion of the market anticipating a decrease in the token’s value, adding a layer of uncertainty to OP’s market dynamics.