Bitcoin: Why it’s considered a good time to make this move

Crypto markets, specifically Bitcoin, have been shrouded in a cloud of worry and panic for about 3 months now. Every guess and prediction continues to fail, every rally is followed by another crash, BTC is struggling to climb back to $40k. Once the torchbearer of optimism, Bitcoin is now the primary reason for everyone’s concern, and its effect can be observed in market sentiment.

Fear and Greed

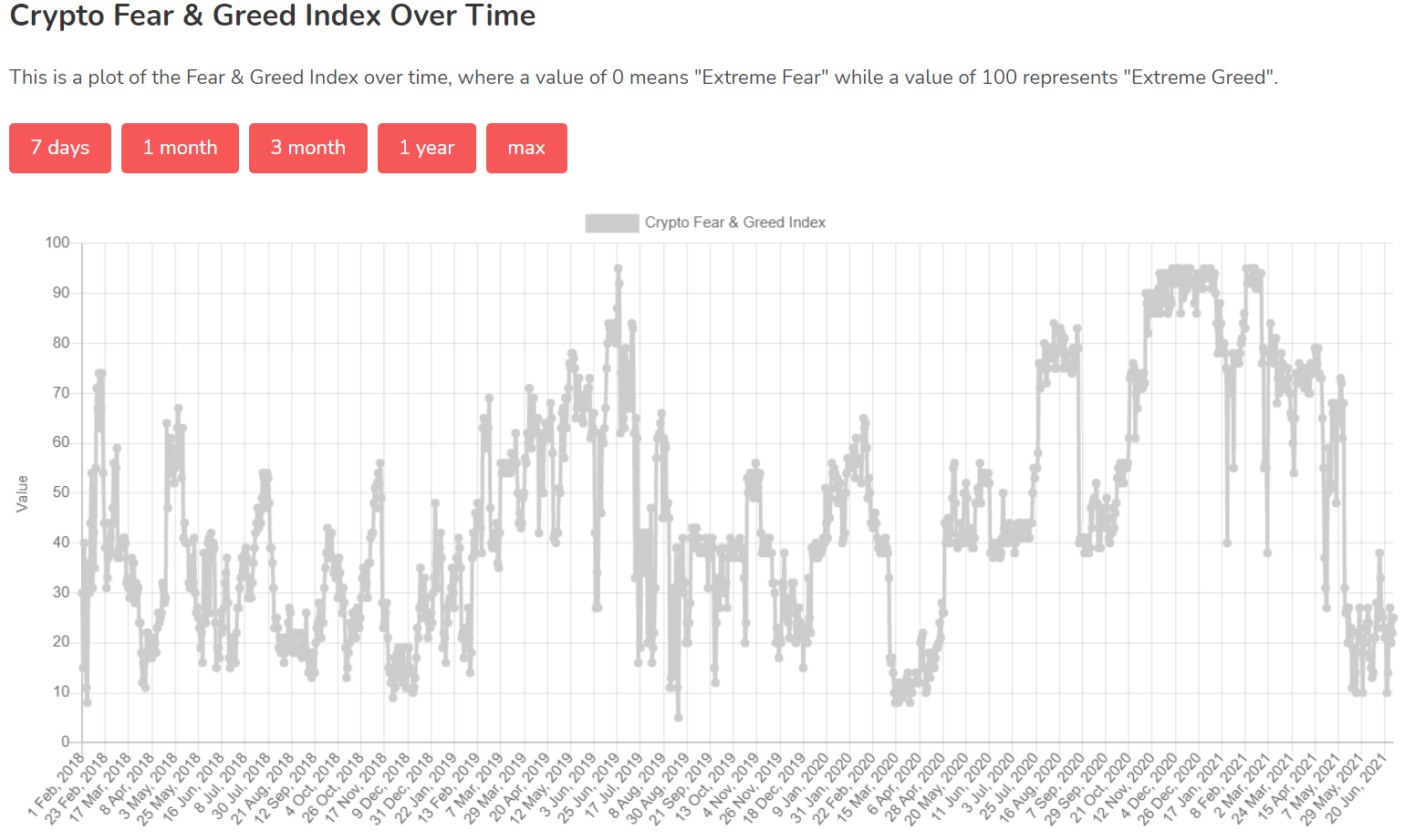

Sentiment is one of the biggest driving factors in the crypto markets. Be it the news of Ethereum’s new upgrade or the rejection of BTC for purchase due to environmental hazards by a certain influencer *cough cough*; people hear and behave instead of looking at the numbers first. Such movements depict the influence people have on a cryptocurrency and vice versa.

Thus, Fear and Greed index is the best indicator when it comes to understanding market sentiment. The numbers drawn on this index are a result of multiple other indicators’ values combined together.

Presently, the Bitcoin market is not in a good shape. On the index, the king coin registered a rating of 25, which translated to extreme fear. BTC has been flickering in that range for a couple of days now.

Fear and Greed Index readings | Source: Santiment

Why does this matter?

This index has proved to be comparatively accurate than other indicators. Every time the index bottoms, the coin rallies. If you observe the index from March to April 2020, you can see that the index was at its lowest that year at a mere 9 points. This indicated that the market was in extreme fear back then. At the moment the situation is almost similar. The index is back in the 10-20 zone and the coin dictates extreme fear in the minds of investors.

Fear and Greed (April 2020) shows rally after reaching the low | Source: Santiment

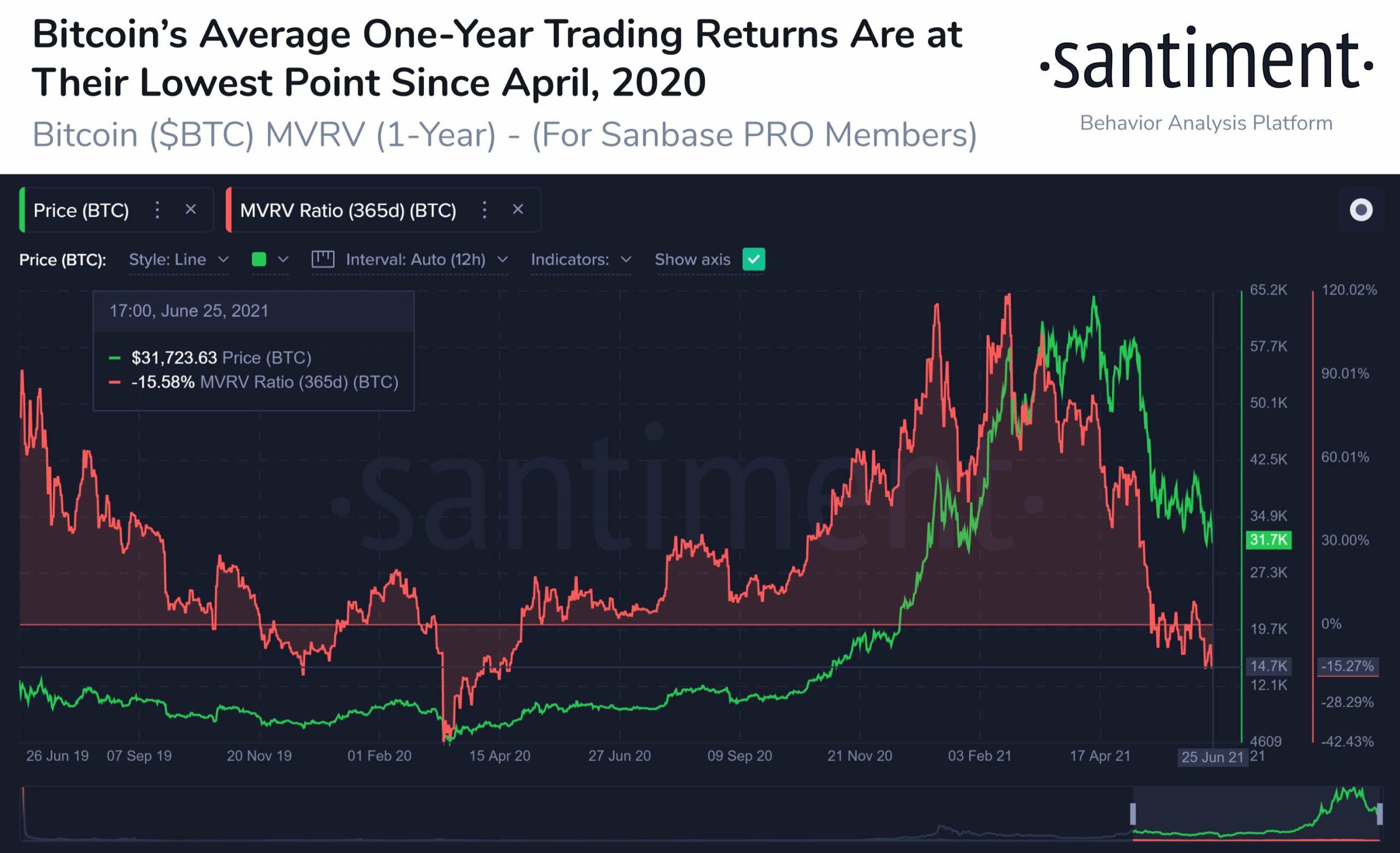

However, this can also be considered as a good sign. As said, when the index falls, the coin soon after picks up a bullish pace and shoots up. And since actively the market is gripped with fear, the only way to move is up. Such a spot is also considered a good time to buy as at the moment Bitcoin is at its lowest average trader returns in 14 months.

Bitcoin 1-year MVRV | Source: Santiment

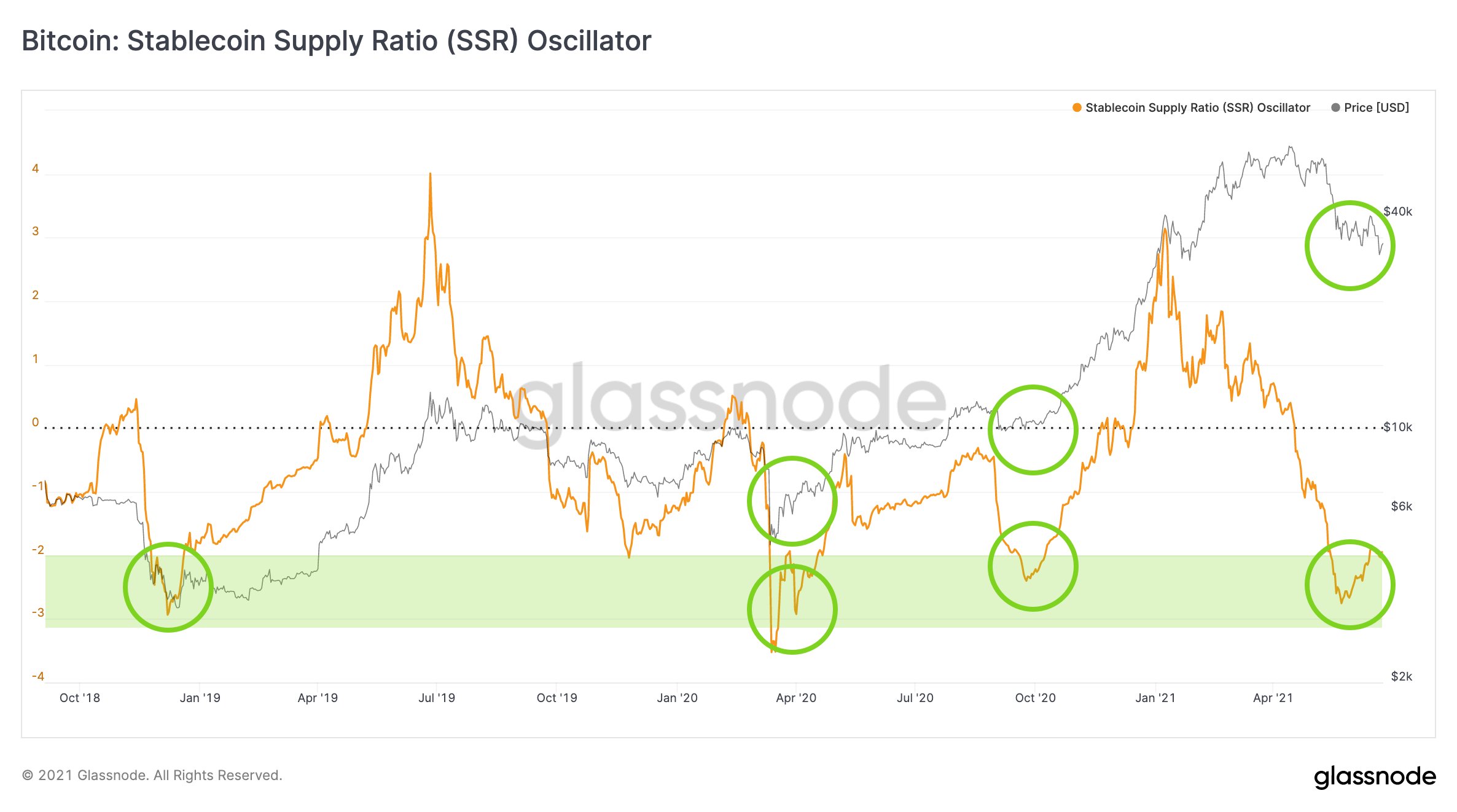

Also in the last few weeks capital has been flowing back into the Bitcoin market from stablecoins. This observation comes from the Stablecoin Supply Ratio (SSR) Oscillator which tanked a couple of weeks ago and just started trending up in recent weeks.

Bitcoin SSR Oscillator | Source: Glassnode

Additionally, active addresses have been rising, which is a positive sign for Bitcoin.

The Stablecoin Supply Ratio (SSR) Oscillator bottomed and has been trending up in recent weeks, indicating that capital has been flowing back from stablecoins into #Bitcoin.

Live chart: https://t.co/5xQnKHnKNl pic.twitter.com/rf6mLxDSXW

— glassnode (@glassnode) June 24, 2021

![Sei [SEI]](https://ambcrypto.com/wp-content/uploads/2025/06/Gladys-13-400x240.webp)