Bitcoin: Why this weekend is worth keeping an eye on

Bitcoin, at the time of writing, was trading around the $48,000-price level, after dropping by nearly 5% in the last 24 hours, from a high of $52,535 a few days ago. However, while the onset of corrections was evident, BTC’s on-chain analysis seemed to underline a bullish sentiment, with two popular metrics signaling the same as well.

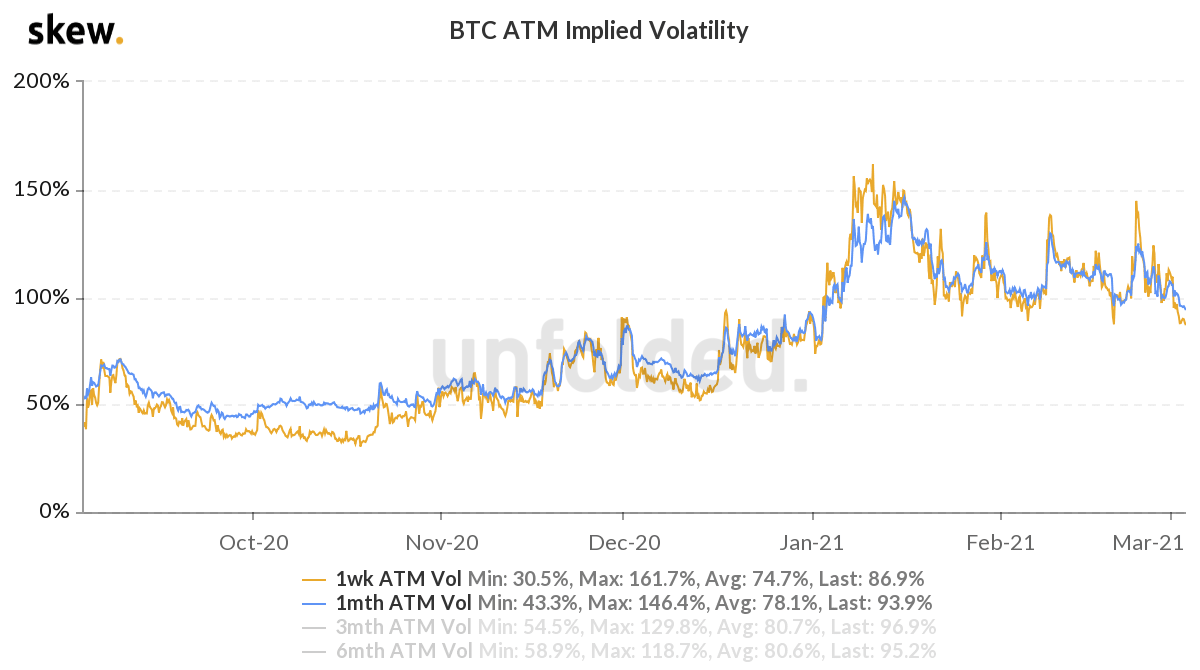

Bitcoin’s volatility is considered critical to its price rally in the current market cycle. Based on data from Unfolded, Implied Volatility has dropped to hit the lows last seen in January 2021. Interestingly, it has been observed that when Implied Volatility resets to lower levels, it has historically emerged as a bullish signal. In such a case, the cryptocurrency’s price hikes to correspond to lower levels of implied volatility.

In the present case, the selling pressure may drop and the cryptocurrency’s price might sustain a breach of $50,000, retesting the high from two days ago.

Source: Unfolded

In bearish markets, Implied Volatility usually hits higher. While February didn’t see a bear market, the IV remained high for most of the month, leaving less room for a price rally after hitting an ATH of $58,330.

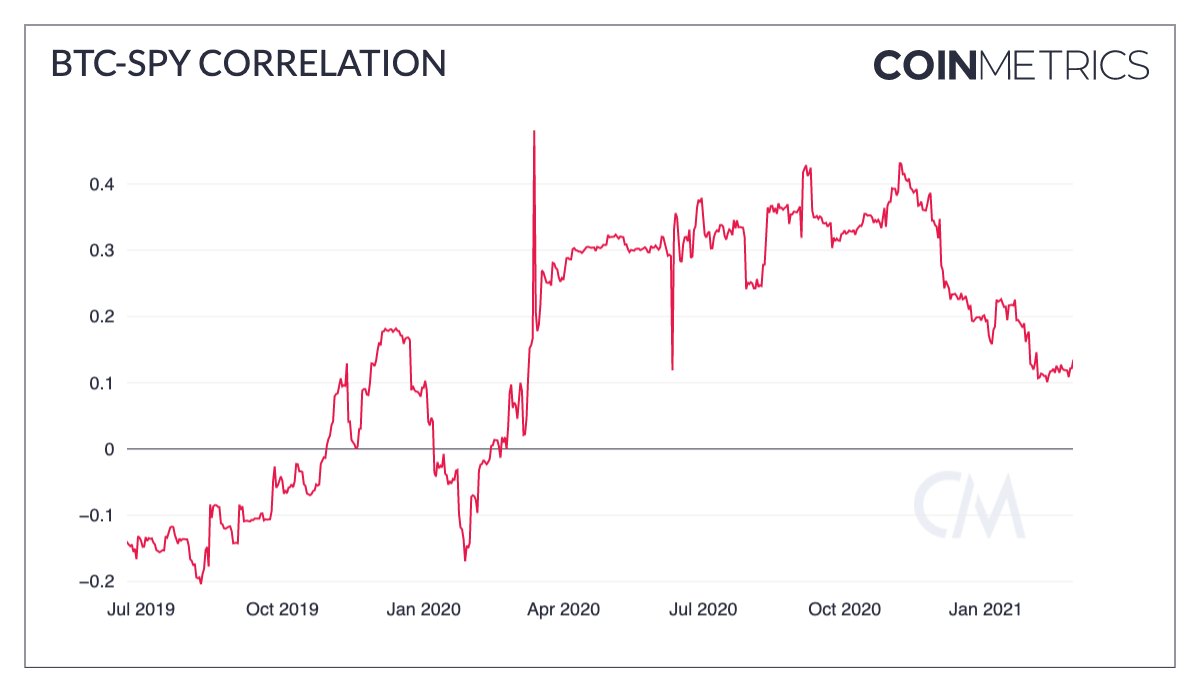

Further, another metric that was flashing bullish signals at press time was Bitcoin’s correlation with the S&P 500. Since November 2020, when Bitcoin decoupled from Gold, its correlation with the S&P 500 has highlighted upcoming trend reversals and the state of the market.

Source: Twitter

The recent hike in correlation is a bullish sign for Bitcoin’s price. The brief appreciation in price to hit $52,535 on the charts led to several shorts getting liquidated and forced buying to cover for open positions. Forced buying does not exactly take the selling pressure off, however, in the short-term, it adds to the generated demand and buying, pushing the price higher.

In the period from 12 February to 25 February, several shorts covered for their open positions by buying. It was expected that the $2.5 billion Options expiry will result in a massive dip in price. However, reclaiming a high of $52,535 was a sign of recovery in the short-term. The next psychological hurdle for the price is $55,000 and with increasing whale activity and large transactions, it looked likely that the asset will hit $55,000 before taking a plunge this month.

With Bitcoin known to move incredibly over the weekends, a quiet one can possibly be discounted. Ergo, if the trend repeats itself, backed by a hike in trading activity, we might see $55,000 as soon as this Sunday.

Source: Coinstats