Bitcoin: Why ‘within reach’ Apple could be next before ‘to the moon’

From its humble beginnings in 2008 to its 2021 price peak, it has been quite a ride for Bitcoin (BTC). In fact, executives at tech giants like Google, Facebook, and Amazon have been quitting jobs to do crypto full time.

But, what’s the hype all about?

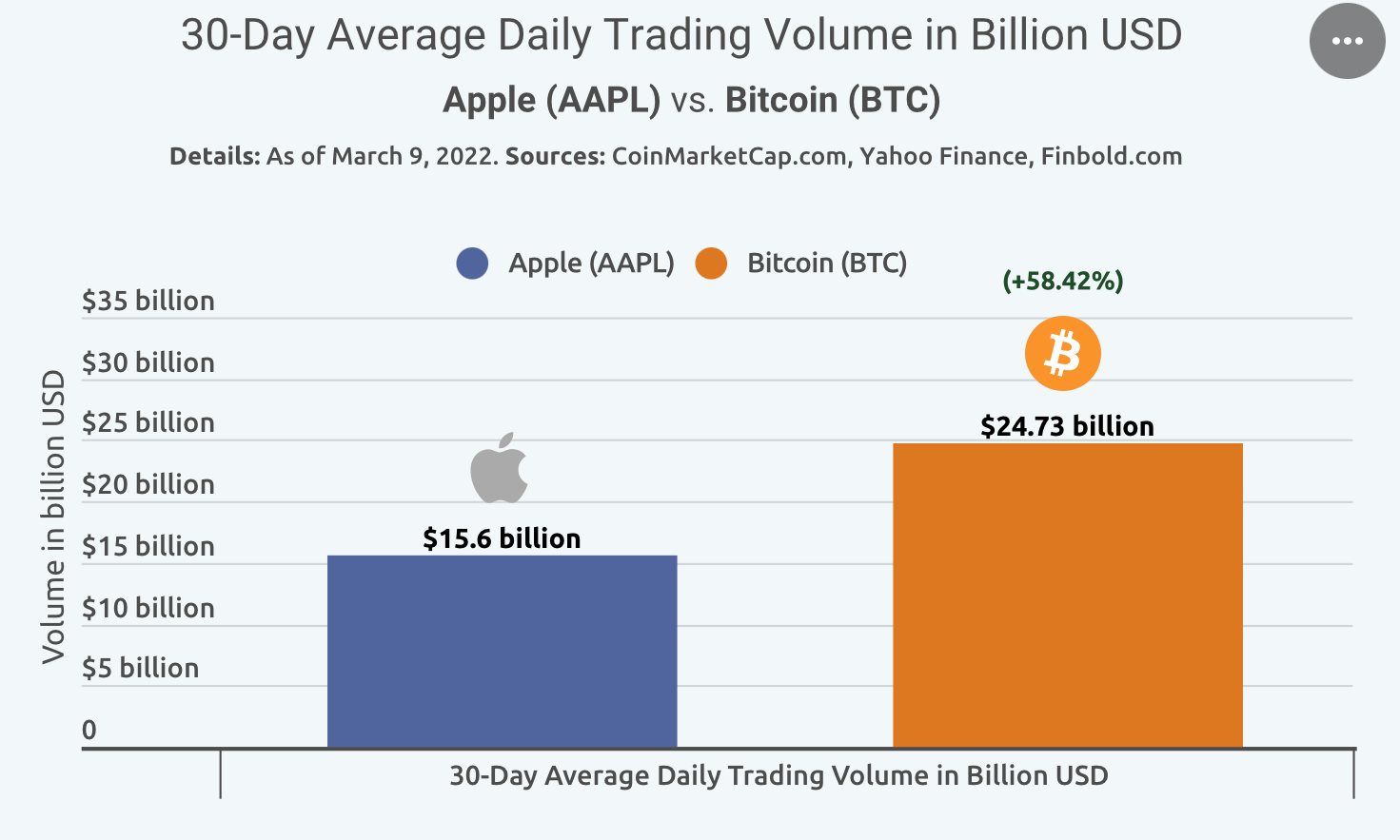

Let’s compare the world’s largest cryptocurrency, Bitcoin (BTC), with one of the world’s largest tech companies, Apple (APPL).

Bitcoin is in the news today after its average daily trading volume surpassed Apple’s by nearly 60%. That’s a massive achievement for a ‘niche’ market’s asset. In fact, the average daily trading volume (APPL) during the observed one-month period leading up to 9 March 2022 was $15.6 billion.

In comparison, BTC’s average daily trading volume over the 30-day period was $24.73 billion. Simply put, Bitcoin’s average daily trading volume was higher than Apple’s by exactly 58.42%.

Source: infogram.com

After the executive order was announced by President Joe Biden, Bitcoin’s price noted a recovery as the market seemed optimistic. In fact, BTC climbed as high as $42,577 on the charts. However, at the time of writing, it was back at square one. It was valued at $39,237, down by 6.66%.

Biden announced the “First Whole-of-Government Strategy” for digital assets. More specifically, he ordered varying federal agencies to work together in formulating a policy. The president’s executive order emphasized that any policies designed for digital assets should protect not only investors but also consumers, companies, and the broader financial system.

This announcement came on the back of the number of new entities (new people buying BTC) spiking last week. By doing so, BTC broke through a pretty rough downtrend, one which started after its previous ATH.

According to the attached Glassnode chart, figures for the same crossed 112.5k new entities.

So, what’s next?

Bitcoin still has a long journey ahead if it aims to surpass Apple in terms of market capitalization. The latter stood at the $2.7T mark whereas BTC was still shy of the $740B mark at press time.

Worth pointing out, however, that on 10 March, Bitcoin’s price shed $3,000 off its value. In fact, the scale of liquidations on the entire network over just one hour stood at $55.81 million.