Bitcoin: Why you need to know about this historically significant move

$30K, $40K, and $42K- These aren’t just figures, these are the levels that the market despaired over, anticipated, and celebrated, in that order. With Bitcoin rallying upward, the market is striking a bullish tone and fears of Bitcoin falling under the 30K level are slowly dying down. On a strictly price-driven note, it is important for the king coin to achieve these major milestones on its way up.

Some exciting price action

Bullishness is the tune of the day as Bitcoin managed to test the $45K mark at press time. Yet again after some minor dips from August 2 to August 4, Bitcoin was bullish on a weekly chart, one-day chart, and 12-hour chart. For the last four days, BTC’s price candlesticks have been closing in green.

In fact on a one-day chart, BTC was above all the SMAs (20, 50, 100) except the 200 week SMA. The last time Bitcoin went above the 200 week SMA (after staying below it for over a month) in April 2020, it stayed above that until the May 2021 price drop. Interestingly, however, the 200 SMA is at the $45K level and this is a milestone as once this level is flipped into support, Bitcoin’s true rally could kick off.

Furthermore, that isn’t the only reason why the $45K mark is a true milestone, analyst Benjamin Cowen chalked out why this level is important. He noted that the $45K zone is part of the lower bounds that BTC would want to break before any significant moves can come up.

Additionally, Cowen underlined a lower trendline that Bitcoin’s price was seeing which also breaks when Bitcoin crosses the $45K mark. Further, that level was a potentially bigger milestone as it had provided some major resistance during the last cycle. The analyst had also highlighted that breaking the 200 week SMA was a historically significant move; whenever that has happened Bitcoin has shown some massive gains.

This large section of investors

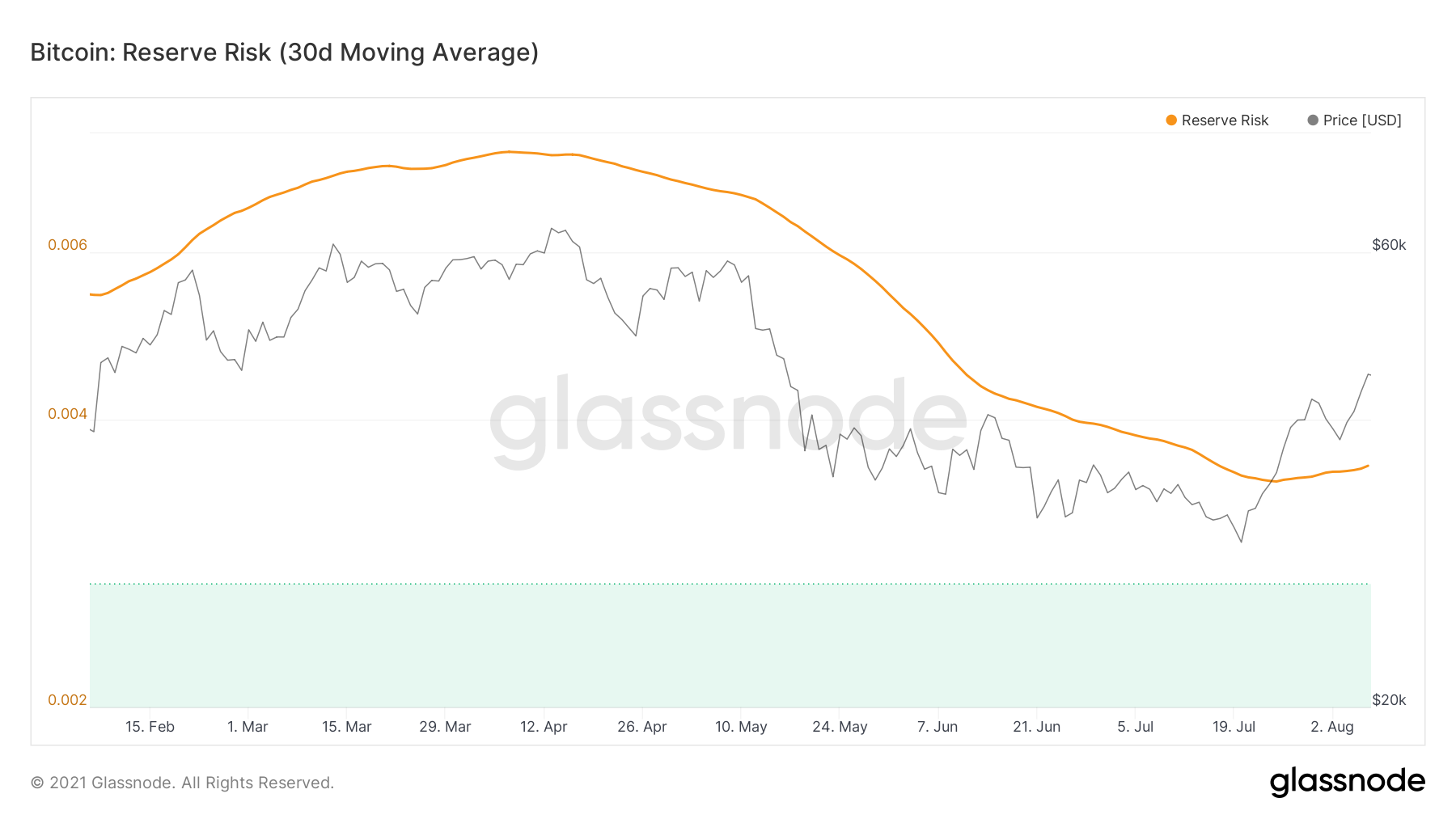

So, price-wise Bitcoin was inching close to this major milestone but what about other metrics. Well, there was one more thing that Bitcoin needed for a further rally and that was higher Reserve Risk. Now risk reserve looks at the confidence of long-term holders relative to the price of the coin. Since risk reserve held low even as prices were going up, it signaled relative undervaluation and indicated that the process of recovery could be a lengthy and prolonged event.

That being said, a look at BTC’s addresses with different balances highlighted that addresses with less than 100 BTC are accumulating but addresses with more than 100 are going down. This again indicated an absence of the high-strength investors from the scene.

Nonetheless, with Bitcoin close to the milestone of blasting well above $45K, there could be renewed excitement in the market.