Bitcoin’s $14 billion dip – Will it threaten BTC’s price rally?

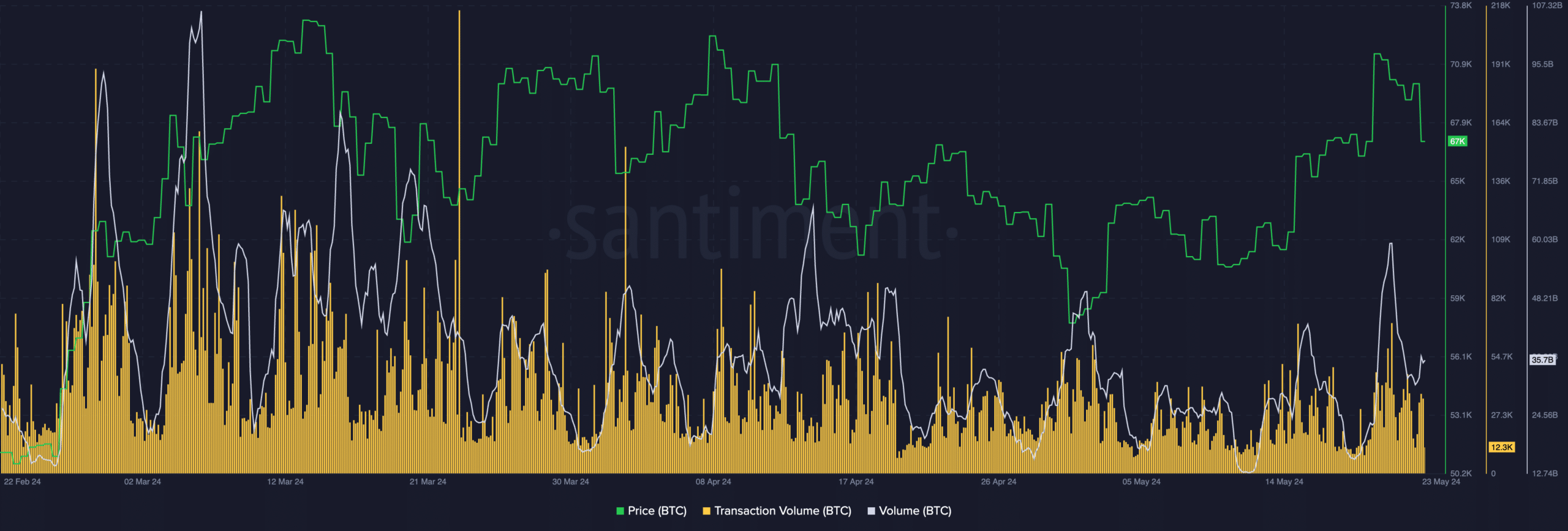

- Data showed that the seven-day trading volume has fallen below $14 billion.

- Price of BTC continued to soar while profitability grew.

As Bitcoin[BTC] approaches its all-time high, the anticipation and FUD around the king coin has also soared. Despite the optimism and interest in Bitcoin soaring, the trading volume around BTC has declined.

Bitcoin volumes decline

Data revealed that the seven-day trading volume dropped below $14 billion, reaching the same level as in 2023 when Bitcoin was trading below $30,000.

This could be a troubling indicator and may suggest that the market has cooled down. On the flipside, it could also be seen as a positive as more addresses are opting to hold their BTC.

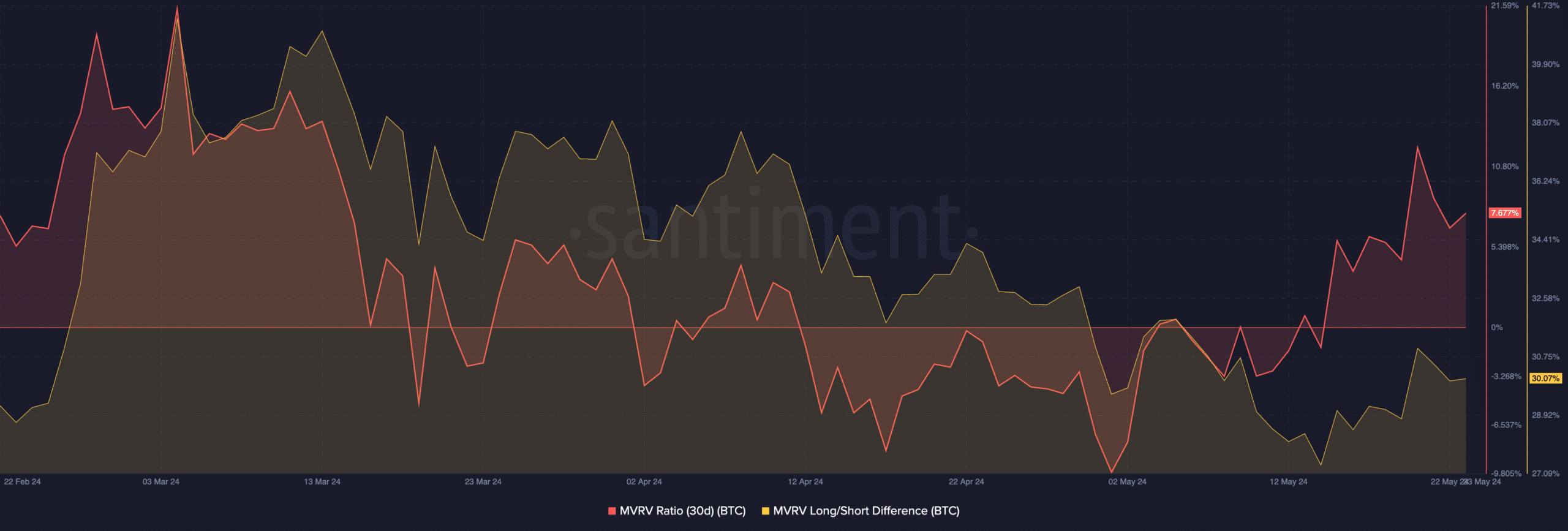

At press time, BTC was trading at $68,899.70 and its price rose by 2.14% in the last 24 hours. The MVRV ratio for Bitcoin soared, implying that most holders had turned profitable over the last few days.

Due to the surge in profitability, more holders could be tempted to sell and drive the price of BTC down.

However, the Long/Short difference for BTC had also grown during this period. This implied that the number of long term holders for BTC rose significantly over the last few days.

Long term holders are less likely to sell their holdings and are much more likely to show a calmer temperament during significant price fluctuations.

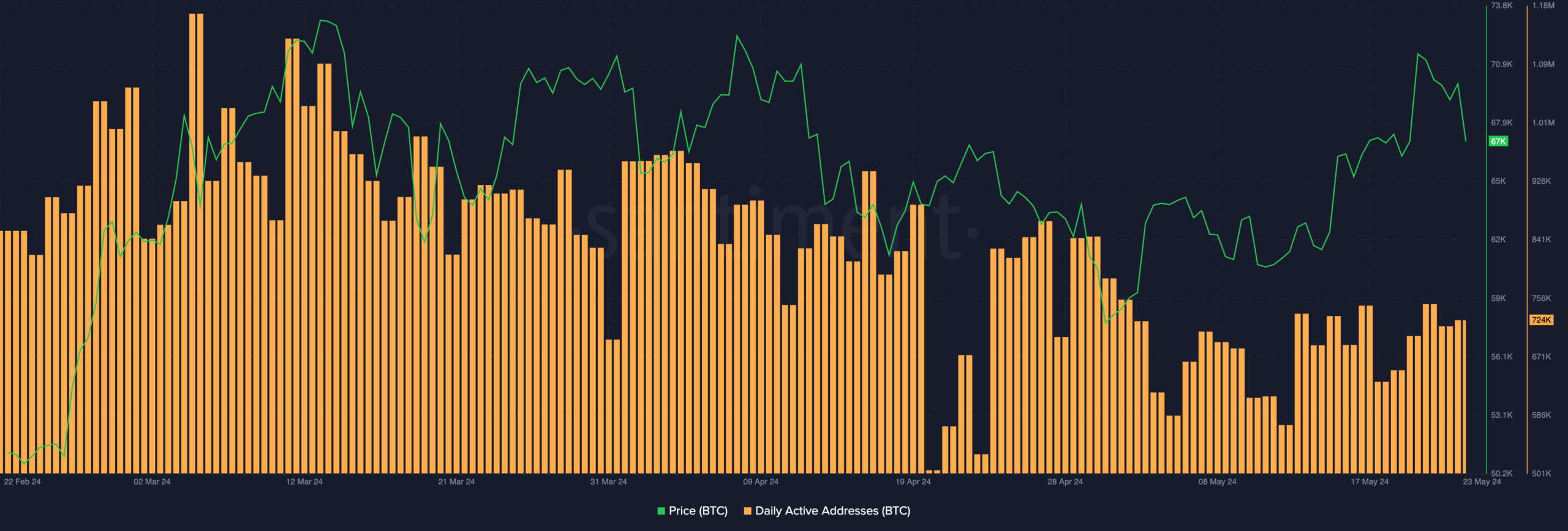

Another indicator of interest in Bitcoin would be the number of active addresses on the network. AMBCrypto’s examination of Santiment’s data revealed that the number of daily addresses on the Bitcoin network fell significantly over the past few weeks.

One of the reasons for the same could be the state of the NFT sector. Over the last few weeks, the NFT sales, buyers and sellers declined.

The sales volume for Crypto Slam fell by 75.36% over the last few days. Coupled with that, the total number of the NFT transactions on the network decreased by 60% as well.

Is your portfolio green? Check the Bitcoin Profit Calculator

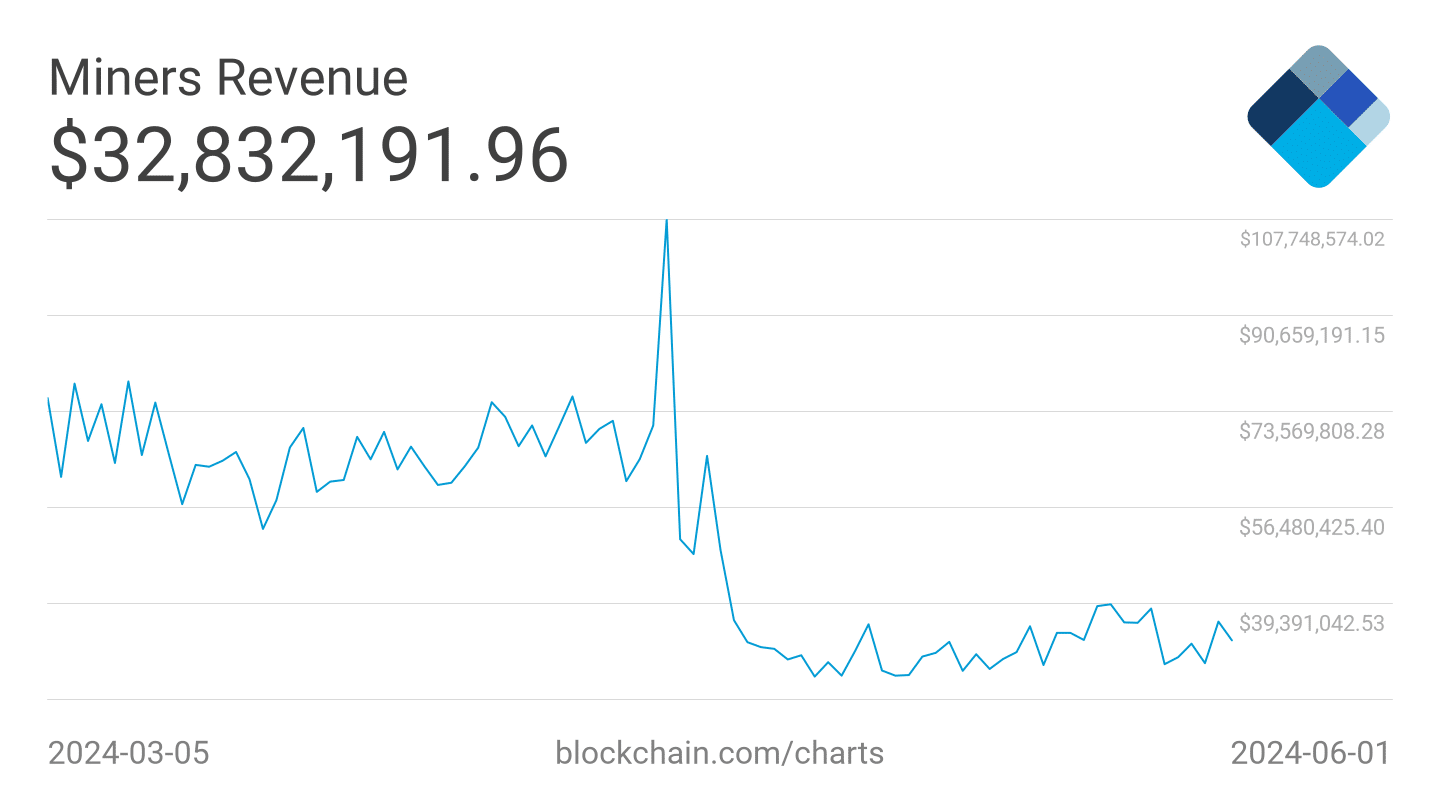

If activity on the network continues to decline, miner revenue can get impacted.

In the recent past, the daily revenue generated by Bitcoin miners had fallen significantly over the last few days. If this continues, miners would have to sell their holdings for profits, causing downward pressure on BTC.