Bitcoin’s 7% drop to $64k: A setback or setup for $70k?

- Short-term investors’ profitability fell but could be a price support for BTC.

- The SSR decreased, indicating that buying power in the market was solid.

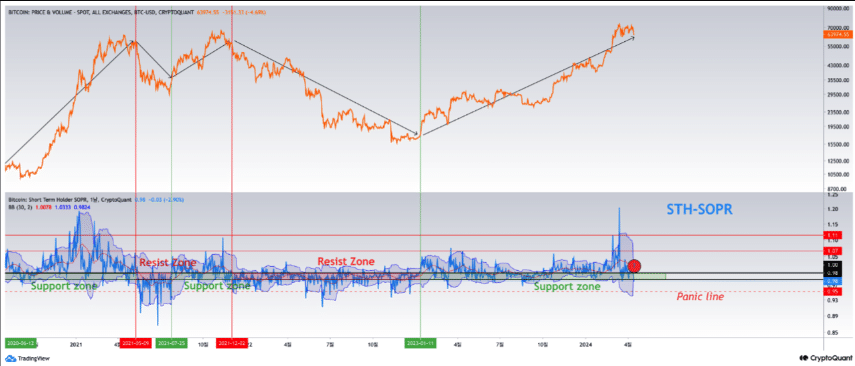

Bitcoin’s [BTC] decrease might have provided a one-shot opportunity for market participants. But this might only be the case if the historical trend of the STH-SOPR repeats itself.

STH-SOPR is an acronym for Short-Term Holder Spent Output Profit Ratio. When the metric trends higher, it means that short-term investors are realizing gains and the market condition gets more profitable.

Historically, the STH-SOPR trending lower is a sign that the market reeks of panic selling. At press time, the metric went downward which aligned with the second inference.

BTC has enough strength in waiting

CoinLupin, a pseudonymous analyst on CryptoQuant, commented on the trend displayed by the metric. According to him, Bitcoin might have entered a stabilization period.

He also agreed that the decline has affected the profitability of investors. But at the same time, mentioned that the metric might have provided support for the coin. CoinLupin wrote,

“Even minor shocks have been significantly affecting the profitability of short-term holders. This suggests that adequate deleveraging has taken place, which could be indicative of “price support” in the data.”

For some time, Bitcoin has been termed to be in a bull phase. If that is the case, AMBCrypto can attest to the notion that the current state offers a buying opportunity.

However, it remains uncertain if the proceeds of this chance might come before the halving or after. At press time, BTC changed hands at $64,392. This value was a 2% decrease in the last 24 hours.

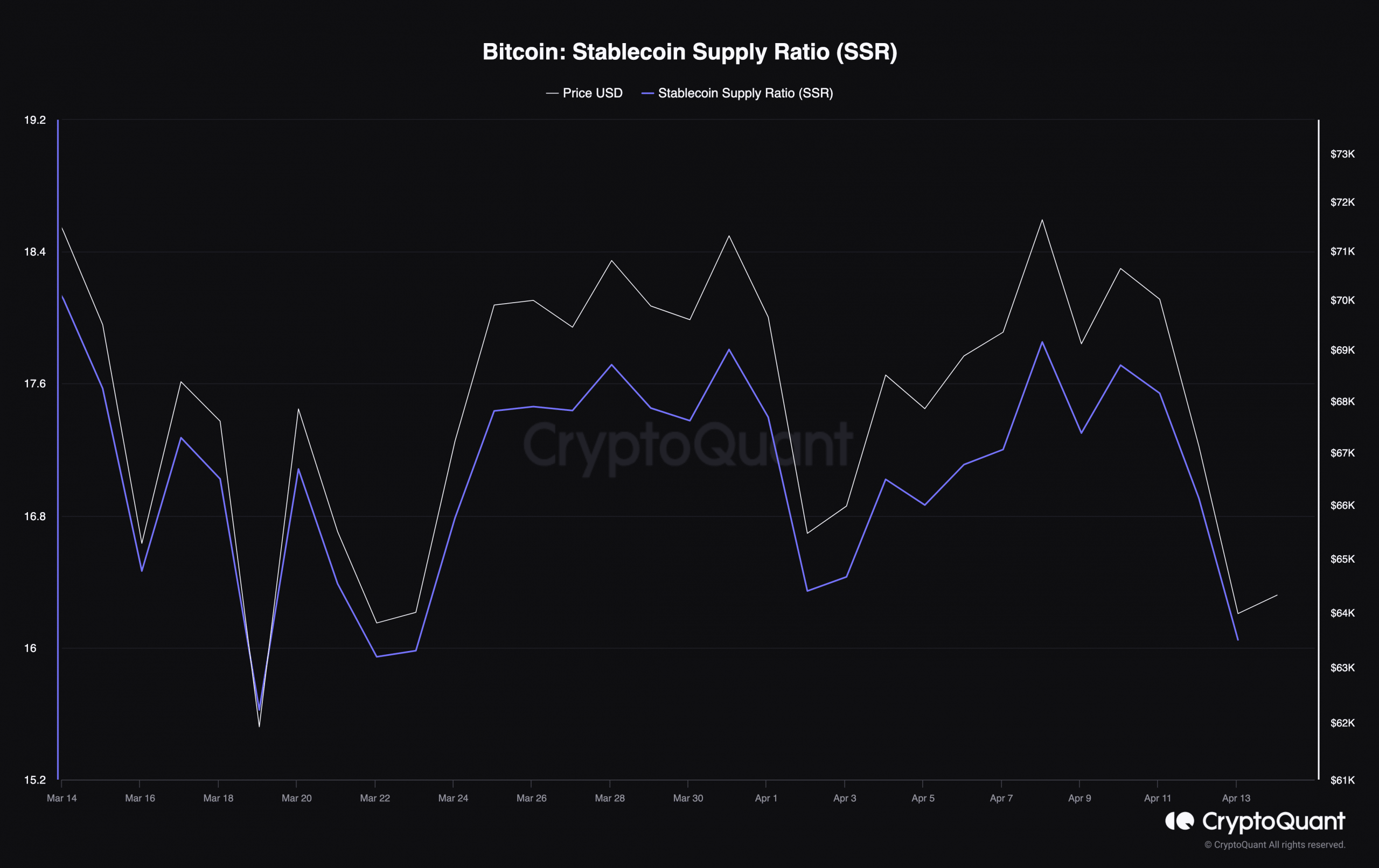

Despite the decline, the Stablecoin Supply Ratio (SSR) showed signals that could be in favor of a price increase. Most times, high values of the SSR indicated potential selling pressure and a possible price plunge.

As of this writing, Bitcoin’s SSR has dropped to 16.04, suggesting an incoming buying pressure. If participants make use of the stablecoin firepower before the halving, BTC might retest $70,000.

However, if they decide to stay on the sidelines, BTC might consolidate. But one thing is almost certain the next before the event and after it might come with a lot of volatility like it has been in the past three halvings.

Some players are scared

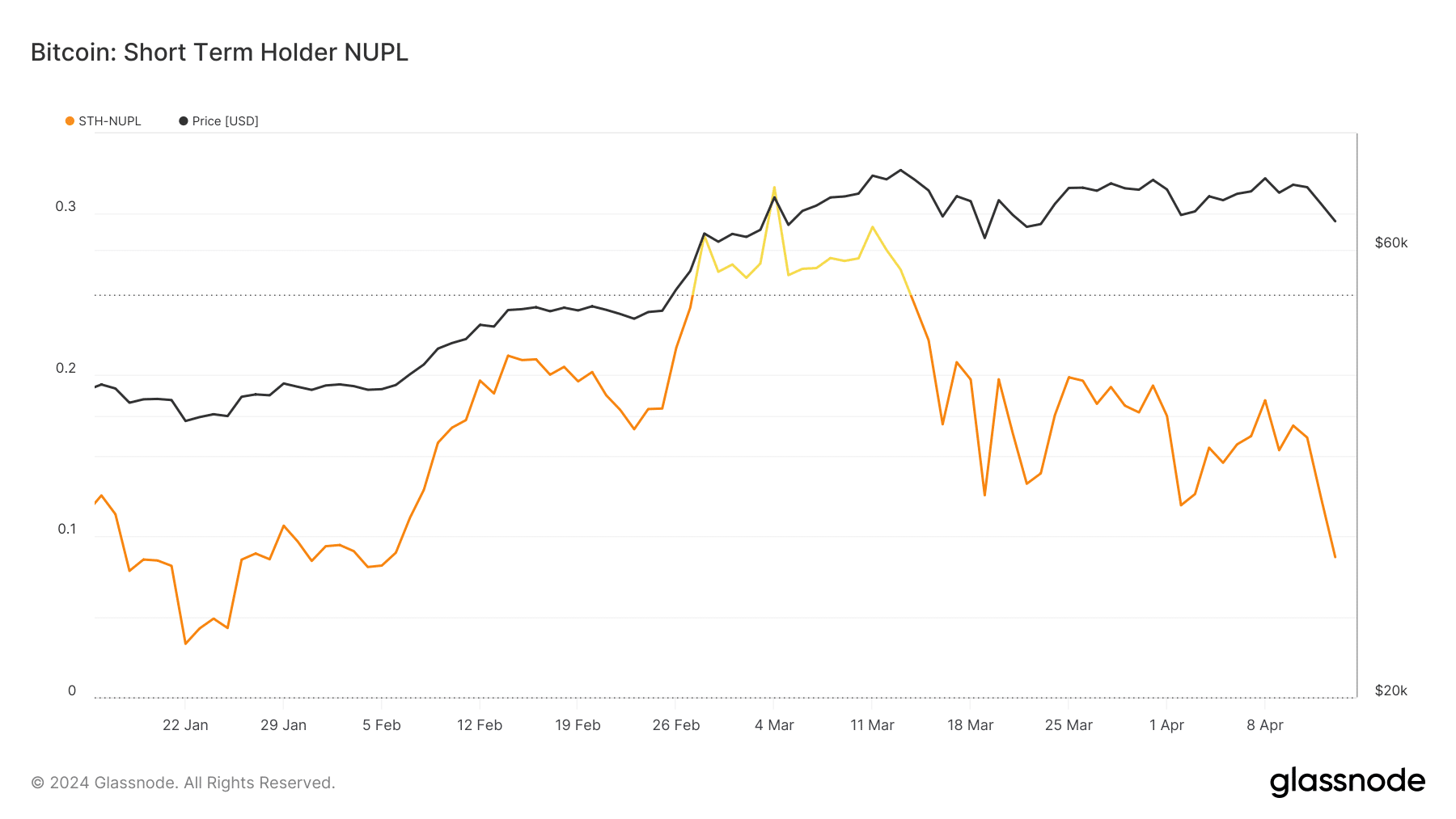

In the meantime, AMBCrypto noticed that the sentiment around the coin had changed. We observed this after checking the Short-Term Holder Net Unrealized Profit/Loss (STH-NUPL).

The STH-NUPL looks at UTXOs younger than 155 days to determine the sentiment of short-term investors. On STH-NUPL was 0.24, indicating that participants were optimistic (yellow) about Bitcoin’s price action.

But it was no longer the case as the sentiment has moved to fear (orange).

Is your portfolio green? Check the Bitcoin Profit Calculator

If history repeats itself, the sentiment could be great for Bitcoin’s price.

For example, the metric was around the same point, and in less than seven days, the price moved from $51,569 to $62,547. Whether it will be the same this time or not, the next few days will tell.

![Kaspa [KAS] on a long-term downtrend? Here's why it should worry investors!](https://ambcrypto.com/wp-content/uploads/2025/06/Kaspa-Featured-400x240.webp)