Bitcoin’s [BTC] price ‘might touch $42,000 this year,’ well only if…

![Bitcoin's [BTC] price "might touch $42,000 this year," well only if...](https://ambcrypto.com/wp-content/uploads/2023/02/aleksi-raisa-DCCt1CQT8Os-unsplash-1.jpg.webp)

- On-chain analysis revealed that BTC has the potential to rally to $42,000 before the year runs out.

- In the meantime, coin distribution exceeds accumulation.

Currently trading at its September 2022 level, CryptoQuant analyst Oinonen_t has opined that Bitcoin [BTC] “has a significant chance to reach its fair price of $42K this year.”

According to Oinonen_t, an assessment of two on-chain indicators, namely BTC’s exchange stablecoins ratio (ESR) and exchange reserves, confirmed the potential for a further price increase.

Is your portfolio green? Check out the Bitcoin Profit Calculator

The analyst noted that BTC’s ESR has surpassed a technical inflection point and is diverging from the spot price, which is a positive sign.

Additionally, BTC’s exchange reserves have been in a long-term downtrend, reflecting entities holding their assets off-exchange, which the analyst referred to as a “healthy development” for the market.

These factors, along with the approaching 2024 halving event, indicate that BTC is moving toward a new pre-halving accumulation cycle, Oinonen_t concluded.

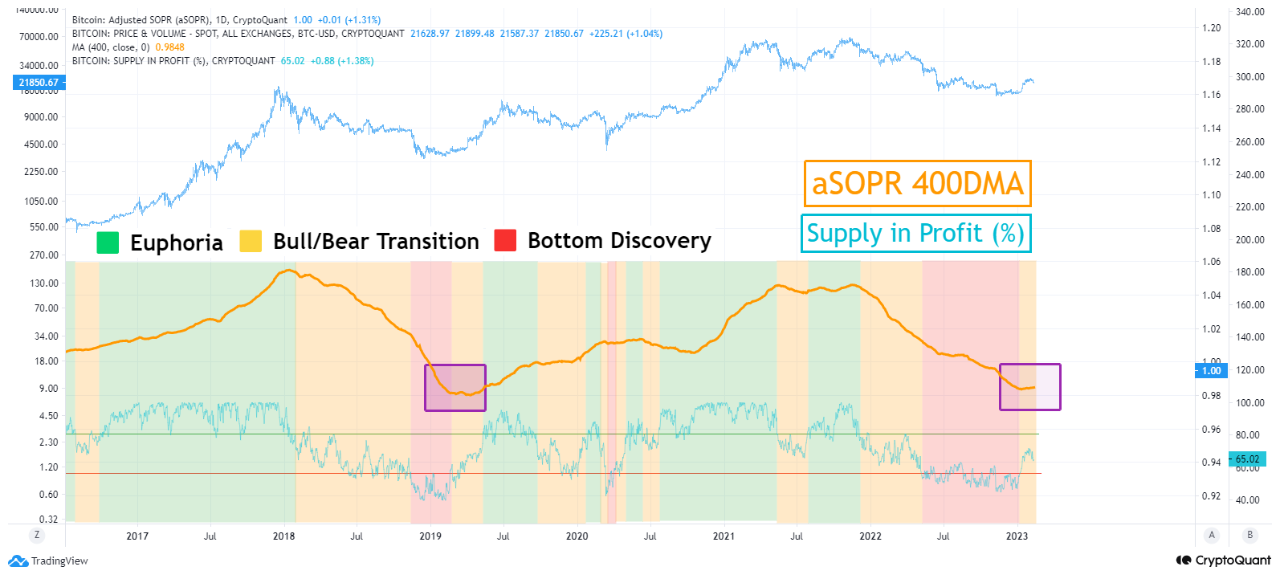

Also sharing a similar belief in a continued rally in BTC’s price, another CryptoQuant analyst operating under the pseudonym Yonsei_dent assessed BTC’s Supply in Profit metric and found that the current market has passed the Bottom Discovery phase and entered the Transition phase, which often precedes a potential for a bull market.

He found further that BTC’s Adjusted Spent Output Profit Ratio (aSOPR) on a 400-day moving average has reached the previous cycle’s low, suggesting that further declines are unlikely.

“Compared to the time of entry into the 2019 bull market, it seems a bull transition is in the process of passing through the bottom. However, in the case of the 2015-2016 Bottom, Supply in Profit (%) went down after entering the Transition phase, and the Bottom period became longer. Since aSOPR 400MA reached the previous cycle’s low, further declines are unlikely. However, there is a concern that the current situation will be prolonged unless it changes to a positive (+) slope,” Yonsei_dent noted, adding a caveat.

Read Bitcoin’s [BTC] Price Prediction 2023-2024

Stay at alert

According to data from CoinMarketCap, BTC’s price decreased by almost 5% in the last week. At press time, the king coin exchanged hands at $21,885.

A daily chart assessment of price movements revealed a significant decline in BTC accumulation in the last week. At 1.74 million at the time of writing, the coin’s On-balance Volume (OBV) had declined by 1% since February began.

A steady fall in an asset’s OBV indicates that there is decreased buying pressure and increased selling pressure, suggesting that market participants are becoming more bearish on the asset. This can signify potential downward price movement, as there is less demand for the asset.

The position of BTC’s Chaikin Money Flow (CMF) confirmed where market sentiment rested. At negative -0.07 at press time, more investors took to distributing their BTC holdings rather than holding on to them. A continued downtrend in BTC’s CMF might be followed by a price drawback. Hence, caution is advised.