Bitcoin’s bull cycle – Don’t be ‘fooled’ by BTC price’s ‘April Turmoil’ because…

- Experts like Tom Lee believe Bitcoin will climb higher

- Metrics suggested the market hasn’t bottomed yet in light of the persistent sell-side pressure

The last few weeks have been very critical for Bitcoin [BTC], with its price dropping below the critical $60,000-level too. However, following significant corrections, the coin recovered on the charts to trade at $63,167 at the time of writing.

BTC’s 6% hike over a period of just 24 hours points to a potential reversal in the cryptocurrency’s market trajectory. Needless to say, this has renewed a sense of optimism among investors and observers alike.

Is there a buying opportunity amidst volatility?

As volatile as Bitcoin may be right now, however, many execs believe this is an opportunity too. Specially, some see this as a good buying opportunity. Foremost among them is Tom Lee, with Fundstrat’s co-founder claiming during an interview,

“I think that we’re kind of being fooled by the April turmoil and I think that’s why it’s a buying opportunity for both Bitcoin and stocks now.”

He added,

“It doesn’t mean it’s going to turn around today but, I don’t think this is a top.”

According to the exec, the most recent decline was a healthy correction, one possibly driven by profit-taking.

That’s not all, however, with another analyst – @el_crypto_prof – taking to X (Formerly Twitter) to draw a parallel with a historical market trend.

“History doesn’t repeat itself, but it often rhymes. $BTC has touched a trend line that has played an important role since the beginning of 2023.

Shedding light on Bitcoin’s future outlook he added,

“The thing will be sent higher. It’s only a matter of time, imo.”

Crypto-analyst TechDev chipped in too, with the analyst stating,

“The impulsive structure of the last 1.5 years says 90-100K is next. $BTC”

Simply put, the general consensus among most analysts is that these market conditions are not the end of the bullish cycle. Rather, they are simply a temporary setback.

What are the metrics hinting at?

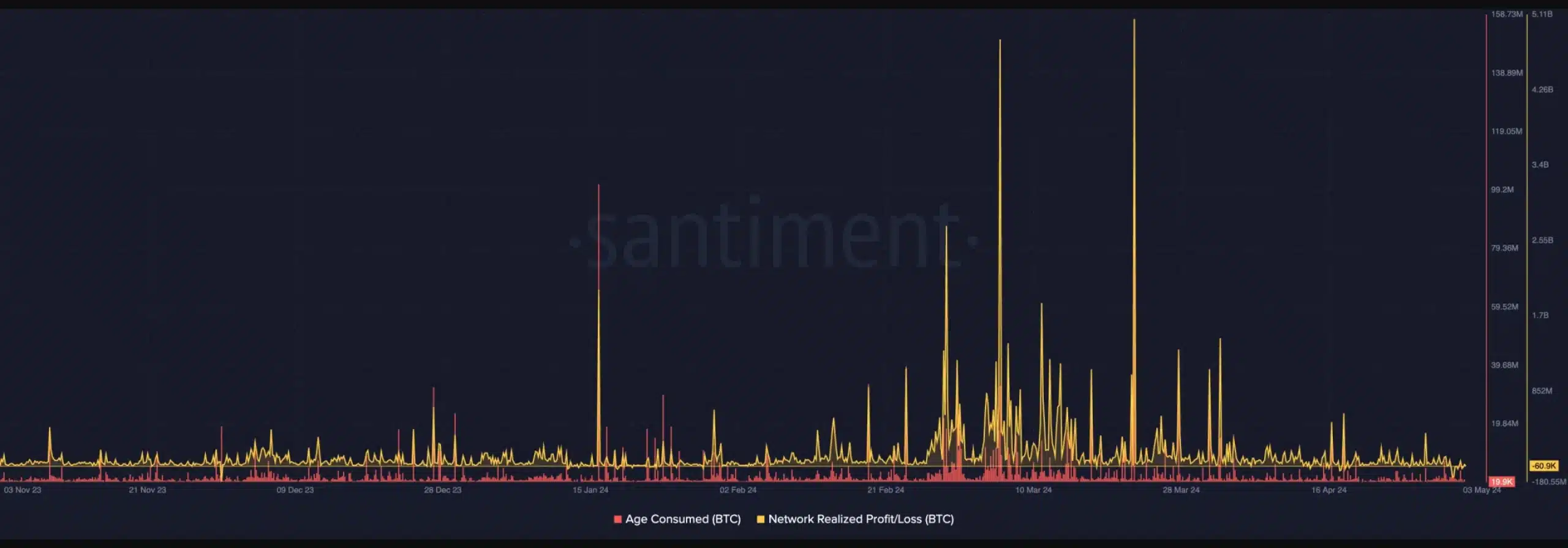

AMBCrypto’s analysis of BTC’s Age Consumed data echoed its previous findings. Since 3 April, there has been minimal activity, suggesting no indication of a price bottom.

Additionally, Bitcoin’s Network Realized Profit/Loss (NPL) data, which measures the difference between the last moved price and the current market price, also failed to show signs of a price bottom.

Ergo, both metrics contradict the sentiments shared by Lee and others, suggesting that the market may not have reached its bottom yet.

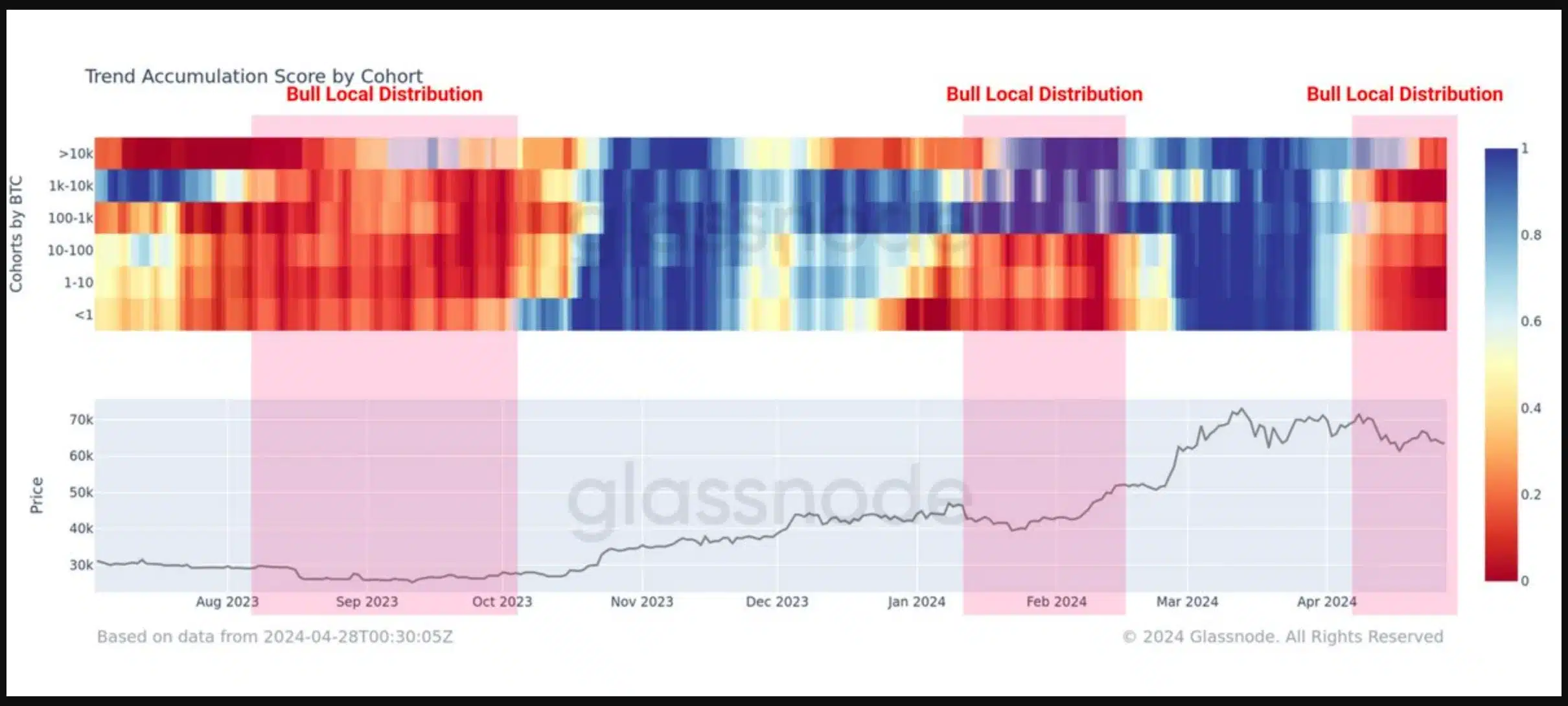

Echoing the same, an analysis by Glassnode highlighted an uptick in Bitcoin outflows in April – A sign of selling pressure in the market.