Bitcoin: Why Schiff’s prediction about Halving and BTC’s price is wrong

- Peter Schiff opined that Bitcoin’s price might not gain from the event.

- Despite its high value, an important metric revealed that buying BTC might remain profitable.

Outspoken Bitcoin [BTC] skeptic Peter Schiff has come out with another prediction, saying that the coin’s supply would not be cut in half by the halving.

Schiff posted this on X (formerly Twitter) on the 12th of March, highlighting his reasons.

According to him, 90% of the total Bitcoin supply already exists. Therefore, the only thing left to cut is the supply growth, not Bitcoin’s.

Schiff’s hypothesis does not hold water

If we were to go by the economist’s opinion, then it could be difficult for the value of BTC to experience exponential growth after the halving.

This was not the first time that Schiff had criticized the coin. But despite his vocal skepticism, Bitcoin has continued to defy his forecast.

This year, the price of the coin has increased by an incredible 64.90% while tapping new all-time highs.

Regarding the halving which would most likely happen in April, miners will get 3.125 BTC as reward. Historically, Bitcoin’s price has surged to amazing heights after the halving.

But this time, it has been different as the coin hit a new high before the event.

However, that does not take away the possibility of further growth. For instance, the first halving in 2021 saw BTC jump to $126 from 12. The 2016 and 2020 halving also created astronomical values for the coin.

For AMBCrypto, opinion and history alone do not move markets. Therefore, we considered it necessary to evaluate the state of Bitcoin on-chain.

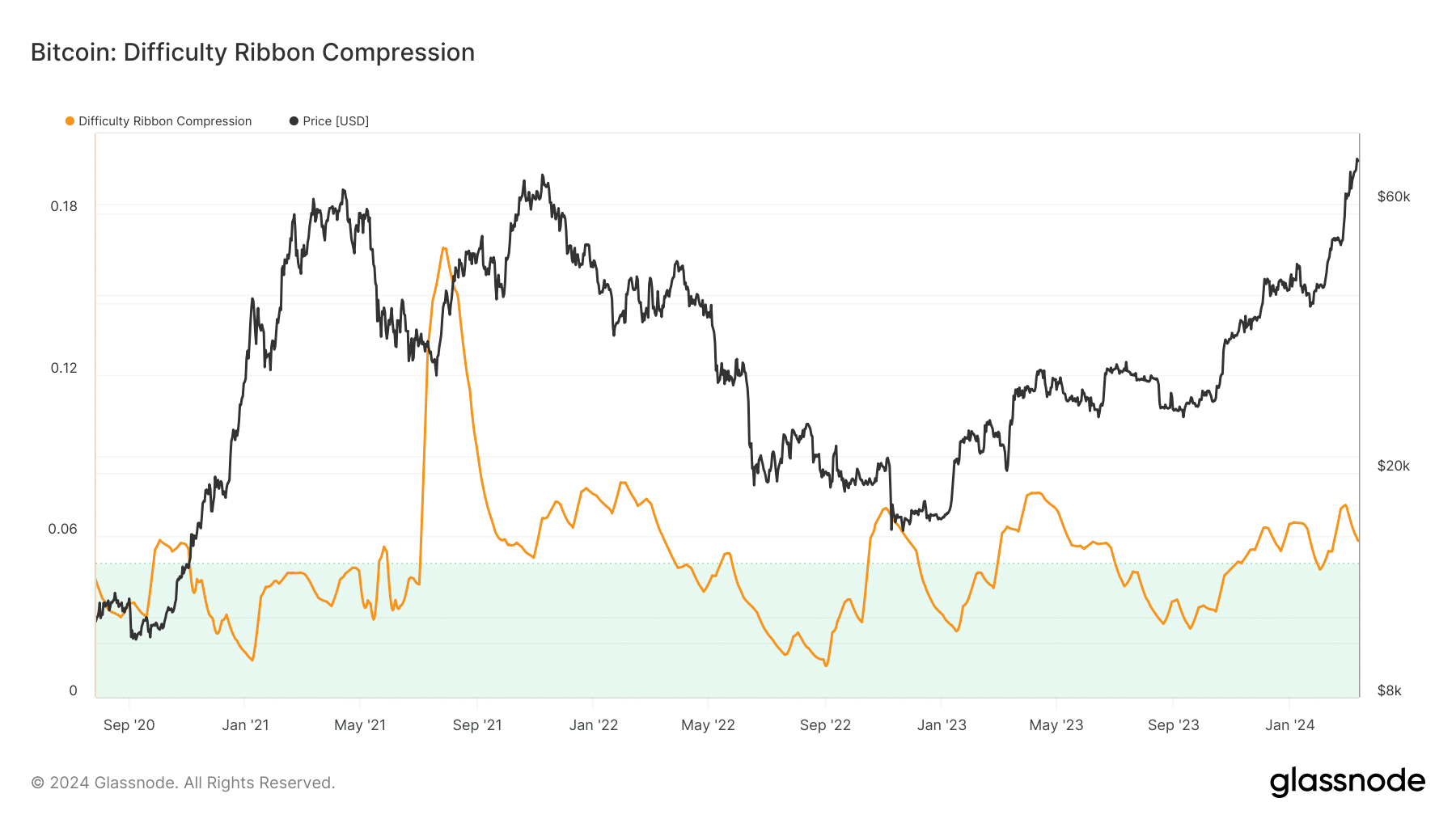

One metric we looked at was the Difficulty Ribbon Compression.

For those uninitiated, the Difficulty Ribbon Compression quantifies zones of high and low compression which can help in spotting buying and selling opportunities.

With a compression threshold of 0.05, the metric suggested that Bitcoin at $72,864 remains a good buying opportunity.

If this metric were to flash a sell signal, then the reading would have been between $0.10 and $0.16 like it was in Q4 2021.

Inflation declines, hype returns

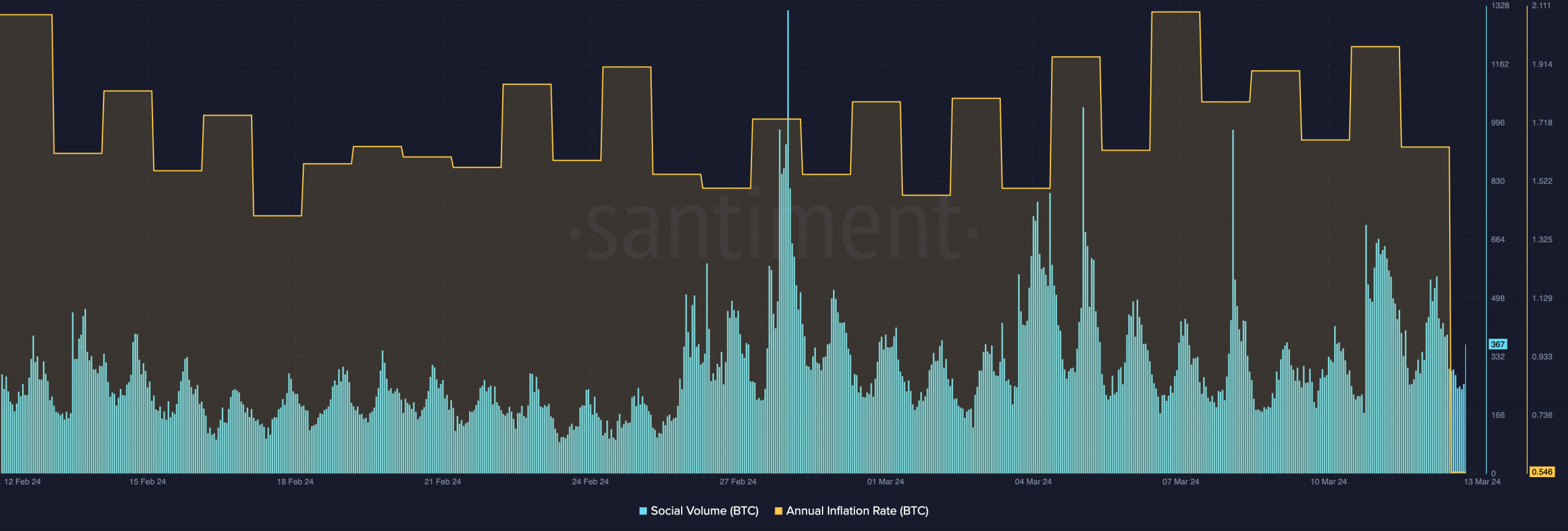

Another metric we checked out was the annual inflation rate. According to data from Santiment, AMBCrypto observed that Bitcoin’s annual inflation rate had dropped to 0.54.

If the inflation rate continues to drop as the halving approaches, gains for Bitcoin might accelerate within months. Furthermore, attention in the coin’s direction has been rising, as shown by the social volume.

At a reading of 367, the surge in social volume implies that mentions of the coin across different social channels have increased.

If this metric continues to increase, then demand for BTC might also follow.

How much are 1,10,100 BTCs worth today?

Should this be the case, Schiff’s opinion might hold no water and the price of Bitcoin could rise in the six-figure direction.

However, traders have to be watchful about their optimism as a correction could happen in the process.