Bitcoin’s high stakes: Why consolidation is key for BTC to rebound

- Bitcoin has surged 4% thanks to the ‘Christmas Rally,’ with secret Santas driving the momentum.

- However, psychological risks remain, keeping the bull rally just out of reach.

Ten days ago, Bitcoin [BTC] hit a new ATH of $108K, a level it’s been eyeing since the “Trump pump.”

But even with no signs of an overheated market and greed staying well below the 90 mark, investor caution soared as the FOMC warned of a “cautious” 2025 ahead.

The result? BTC saw a sharp decline, wiping out much of the gains made during the final phase of the election cycle.

With a potential correction looming, many chose to cash out at the $94K price point – leading to over $7.17 billion in profits being realized.

While it might seem like a setback, the exit of weak hands is often seen as a ‘healthy’ retracement, setting the stage for fresh players to enter and grab the available supply.

Now, with BTC creeping back toward $100K, is new capital flooding back into the market, or is the aftermath of that ‘unexpected’ decline still fresh, keeping investors on edge?

Risk-averse investors exit amid caution

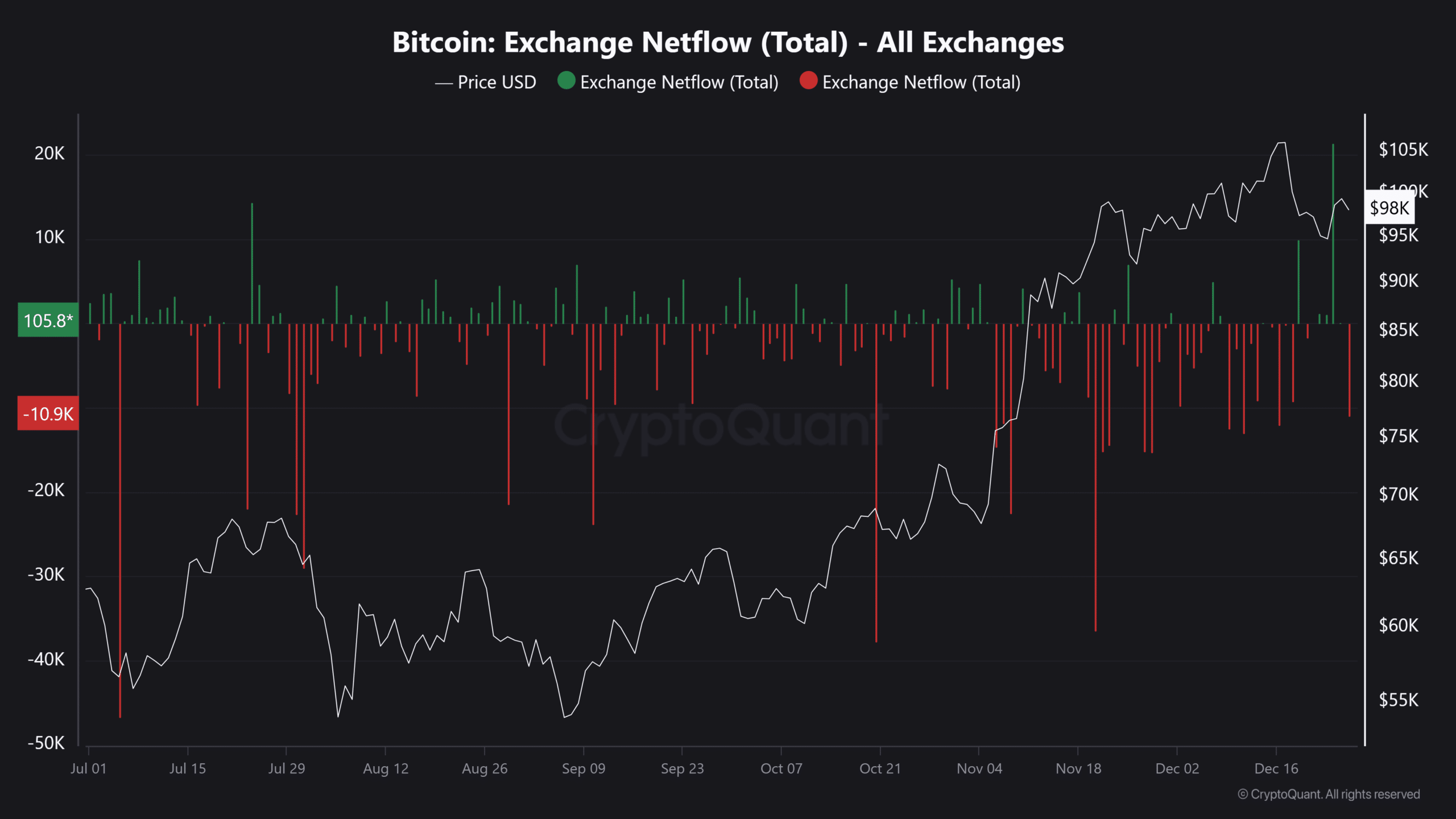

Following the massive cash-out, Bitcoin exchange reserves surged to 2.427 million – the highest spike since November.

Short-term holders’ SOPR also hit 1.04, signaling that those with less than five months of exposure were cashing out and locking in profits.

In addition, BTC inflow into exchanges reached a five-month high, with 21K BTC deposited at an average price of $98K.

This sent BTC down to $92K, its lowest level in over two weeks, with $94K clearly proving to be a strong profit-taking zone.

But just as things seemed to be heading south, the holiday cheer kicked in.

Before a deeper pullback to the $88K-$90K range could take hold, BTC bounced back with a 4% jump, finding itself back in the $98K-$100K band.

Despite this recovery, institutional demand through Bitcoin ETFs has remained sluggish, continuing a four-day consecutive outflow streak.

This suggests that the current price point has yet to attract significant institutional capital.

On the retail side, buying has picked up, though not aggressively enough to signal full “accumulation.” As the New Year excitement builds, BTC could range between $100K-$105K. Yet, a new ATH still feels a bit far off.

Ultimately, the ‘risk’ factor looms large. With recent declines still fresh in investors’ minds, the psychological resistance could deter new capital from flowing in.

So, is Bitcoin heading south?

Historically, the first quarter of each year has been bullish for Bitcoin, marked by a supply shock where limited supply meets high demand, creating the perfect economic imbalance.

However, with the current metrics in mind, it wouldn’t be surprising if Bitcoin diverges from its typical pattern.

External forces are becoming more powerful, and the lack of clear economic signals could pose a significant hurdle in 2025, even with healthy on-chain metrics.

So, unless BTC breaks its previous all-time high by mid-January, calling a bull rally just yet may be premature.

The absence of substantial retail and institutional capital means even big players like MSTR might not be enough to spark the rally.

Read Bitcoin’s [BTC] Price Prediction 2025-26

Instead, a consolidation in the $95K–$98K range could be just what Bitcoin needs to build momentum for the next big move.

This would keep risk-averse investors in the game by squeezing their profit margins, while reigniting FOMO and setting the stage for the rally that could carry us through the next couple of weeks.