Bitcoin’s market steps back from ‘extreme greed’ – A positive sign?

- Bitcoin exited the ‘extreme greed’ zone and could aid sustainable growth

- MVRV and Pi Cycle Top indicators revealed that BTC still had room for upside

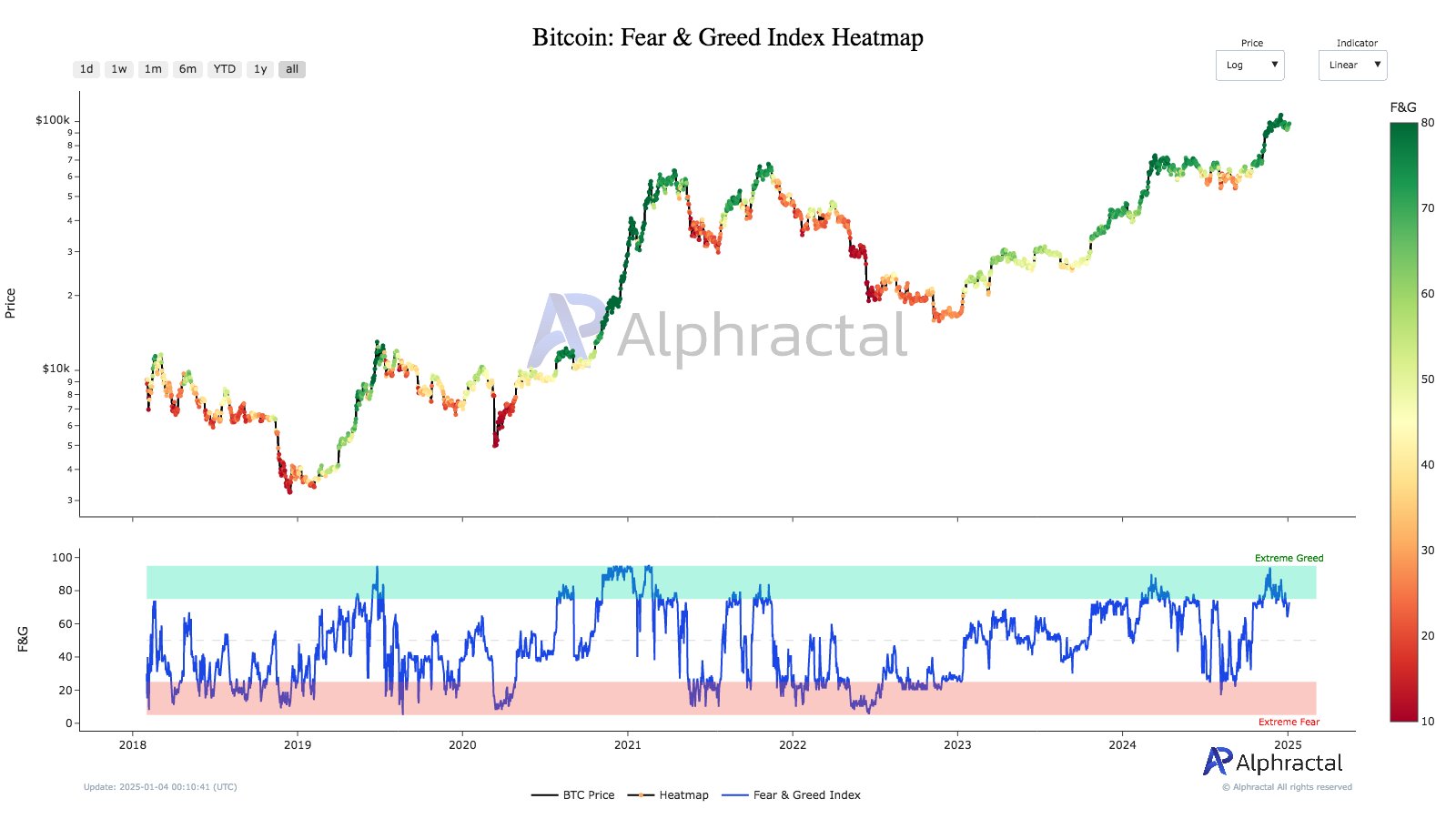

Bitcoin’s [BTC] market sentiment has exited the “extreme greed” zone for the first time since the “Trump pump” trade began in November. This can offer BTC much-needed room to grow.

According to the pseudonymous on-chain analyst Dark Fost, the “extreme greed” phase marked an overheated market and a potential pullback. According to Fost, this is what led to the cryptocurrency’s decline from $108k to nearly 90k.

A set-up for a sustained BTC rally?

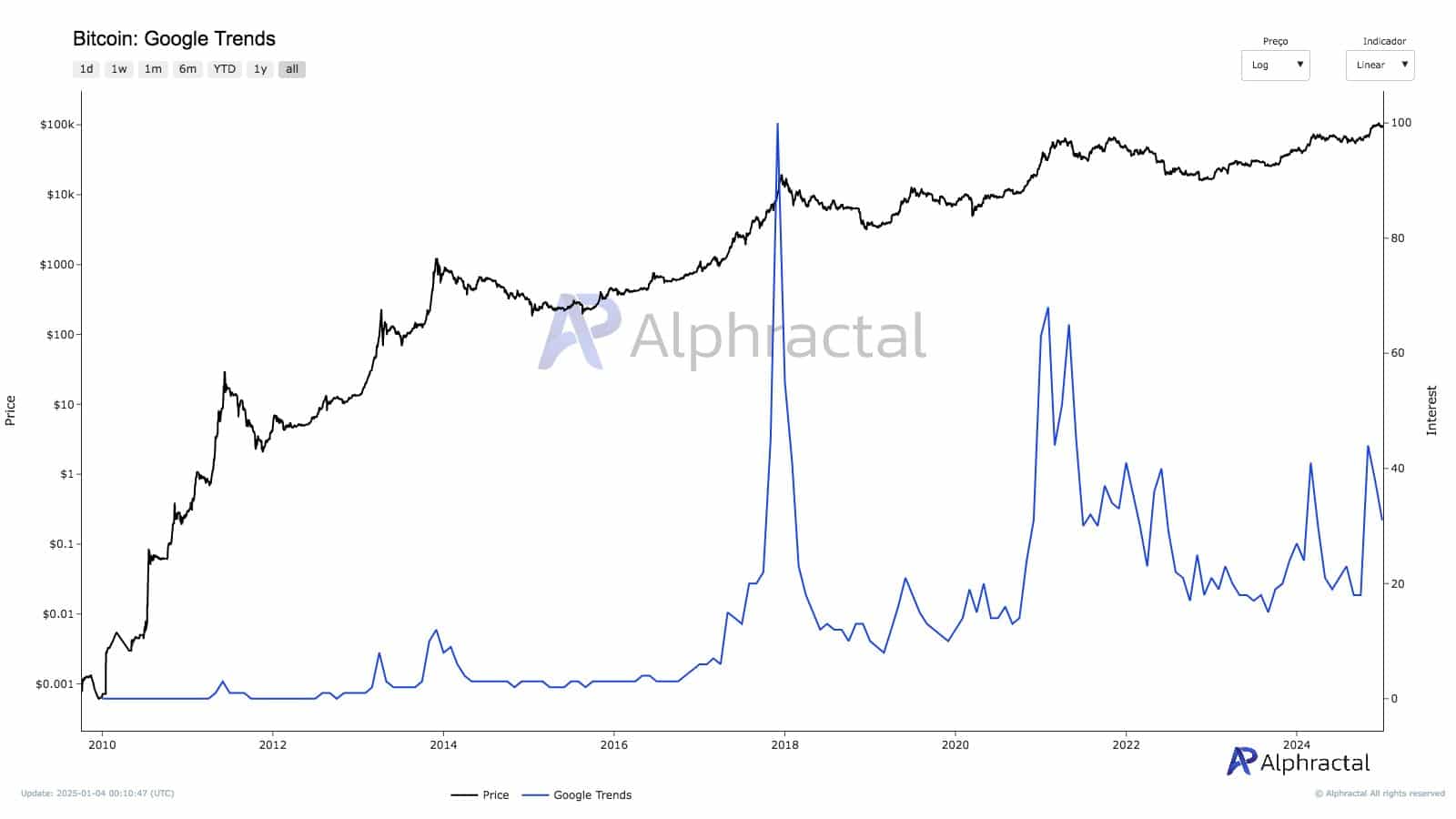

Additionally, new market interest in Bitcoin, as tracked by Google Trends, dropped significantly as the asset declined below the $100k milestone.

Historically, a surge across Google Trends is always associated with euphoria and potential market corrections or tops.

Taken together, Dark Fost noted that the aforementioned trends mean that BTC has more room for growth in the near term. He stated,

“Overall sentiment remains positive, yet interest from potential newcomers stays relatively low, it may lead to the continuation of the bullish phase in the mid-term.”

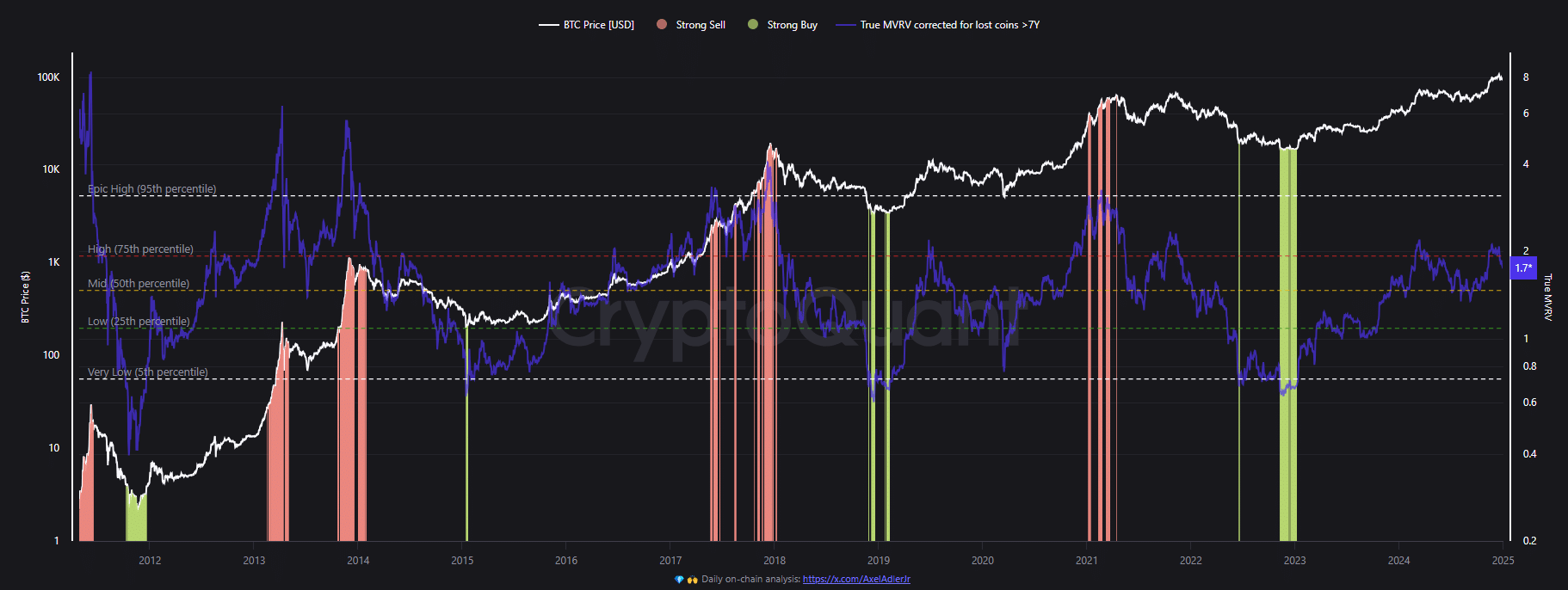

His observation was echoed by the True MVRV (Market Value to Realized Value) – A metric used to gauge whether BTC is overvalued and to track the market cycle.

The metric accurately pinned previous local and market cycle tops. In fact, the 2024 March and December tops were triggered when the metric tapped 2. In most cases, a surge to 4 marked a cycle top.

At the time of writing, the metric had retreated to 1.7 and was far from 4, suggesting that BTC’s cycle top wasn’t close.

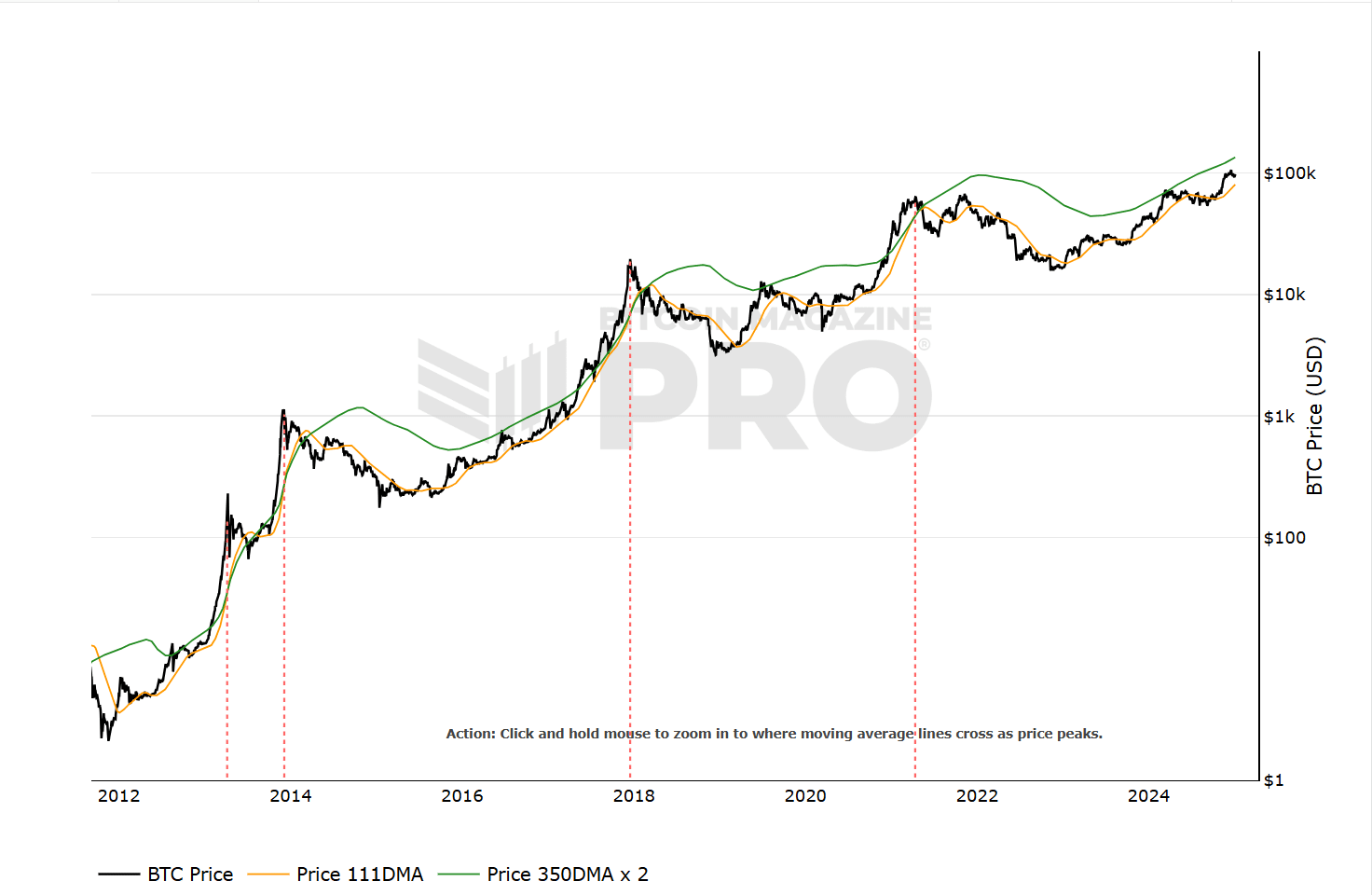

Another cycle top indicator, the Pi Cycle top, was far from triggering this market peak. The metric flagged previous market peaks when the 111-day moving average crossed the modified 350-day moving average and cycle.

Read Bitcoin [BTC] Price Prediction 2025-2026

In summary, BTC’s retreat from “extreme greed” can be seen as a welcome relief for extended and sustainable growth in the mid-term. The potential for upside was further illustrated by key market cycle top indicators that were yet to trigger a likely peak for the cryptocurrency.