Bitcoin

Bitcoin’s on-chain traffic slows down as…

The fallout from SEC’s actions lingered for the second straight week as on-chain activity on the Bitcoin [BTC] network failed to pick up.

- The daily transaction count witnessed a 35% decline from the previous month.

- Of the total inflows to the exchanges, the share of whales was just 32% as of 14 June.

The hostile U.S. regulatory environment continued to test the resilience of the crypto market. The fallout from the back-to-back legal charges against juggernauts, Binance and Coinbase, lingered for the second straight week as on-chain activity on the Bitcoin [BTC] network failed to pick up.

Are your BTC holdings flashing green? Check the Profit Calculator

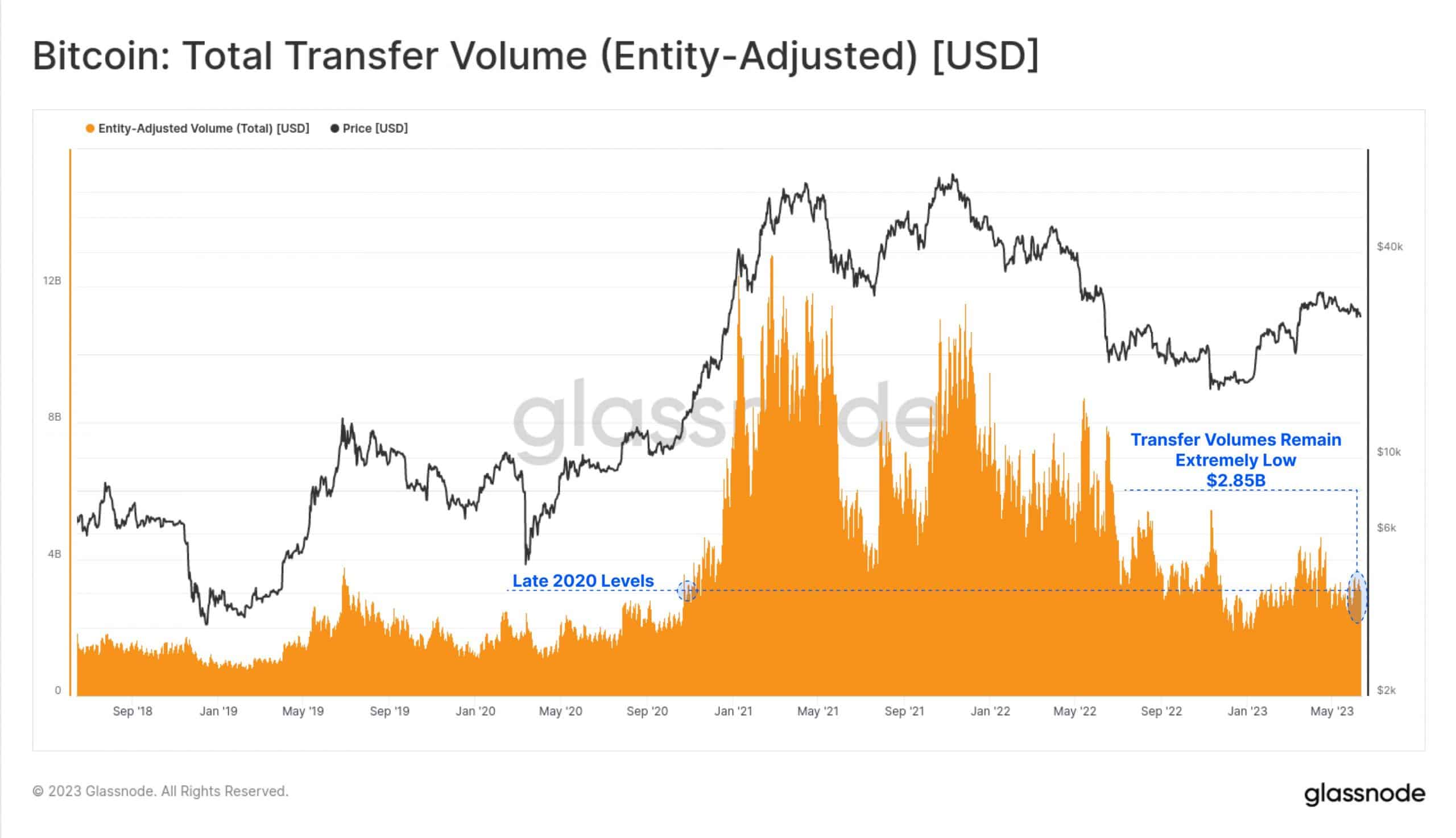

Data from blockchain analytics firm Glassnode

highlighted that the total transfer volume i.e. the total number of coins transferred on-chain, was hovering around $2.85 billion/day, on par with levels seen during late 2020.What’s striking is that, unlike the post-FTX period, when volumes increased, the new crisis has moved investors away from exchanges significantly. The skepticism around the future of centralized exchanges has reignited the demand for self-custody with hodling rather than trading being the norm, at least for now.

Transactions see sharp decline

The recent slowdown in Bitcoin on-chain activity contrasts sharply with the network jamming phase in May, which resulted in a massive backlog of unconfirmed transactions. Because of the combined effect of falling volatility and the FUD around centralized exchanges, the number of transactions has trended downwards since then.

At the time of writing, the transaction count was 380,180. This represented a decline of 35% from the previous month, data from Glassnode showed.

Whales sit quiet

However, transactions independently don’t reveal the true picture. While transaction count was indeed up during May, the transfer volume was comparatively lower. This suggested that the surge was driven by low-value transactions done by investors holding smaller quantities of BTC.

Large addresses who hold a big chunk of BTC supply have been sitting quietly, unfazed by market dynamics. According to CryptoQuant, of the total inflows to the exchanges, the share of whales was just 32%.

This proved that high value transactions were missing on the network due to the absence of whales.

Read Bitcoin’s [BTC] Price Prediction 2023-24

At the time of writing, BTC was trading in the red with a 24-hour fall of 3.58%. The drop pulled it below $25,000 for the first time since mid-March, per CoinMarketCap.

Interestingly, the pullback came despite the U.S Federal Reserve’s decision not to go ahead with an interest rate hike for the first time in over a year.