Bitcoin’s price may be ‘holding up well,’ but the big picture is this

It’s not been a good year for Bitcoin, the world’s largest cryptocurrency. Less than three months ago, with BTC trading close to $69,000 on the charts, many expected the crypto to hit $100k soon. Alas, that didn’t happen. In fact, Bitcoin dipped and depreciated. And, did so very significantly.

While the last 10-14 days have seen BTC recover from its near-term lows close to $32,000, the cryptocurrency is still well away from touching its heights from a few months ago.

Understandably, this has fueled a significant query in the minds of many – Is the crypto winter here? Is the Bitcoin ice age upon us after a bullish 2021?

Ordinarily, a crypto-winter can be identified by a series of red candlesticks on the monthly frame. According to some, it might just be too early to call anything right now. Then again, the crypto-community and market aren’t really famous for cold rationality, are they?

A frosty reception

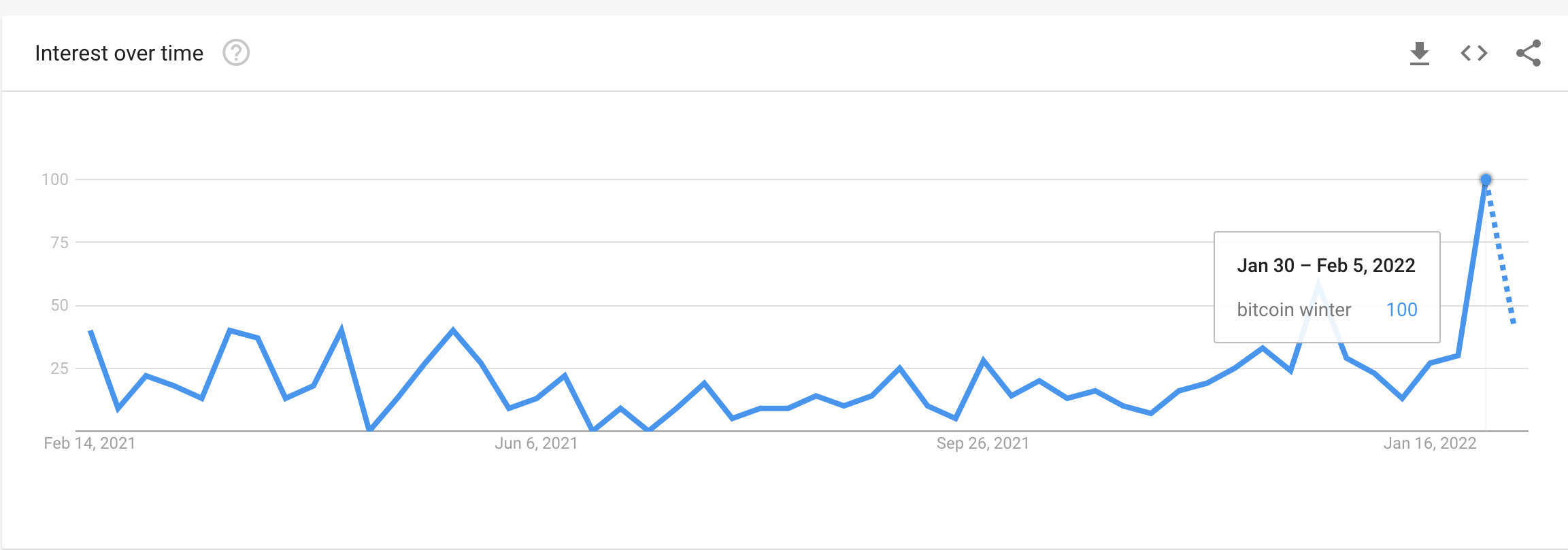

Consider the latest data from Google Trends, for instance. After flashing a reading of 7 between 7/11/2021 and 13/11/2021, search interest for the term ‘Bitcoin Winter’ climbed to 100 last week. Whether it is here or not, a lot of people really are keen to find out.

That’s not all. The Fear and Greed Index isn’t giving a lot of confidence either with a reading of 44, at press time. This, despite the fact that the scale has moved from ‘Extreme Fear’ to ‘Fear’ over the last 30 days.

The aforementioned datasets can be supported by the fact that of late, most are revising their initial predictions for Bitcoin. Furthermore, some are specifically suggesting there may be tougher times ahead.

Consider this – According to Huobi Research Institute, Bitcoin has emerged to become an asset that is very sensitive to changes in liquidity. With the Federal Reserve’s tapering policies contributing to a fall in the same, BTC will “face a bear market,” its report said.

Furthermore, one of Glassnode’s latest newsletters also argued that while it is hard to define a bear market for Bitcoin, there are some signs to indicate the same.

A contrary position

However, the operative phrase in the aforementioned observations is this – ‘hard to define.’ That is true, and it is so because there is no consensus as to what is a Bitcoin bear market.

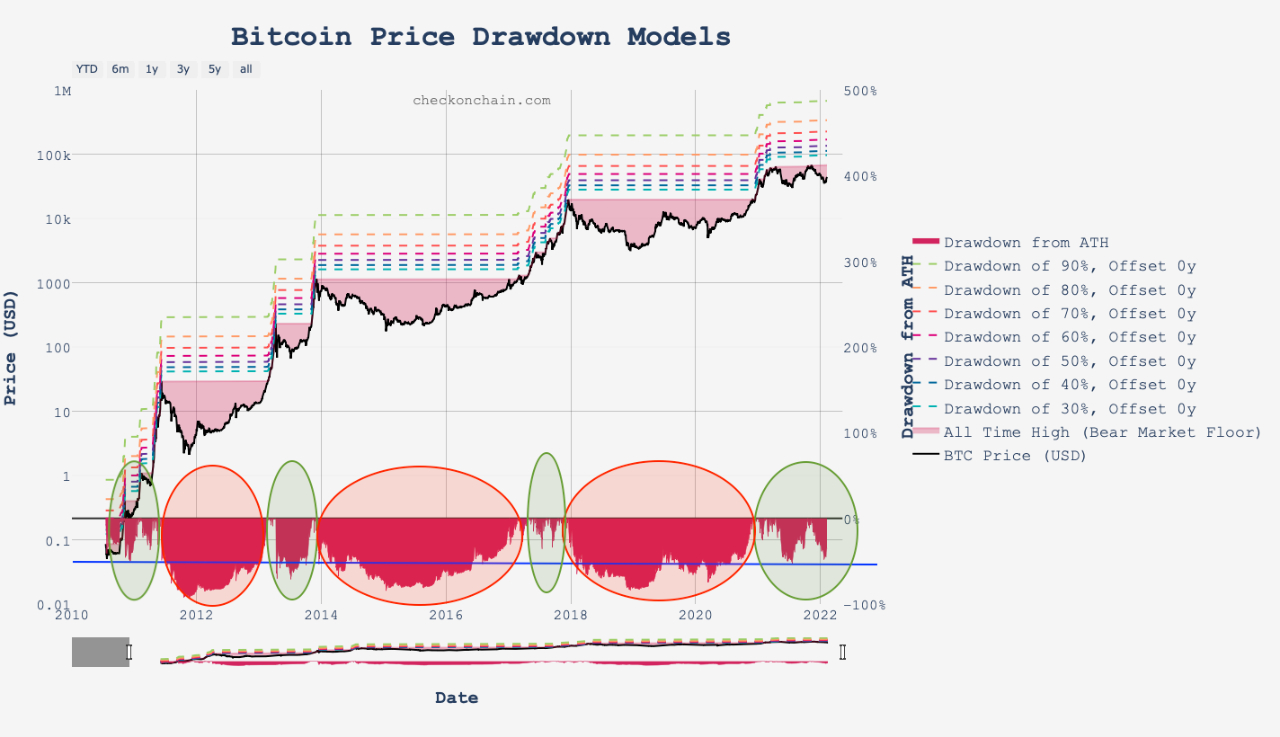

Consider the views of Jan Wüstenfeld, for instance. Contrary to the assertions of others, the Quantum Economics analyst believes,

“… the price drawdowns after both #Bitcoin ATHs this cycle have been small and brief compared to previous bear markets.”

Arguing that Bitcoin’s price is holding up well, Wüstenfeld claimed that these drawdowns are more like “mid-cycle corrections.” He concluded,

“If that’s how this bear market looks like, I take it.”

Source: Twitter

There are other metrics too, findings that seem to support the notion that winter or no-winter, better days might be ahead for Bitcoin. In fact, they back Wüstenfeld’s assertion that the last 10-12 weeks are just “mid-cycle corrections.”

Take the example of the Short Term Holders SOPR – After almost 80 days of the STH SOPR capitulating, the metric is finally above 1 on the charts. What this means is that investors are now selling Bitcoin in profit. The last time the STH SOPR capitulated, it was for a period of 74 days.

Source: CryptoQuant

Finally, on the Bitcoin stablecoin supply indicator, the EMA7 bisected the EMA21 on the charts recently. Historically, this has predated a bull rally on BTC’s charts.

Is there even a right or wrong?

Worth pointing out, however, that these metrics don’t conclusively suggest that it’s not a ‘bear market’ for Bitcoin. After all, indicators like the whale exchange ratio have been above 85% since the beginning of the year.

What this means then is that there is no right or certain answer. It could be a mid-cycle correction or a major drawdown or somewhere in between. What is evident though is that the situation remains one that is quick to change.

After all, who knows? Maybe the Fed will increase interest rates, maybe Russia will invade Ukraine, or maybe Elon Musk will tweet Bitcoin again. No one knows. The best course of action, ergo, is to look out and DYOR.

A note of caution, however: While it is holding up, no one can really say what happens when the rate hike by the FED actually takes place in March or if they do an emergency rate hike in the coming weeks; Particularly considering that inflation has not slowed.

— Jan Wüstenfeld (@JanWues) February 12, 2022