Bitcoin’s RPV ratio reveals if BTC bull run is in jeopardy?

- RPV ratio suggests a decrease in enthusiasm for the Bitcoin bull run.

- Trader sentiment remains positive and volume, velocity, and exchange reserves all show market strength.

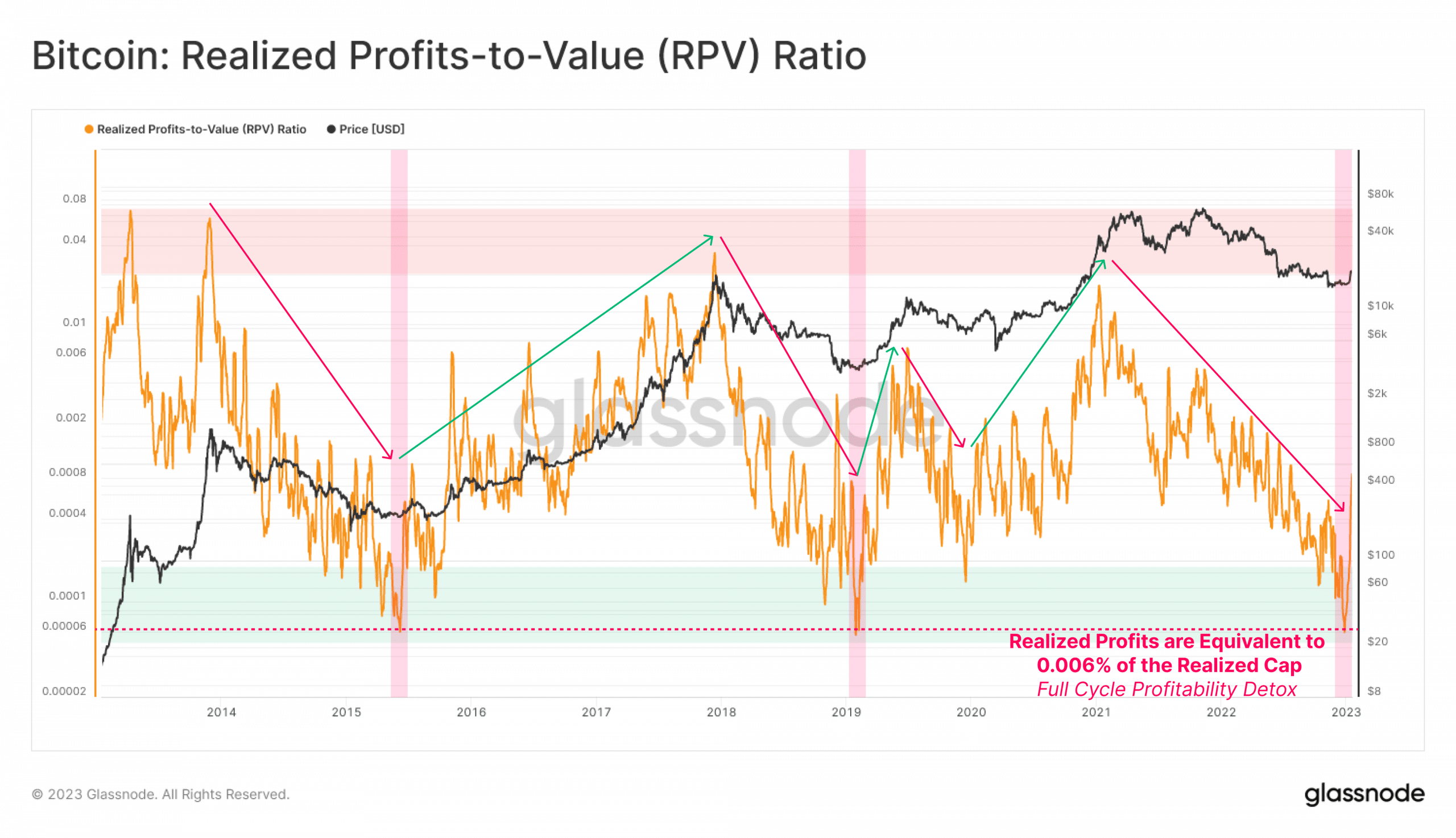

According to data provided by glassnode, Bitcoin‘s RPV, or Profits-to-Value Ratio, declined significantly over the last few days. This ratio compares profit-taking in the market against the network valuation and its decline suggests that a lot of enthusiasm for the bull market has dissipated.

This can have implications for both short-term and long-term holders of Bitcoin.

How much are 1,10,100 BTC worth today?

HODLers get tempted

RPV decline was reflected in an increased MVRV ratio, indicating most holders would profit from selling. The long/short difference remained negative which also incentivized short-term holders to sell as they could collect most of the profits.

Another indicator of this would be the decline in the number of addresses in losses. According to glassnode, the number of addresses in losses reached an 8-month low. This would suggest that multiple addresses would be tempted to sell their holdings during this period.

Traders show faith

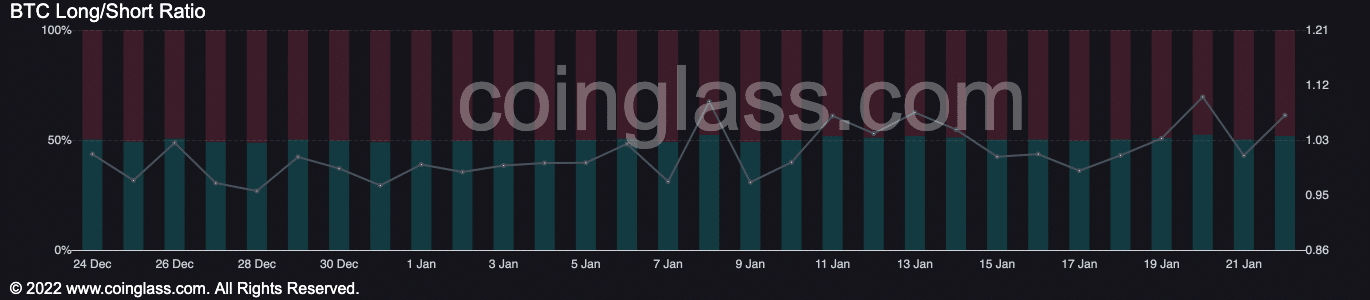

Despite the decline in RPV, trader sentiment remained positive. According to data provided by coinglass, 51.2% of all positions were long on Bitcoin. This indicated that traders were still optimistic about the future of Bitcoin and believed that it will continue to rise in value.

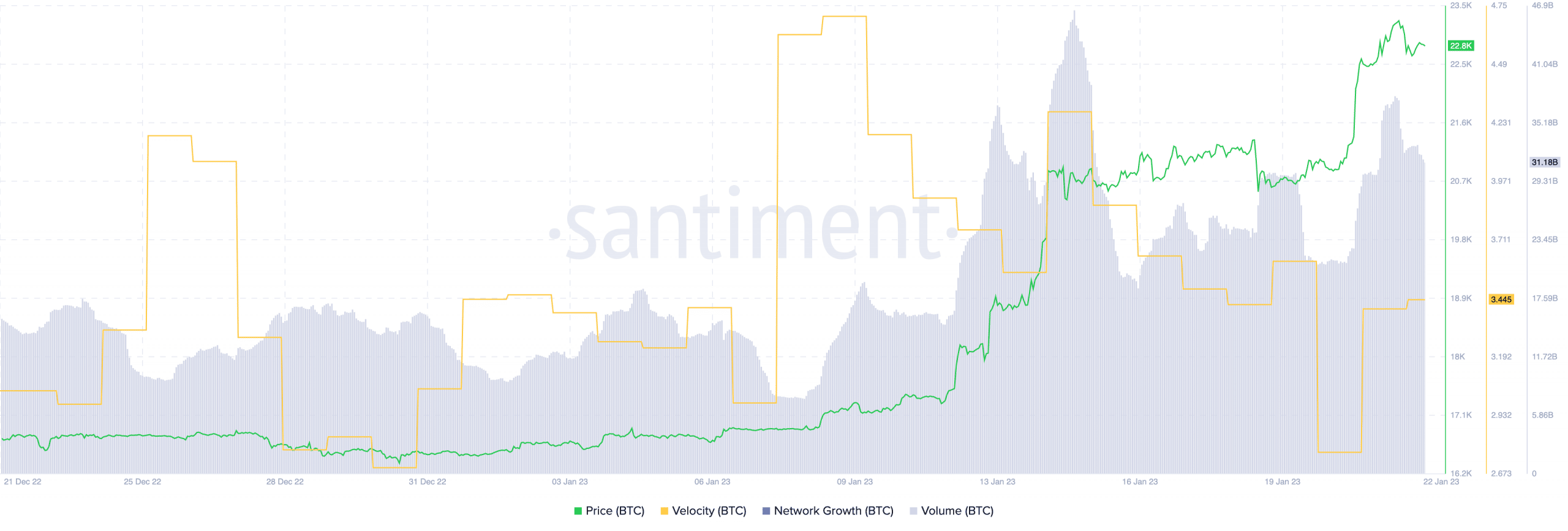

Additionally, another positive indicator for Bitcoin is the decline in exchange reserves, as it indicates lower selling pressure. This means that there is less supply in the market, which could contribute to an increase in price.

Furthermore, Bitcoin‘s volume has also increased, going from 14.56 billion to 31.1 billion over the last month. Its velocity also declined during this period, suggesting that BTC wasn’t being transferred amongst addresses and addresses were holding on to their coins. This could indicate that holders are becoming more confident in the long-term potential of Bitcoin and are less likely to sell their positions.

Is your portfolio green? Check out the Bitcoin Profit Calculator

In conclusion, the decline in RPV suggests decreased enthusiasm for the bull run. However, on the other hand, positive trader sentiment, declining exchange reserves, and increasing volume and velocity suggest market strength.

![Shiba Inu [SHIB] price prediction - Mapping short-term targets as selling pressure climbs](https://ambcrypto.com/wp-content/uploads/2025/03/SHIB-1-2-400x240.webp)