Bitcoin’s unexpected ally: Presidential candidate Kennedy shows support amid backlash

- Presidential Candidate advocates for Bitcoin. Retail investors begin accumulation.

- Whale concentration of BTC holdings increased.

The U.S. government was the largest public holder of Bitcoin [BTC] at press time. The government’s plans to sell Bitcoin in phases throughout the year have led many to believe that BTC prices will be impacted negatively in the future.

Is your portfolio green? Check out the Bitcoin Profit Calculator

Some positive comments

These factors have turned many in the crypto space cynical. However, the comments made by presidential candidate Robert F Kennedy could inspire some optimism amongst holders.

At the recent Bitcoin conference, Robert stated his support for Bitcoin. Additionally, he emphasized the fundamental entitlement of every citizen to exercise self-custody and operate a node.

Furthermore, he expressed his intention to advocate for the regulation of the king coin as a commodity.

During his address, Kennedy expressed to the audience that his initial encounter with Bitcoin served as a profound source of inspiration, recognizing it as a crucial technology for fostering individual freedom.

This realization was triggered by his awareness of Bitcoin’s application in circumventing financial limitations during the Canadian trucker protest that transpired last year.

Despite the potential interpretation of his remarks as a political strategy to appeal to Bitcoin maximalists and crypto enthusiasts, they possess the capacity to positively influence public perception.

Substantial backing from influential candidates may contribute to the adoption of BTC in the future.

As of this writing, there was a notable surge in retail interest towards Bitcoin. According to data provided by glassnode, the number of addresses holding 0.01 or more coins has reached an unprecedented peak.

? #Bitcoin $BTC Number of Addresses Holding 0.01+ Coins just reached an ATH of 12,063,941

View metric:https://t.co/oyguxpaA2y pic.twitter.com/Z6vGKf6BpP

— glassnode alerts (@glassnodealerts) May 19, 2023

Whale concentration increases

Despite the high retail interest, a huge amount of BTC was still under the control of whales.

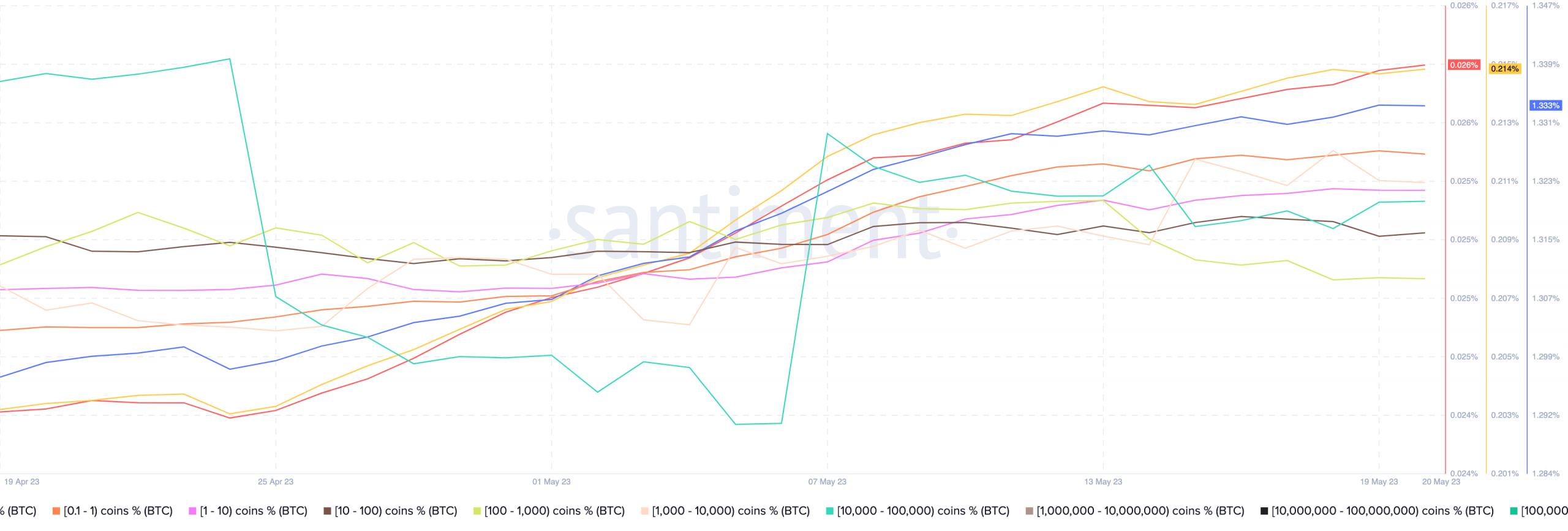

According to Santiment’s data, the majority of BTC is held by addresses holding 10-100,000 Bitcoin. These large addresses were also observed to be accumulating BTC at press time.

Read Bitcoin’s Price Prediction 2023-2024

Nevertheless, the significant concentration of BTC held by large-scale investors may render retail investors vulnerable to the influence of whale activity.

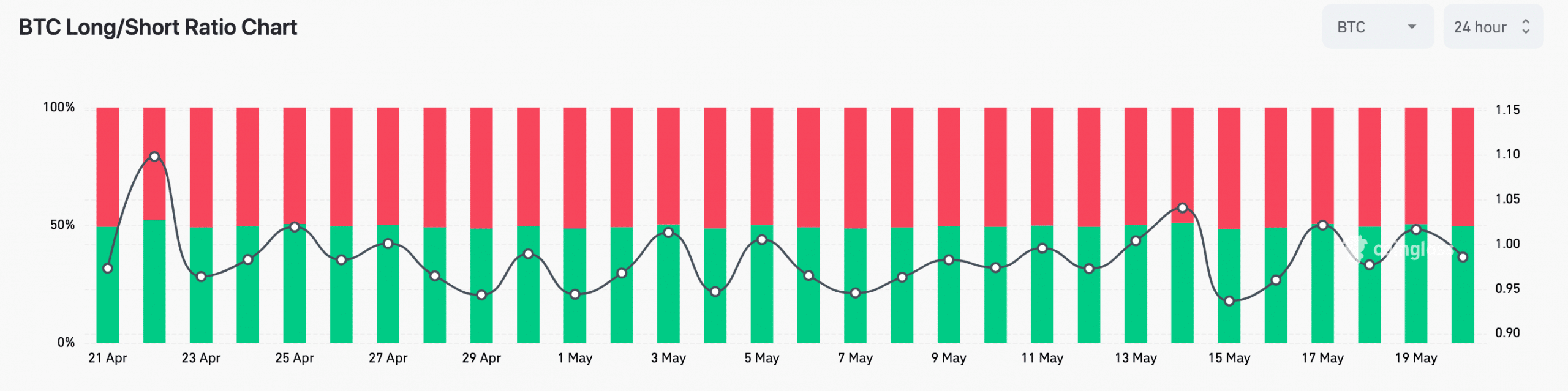

Coinglass’ data indicated that over the last month, traders were largely holding short positions against Bitcoin. At press time, 50.36% of traders held short positions against the coin.