Bitcoin’s UTXO hit 82% in profit- What does it mean for your portfolio?

- Bitcoin’s UTXO hit 82% in profit, on-chain data disclosed.

- The BTC premium was in high demand as derivatives market interest increased.

Over 80% of the Bitcoin [BTC] Unspent Transaction Output [UTXO] hit profit levels, according to CryptoQuant analyst Vadym_Za.

The UTXO is a fundamental element of the Bitcoin network, which defines where a transaction starts and finishes. It also describes discrete BTC pieces that can act as input in a new transaction.

Read Bitcoin’s [BTC] Price Prediction 2023-2024

This condition explains that many investors took advantage of the BTC price below $20,000. Also, it indicated that many UTXOs were created within the said period.

BTC: To follow the lead to $25,000?

According to the analyst, the last time the market had the metric in a high state was during the 2021 bull market. Notably, it was the period when the king coin traded between $43,000 and $45,000.

The journey to this milestone was a result of BTC’s performance over the last few days. Since putting up a 40% increase in January, the coin had slowed down the momentum as the second month began. However, the surge above $24,000— a 50% value increase since the new year, was vital to the UTXO gains.

Deposit the recently hit landmark, some analysts are of the opinion that there was more uptick to come. Bitcoin’s firm believer and crypto strategic Advisor Ash WSB tweeted that the coin had the potential to cross $25,000 before the week comes to a halt.

Pointing to the 50 and 200 weekly Moving Average (MA), the trader opined that the biggest one-day rally could be surpassed again.

BTC is testing big major resistance Weekly 50 MA $24,733 and Weekly

MA 200 $25,013.BTC surprised everyone & took a

biggest 1 day rally of 12%. Bitcoin

have to cross above $25000 to

avoid death Cross on weekly chart. pic.twitter.com/6sSjSXDhyP— Ash WSB (@Ashcryptoreal) February 16, 2023

Demand on the rise but keep an eye on…

For the time being, optimism was high among traders in the derivatives market. According to CryptoQuant’s analysis, the Open Interest (OI) towards BTC has been primarily high.

Funding rates have also not been left as most positions opened seemed to support a BTC long. The CryptoQuant publication opined,

“Funding rates have been predominantly positive so far this year, demonstrating the willingness of traders to go long bitcoin.”

Is your portfolio green? Check out the Bitcoin Profit Calculator

However, the data insight platform encouraged investors to be watchful since orders placed by sellers outweighed buyer confidence for most of the year.

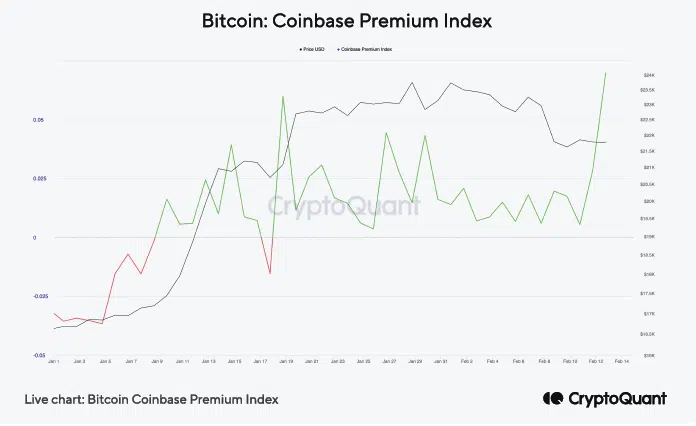

Nonetheless, demand for BTC continues to skyrocket despite stiff regulations. CryptoQuant based this conclusion on the manner in which the BTC premium offered by Coinbase hit the highest since June 2022.

Besides Bitcoin’s increased demand, CryptoQuant also made a quick mention of Ethereum [ETH]. In addressing this part, the publication read,

“This year has also seen a significant increase in the ETH Coinbase premium, which has already reached 7%.”