BlackRock makes a surprising move as Bitcoin reacts – All the details

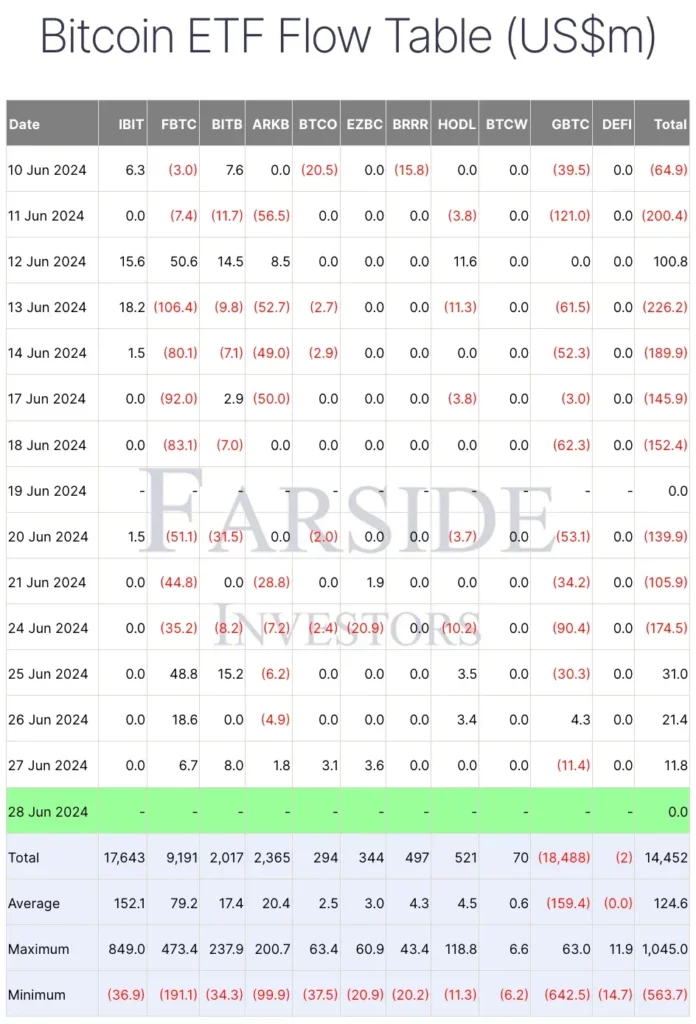

- June saw all Bitcoin ETFs noting significant outflows, led by Grayscale Bitcoin Trust with $559 million

- BlackRock’s Global Allocation Fund disclosed ownership of 43,000 IBIT shares

We are nearing the final approval of the spot Ethereum [ETH] ETFs scheduled for 4 July. And yet, according to a recent CNF report, Bitcoin [BTC] ETFs have consistently seen significant outflows over the course of the month.

Bitcoin ETFs underperform

In fact, data from Farside Investors revealed that this was the case across most Bitcoin ETFs in June. At press time, Grayscale Bitcoin Trust (GBTC) led the pack with nearly $559 million in outflows since 10 June.

As of 27 June, GBTC was the only BTC ETF to record $11.4 million in outflows, while others recorded inflows or remained neutral with zero inflows or outflows.

BlackRock’s surprising move

While BTC’s Spot ETF market has seen its fair share of volatility since its approval, it’s worth noting that at press time, iShares Bitcoin Trust (IBIT) by BlackRock was the only one that stood out with zero outflows since 10 June.

However, surprisingly, a recent SEC filing revealed that BlackRock’s Global Allocation Fund now holds 43,000 shares of the IBIT. This makes it the third internal BlackRock fund to invest in BTC.

The same was first highlighted by a blockchain analysis firm – MacroScope. Its tweet claimed,

“In an SEC filing today, BlackRock’s Global Allocation Fund disclosed owning 43,000 shares of the iShares Bitcoin Trust as of April 30.

Further expanding on the same, the firm added,

“This follows two filings that BlackRock made on May 28 disclosing Bitcoin exposure in its Strategic Global Bond Fund and in its Strategic Income Opportunities Portfolio (see my tweets on that day).”

Other ETFs in the pipeline

This news came on the back of VanEck filing for an S-1 registration statement on Thursday for its “VanEck Solana Trust,” This marks the first public attempt to launch a spot Solana [SOL] ETF in the United States.

Needless to say, with the crypto-community now eagerly anticipating the launch of a Spot Ethereum ETF and on the back of VanEck’s Solana update, BlackRock’s surprising revelation has sent ripples across the market.

Reiterating the same, an X user – Bam – said,

“Does this mean they own Bitcoin themselves and not only on their customers behalf? This is news right ?”

Worth pointing out, however, that some also came out to defend BlackRock. One of them claimed,

Impact on Bitcoin’s price

On the back of these updates, BTC saw a modest hike of 0.35%, with the crypto trading at $61,401 at the time of writing.

And yet, Bitcoin was still struggling to break into the bullish zone on the charts, as confirmed by the RSI remaining well below the neutral level.