BLUR hype skyrockets: To HODL or to sell, that is the question

- Gas usage for the protocol surged as activity rose.

- However, the token’s price saw extreme volatility.

According to a tweet by Blur’s [BLUR] official account on 20 February, the overall gas usage in the ecosystem increased. This occurred due to its growing prominence in the NFT space as more users started using the platform.

Is your portfolio green? Check out the Blur Profit Calculator

One reason for the growing fees on the network would be its high daily activity, which surpassed OpenSea. According to Dune Analytics’ data, Blur accounted for 82% of the overall volume in the NFT space.

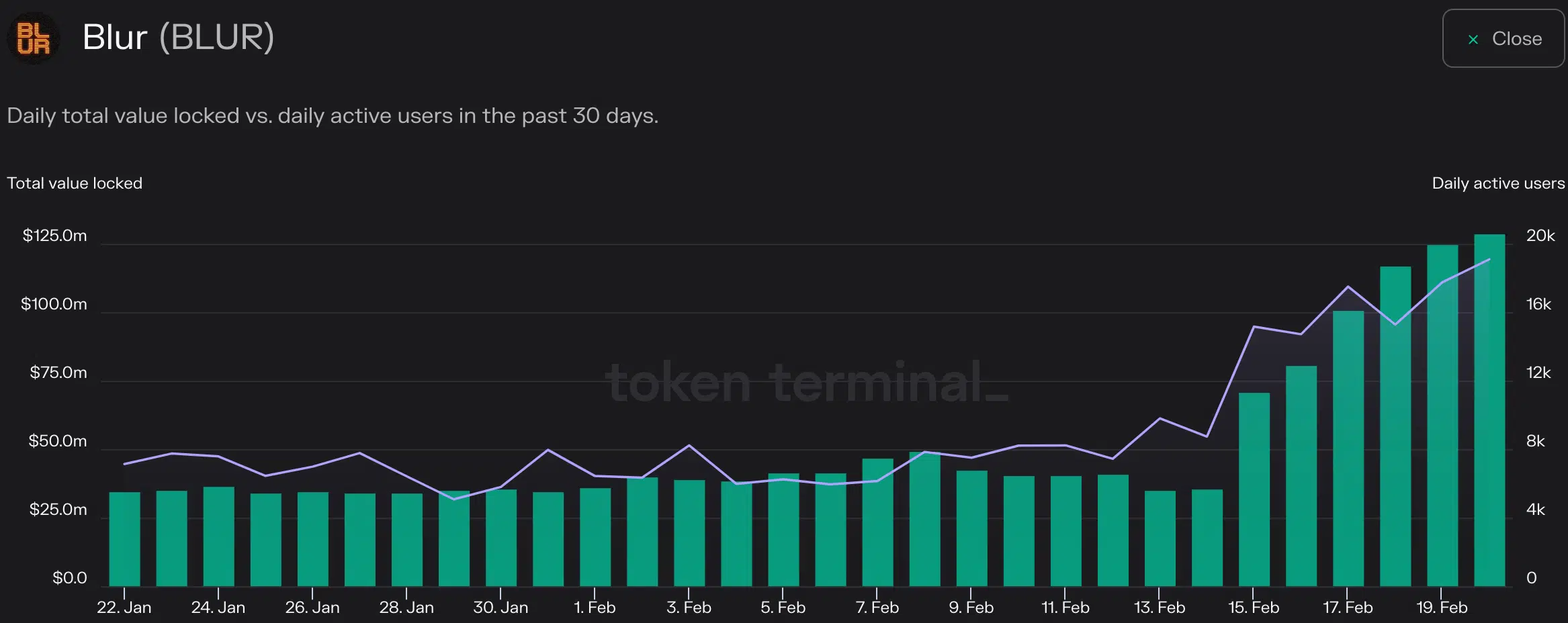

Due to this high activity, the Total Value Locked in smart contracts on the network increased as well. The TVL stood at $128.8 million at press time, according to Token Terminal’s data.

To capitalize on this current dominance, Blur announced a token distribution. The tokens will be distributed on the basis of “loyalty”. Loyalty is calculated by how an NFT collection is listed on the platform. Users will get a 100% loyalty score if their NFT collections are listed only on Blur and nowhere else.

What does Blur’s future hold?

Despite the prominence of the protocol, BLUR token’s price fell immensely by 22% in the last 24 hours, according to CoinMarketCap. Even though the price of the token was falling, whales continued to show interest. This was indicated by the data provided by Santiment, through which it was observed that the percentage of large addresses holding the token increased.

Along with that, the activity around the token surged. A high velocity suggested that the frequency with which BLUR was being traded was getting high.

Realistic or not, here’s BLURs market cap in BTC’s terms

However, even though there was high activity surrounding the token, new addresses weren’t interested in BLUR. This was showcased by the declining network growth of the token. A falling network growth suggested that the number of times new addresses were transferring the token had decreased.

Overall, despite the protocol showing improvements, the activity of the token was too volatile. Investors should proceed with caution as the hype around the BLUR has made the token too vulnerable to price fluctuations at the time of writing.