Binance Coin – How low can the dip go?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

The sustained selling pressure on Binance Coin [BNB] finally saw bears break below the key $303 support level. The support level had been under a constant barrage from sellers with price testing the level four times between 12 May and 3 June.

The bearish momentum over the past 24 hours that broke the bullish defense might have been triggered by the events surrounding the recent SEC lawsuit against Binance.

Read Binance Coin’s [BNB] Price Prediction 2023-2024

With Bitcoin [BTC] desperately clinging to the $26k price zone, BNB bears could be looking to extend shorting gains.

Sustained selling pressure forces range breakout

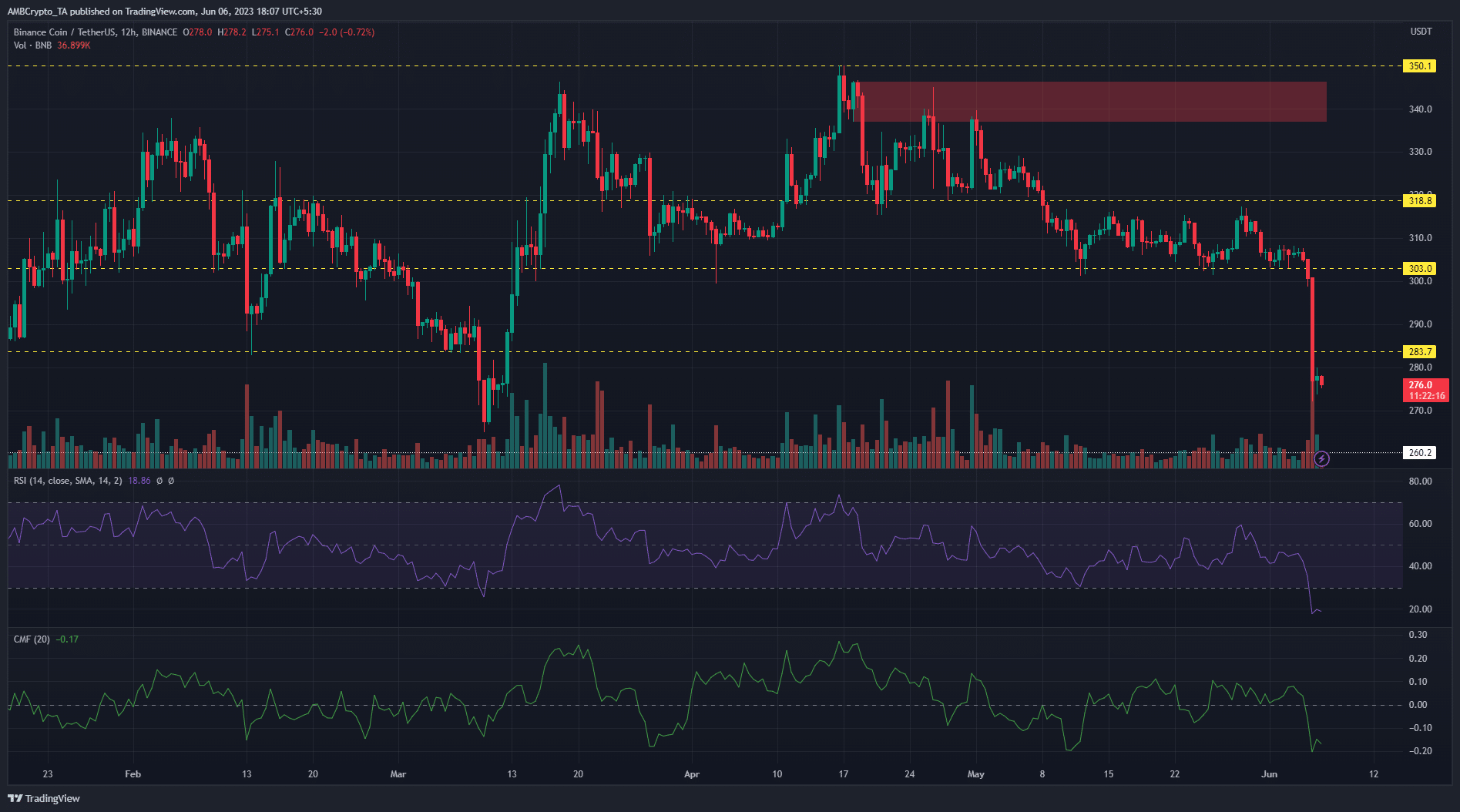

BNB has been on a bearish slide since 18 April after the price was rejected at the $350 resistance level. The bearish momentum saw the price crack the $318 support level before a bullish rebound at the $303 support level halted the selling pressure. The bulls’ staunch defense of the $303 support saw price trade sideways, as attempts to rally was met with stiff resistance at the $318 resistance level.

Over the past 48 hours, price hovered just above the support level and recent events might have accelerated the break of the level. The markets reacted negatively to the SEC’s lawsuit against Binance with investors fleeing from BNB to the safety of stablecoins. The sustained selling pressure on the 12-hour timeframe saw BNB smash the $303 and $283 support levels.

In the meantime, the Relative Strength Index (RSI) remained in the oversold area with a reading of 19. The Chaikin Money Flow (CMF) also stood at -0.16. Both indicators together revealed the weight of the selling pressure was bearing down on buyers.

An advancement in bearish activity could take BNB’s price to the March low of $265. If bulls are unable to rally before then, the $265 price zone could serve as a potential stronghold for a sustained bullish reversal.

Bullish hopes deflated by a rapid decline of active addresses

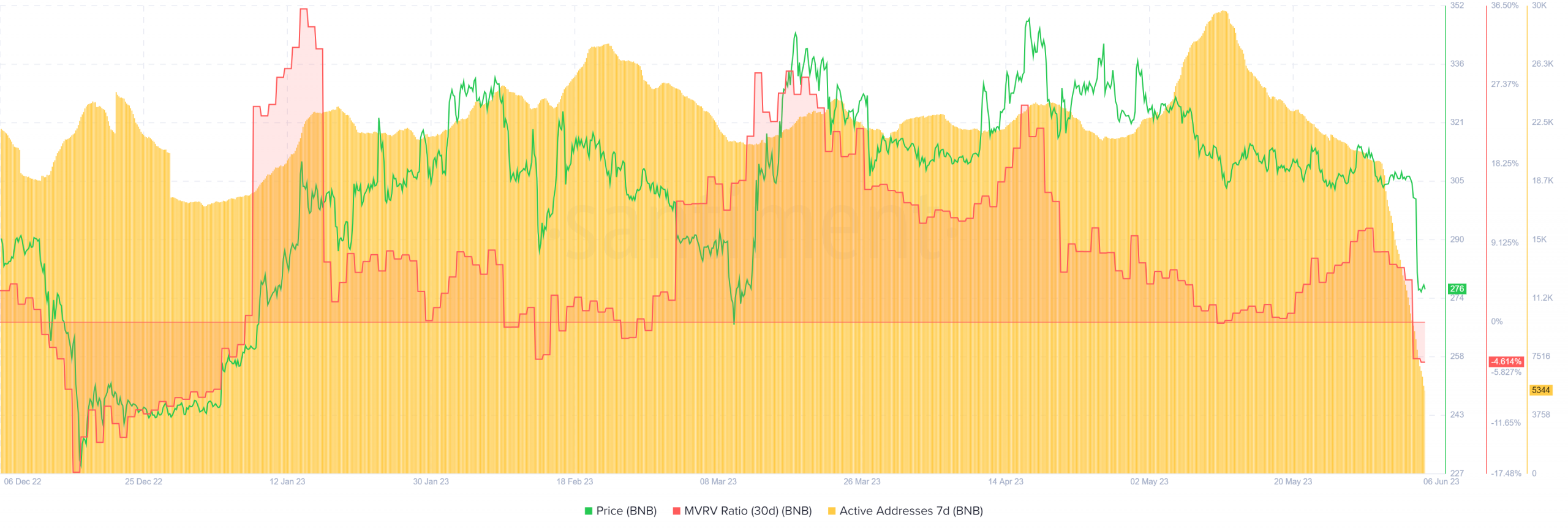

A look at the 7d active addresses data from Santiment showed heavy bearish sentiment among market speculators. The active addresses as of 31 May were over 20k. However, it experienced a sharp drop and stood at 5.3k, as of the time of writing. This large decline in BNB interactions inferred that prices could sink lower.

How much are 1,10,100 BNBs worth today?

Similarly, the Market Value to Realized Value (MVRV) ratio showed that BNB was in the undervalued territory. The MVRV stood at -5.14%, as of press time. This showed that BNB holders were holding onto unrealized losses.

With the SEC lawsuit looming large over Binance, traders should exercise caution to avoid volatile price movements.