BNB bears forced to retreat as prices climb past $250

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- The near-term trend has begun to favor the bulls.

- A breakout and retest of $250 could offer a buying opportunity, but patience was necessary.

Bitcoin [BTC] whale accumulation since April, combined with a series of applications for Bitcoin spot ETF from traditional financial firms saw investor sentiment shift positive. BTC prices climbed past $30k, posting gains of close to 17% from 19 June’s lows.

Read Binance Coin’s [BNB] Price Prediction 2023-24

Binance Coin was caught in the middle of a regulatory fire. The SEC’s lawsuit against Binance sparked fear in the market, but over the past ten days, the prices have begun to climb higher. Does this reversal have the legs to go higher?

The slow grind above $240 and subsequent retest as support were important for the buyers

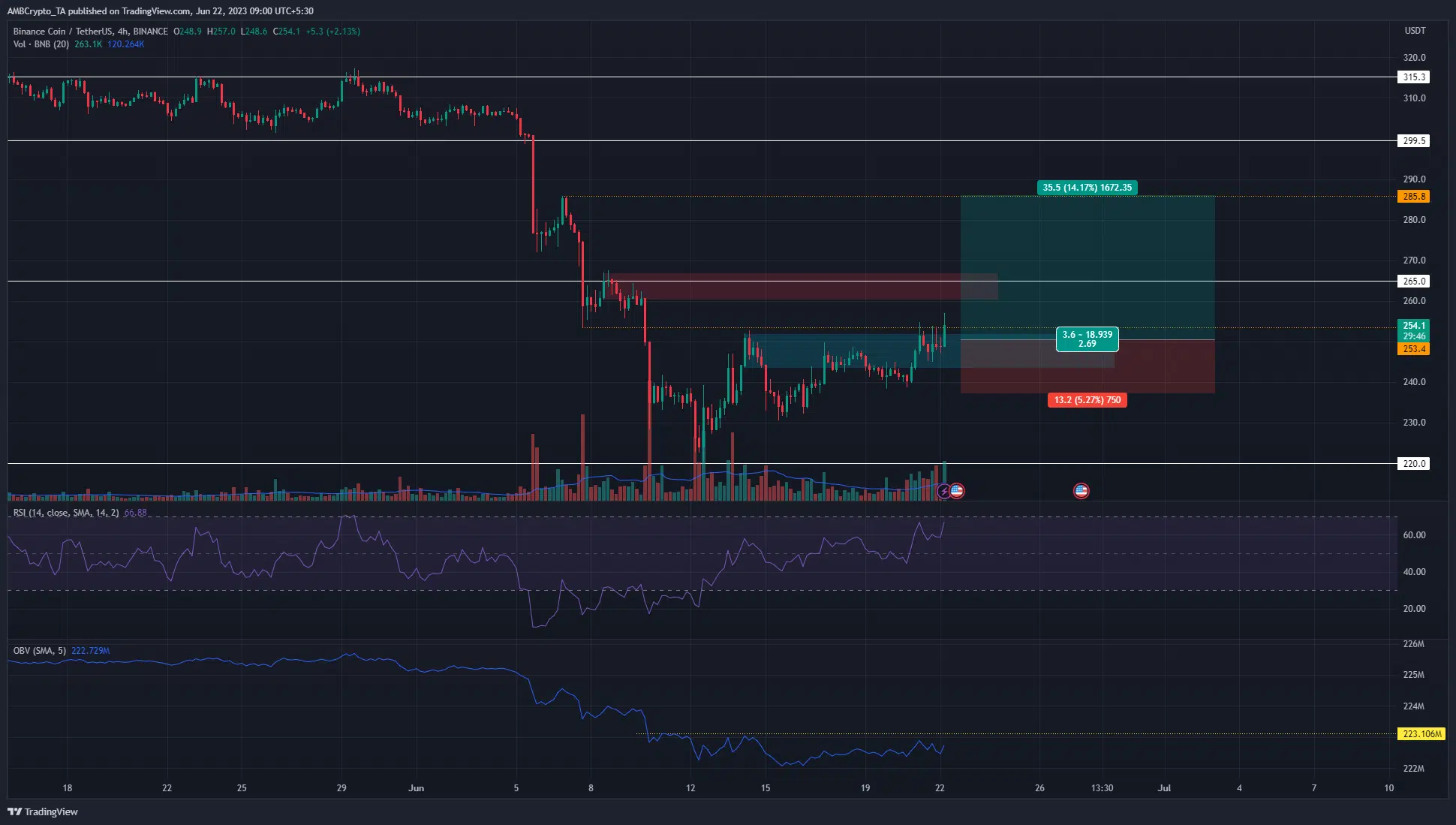

On the higher timeframes, the price action of Binance Coin was strongly bearish. But on the 4-hour chart, it had a bullish market structure. Moreover, the move above $250 that appeared just a few hours ahead of the time of writing would signal an uptrend on H4.

The bearish order block from last week at the $250 area was highlighted in cyan because it could be flipped to a bullish breaker block soon. Further north, another H4 bearish order block lay at the $265 level.

The RSI showed strong upward momentum but the OBV did not yet break above a key resistance, which showed that demand might not be as strong as the chart suggests. This in turn could make a bullish breakout a drawn-out affair as bulls and bears vie for control.

If the scenario unfolds where we see a rejection from $265 and a retest of the breaker block, a BNB buying opportunity could present itself. The $285 and $300 would be the next targets.

A sudden jump in spot CVD reinforced the idea of renewed demand

Source: Coinalyze

The spot CVD on the 1-hour Coinalyze chart was in decline from 16 June to 20 June. During this time BNB saw a rejection from $250 and fell to $238. In the past 48 hours, the metric has surged higher. It was accompanied by BNB prices reaching $250.

How much are 1, 10, or 100 BNB worth today?

The Open Interest was flat over the past week but in the past 24 hours it began to climb higher as well. This was another sign of capital inflow to the market. If this trend proceeded in the short-term, BNB could achieve a breakout past $250.